Uncharted RSR: Profitability Of Multi-Channel Shoppers By Vertical

With an average of 25 questions and at least four different ways of looking at the results, RSR easily generates literally 100+ data charts for every benchmark report we write, and then ends up using around 20-25 of those charts to tell the main story about each topic we cover.

That leaves a lot of story untold – at least 75 data charts worth. Sometimes the data doesn’t jive with what we hear in the market or the rest of the data. Sometimes we asked a bad question (it happens). Sometimes the story is, as they say in the news business, one of “dog bites man ” – the kind of thing that is generally unremarkable.

Sometimes, because we spend so much time in the data, the things we find to be unremarkable actually have a lot of meaning to other people. It’s just that we see it so often we get a little jaded.

So, after a lot of thought, we’ve decided to use our Facebook page to share with you “Uncharted RSR “. Every week (or so) we will publish a data chart we did NOT use, what we think it means, and why we didn’t use it. You’re welcome to comment on it, share it, use it (please cite it – the correct citation for each chart is in the post), question our sanity, whatever you like.

But the important thing to note is, you will only get this uncharted content on Facebook. Nowhere else. However, to get the ball rolling, we’ll give you a taste of what we’re publishing there. If you like what you see, please share it, tell people, etc.

Profitability Of Multi-Channel Shoppers By Vertical

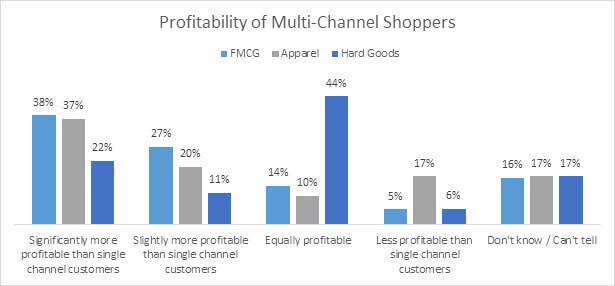

In our 2016 Omni-Channel benchmark, Retailers’ Omni-Channel Blind Spot: Digital, we talk a lot about the profitability of omni-channel shoppers. Turns out retailers have made some progress in understanding whether or not multi-channel shoppers are profitable, and that has given them some increased confidence that multi-channel shoppers are, indeed, more profitable than single channel shoppers.

One chart we didn’t use, though, was this one – the profitability of multi-channel shoppers, cut by vertical. One bar clearly stands out from the rest, and that is the very large plurality of hard goods retail respondents who believe that multi-channel shoppers are no more or less profitable than single channel shoppers.

Source: RSR Research, 2016 Omni-Channel Benchmark Survey Data, August 2016

Our take? This is a clear indicator of the Amazon effect. Hard goods retailers have been competitive to Amazon the longest, and the online retailer’s relentless pursuit of low price has hurt this segment of retail the most. When it comes to omni-channel, hard goods retailers tend to be the most pessimistic. And this chart underscores that perspective.

We didn’t use this chart because it’s something of a “one-hit wonder ” – it only tells one story, that of hard goods retailers’ pessimism. In the space we have in our reports, already long and dense as it is, we just didn’t have room to include this one.