Why RSR Keeps Saying That Now Is The Time For Better, Faster Forecasting

For the last few weeks, the RSR team has commented on why more agile supply chains are increasingly important to retailers and their partners. To summarize, there are three big reasons to consider modernizing the systems and processes associated with the supply chain: first, omnichannel consumer demand is more dynamic than in the days of store-centric retailing; second, anti-global-economy sentiment in today’s geopolitical environment is creating new issues for trading partners and consumers alike; third, Mother Nature keeps throwing wrenches into the smooth workings of the global supply chain.

Our studies have consistently shown that there are two important to-do’s before retailers can reasonably start to address addressing the “agility” challenge in the supply chain. In our soon-to-be-published on the state of the retail supply chain (The Retail Supply Chain: Designing New Ways To Satisfy Demand, scheduled for release the week of March 16th), we address them with the two recommendations below.

The first relates to inventory visibility throughout the system:

“Retailers’ ability to see inventory as it flows from source to consumer purchase remains a critical to-do for roughly 4 out of 10 retailers. But until ‘digital twin’ technologies are fully implemented across the entire supply network, it’s unlikely that true “100% visibility” can really be achieved. Nonetheless, retailers can do a lot to improve visibility now, by closing the loopholes in their operational systems, establishing data sharing arrangements with trading partners (for example, using vendor/retailer portals), and implementing exception alerting capabilities at critical points along the supply chain. Most fundamentally, retailers need to continue to improve their ability to see available-to-sell inventory within the enterprise. This affects not only a retailer’s ability to commit to sell any piece of inventory to customers, but also the forecast.

The second is all about the demand forecast:

“RSR has said this before, and we’ll say it again: next-generation demand forecasting engines will help retailers improve their ability to plan for cross-channel demand. New solutions help retailers consume new data that are important to the forecast, including past promotion, lost sales calculations, competitive and market data, consumer sentiment data, and environmental information.”

This second recommendation led RSR partner Paula Rosenblum to say in her column last week in the Retail Paradox Weekly (Coronavirus Hits Keep On Coming, 2/23/2020), that “RSR’s mantra <is that> it is time for better, faster forecasting (and re-forecasting) systems. It would help if those forecasts were tied into sourcing systems to improve reaction time.”

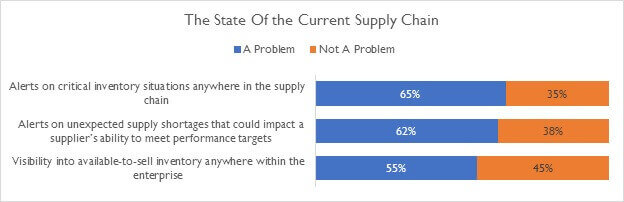

That point-of-view is further supported in a new study we are conducting. The new study is focused on the potential for artificial intelligence (AI) technologies to enable a new generation of supply chain capabilities. Our preliminary responses show that “visibility” is by far a top concern for retailers – and issues related to inventory visibility are the top-three problems that concern retailers (Figure 1).

Figure 1: The Need To “See”

Source: RSR Research, PRELIMINARY, March 2020

How does greater visibility improve forecasting? Enterprise-wide inventory visibility is not an attribute of the next-generation retailing, but a prerequisite for it. Clean and complete information is one requirement for a better forecast. More on that in a moment….

Accurate and available inventory information is a consumer expectation. Even retailers who have little appetite to look inside the black box that is their supply chain know that they have to address the issue at least so that they can reliably commit to sell any inventory in the chain to consumers who want to buy it. In yet another studywe are currently conducting on the state of buy-online-pickup-instore (BOPIS), the #1 business challenge that retailers are trying to address is that “Consumers still prefer to look at what they are buying – but increasingly the shopping experience starts in the digital domain”, and that means that they expect reliable information about the products that retailers want to sell to them, especially what’s in stock and available to them right now.

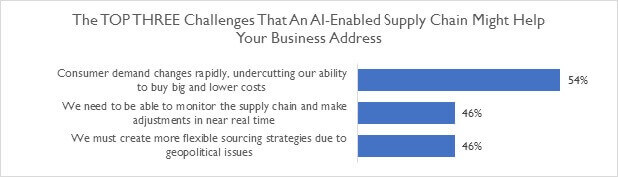

That brings us right back to why retailers need to revisit how they forecast demand. As important as the effects of poor inventory visibility challenges in an omnichannel environment are, they are compounded by rapid changes in consumer demand. Retailers struggle to put inventory closest to the place where it will be used to fulfill customer orders, and retailers are clearly looking for AI-enabled solutions to help them now, according to the AI-enabled Supply Chain study (Figure 2).

Figure 2: Changing Consumer Demand Trumps Other Considerations

Source: RSR Research, PRELIMINARY, March 2020

That challenge is the reason why, of all the artificial intelligence & machine learning technologies needed to enable an AI-enabled supply chain that we listed in the survey, retailers rate “Demand forecast modeling using macro indicators (geo-market, weather, competitive, social, etc.)” is the top valued choice.

That is no small thing. While arguably when we first exposed next-gen forecasting is a top opportunity for retailers several years ago, AI enablement wasn’t quite ready for prime time, that is clearly not the case now, as even a casual scan of the solutions marketplace will show. Retailers increasingly understand the need, and solutions providers just as clearly see the opportunity.

And that, in a nutshell, is why RSR keeps saying that now is the time for better, faster forecasting. It’s a perfectly timed meeting of a need and available solutions.

ED. NOTE: Two studies mentioned in this piece are still in-flight, and we’d love to get your point-of-view. Remember, your individual responses are always kept confidential! The two studies are:

Getting To Profitability: BOPIS & BORIS, and The Case For An AI-Enabled Supply Chain .

As an incentive for you to take the Supply Chain study, our research partner, LLamasoft, will donate $25 to the Retail Orphan Initiative helping fund a project that will bring first world educational and computer training to third world children in need.