RSR Research Preview: The State Of Buy-Online/Pickup-In-Store

The COVID-19 pandemic is a major disruptive force in an already-risky global retail environment. Business challenges that before were merely emerging are here now, and retailers and their suppliers are feeling the full force of their impact. While buy-online/pickup-in-store (BOPIS) shopping has skyrocketed, that has led to dramatic backups on in order fulfillment processes.

RSR’s soon-to-be-released benchmark on the state of Buy-Online/Pickup-In-Store and Buy-Online/Return-In-Store (BOPIS & BORIS: Good Or Bad For Retailers?), is based on results from a survey that was completed in January and February, just before COVID-19 hit the U.S. If anything, the COVID-19 crisis is likely to cement the value of BOPIS and BORIS in consumers’ minds, just as the Great Recession caused consumers to use smart mobile technologies to investigate and select the best products to meet their needs – leading directly to today’s omnichannel retail environment.

Until the dramatic impact of the coronavirus crisis, retailers found some comfort in the fact that the majority of sales flow through stores. For example, in the US about 88% of total sales continue to flow through the stores, while in the UK store sales are approximately 81% of total sales. Retailers understand the value of enabling customers to build orders in the digital domain while still bringing them to the store with a BOPIS option. It should be a win-win: consumers have more control and all the advantages of 24X7 shopping, while retailers can breathe new life into the stores.

Because of the singular shock to the retail environment brought on by COVID-19, the percentage of in-store sales that is the result of the interaction between the digital selling environment and the store is increasing – dramatically. The question is, how can retailers fill those orders profitably? The new benchmark tries to answer that question.

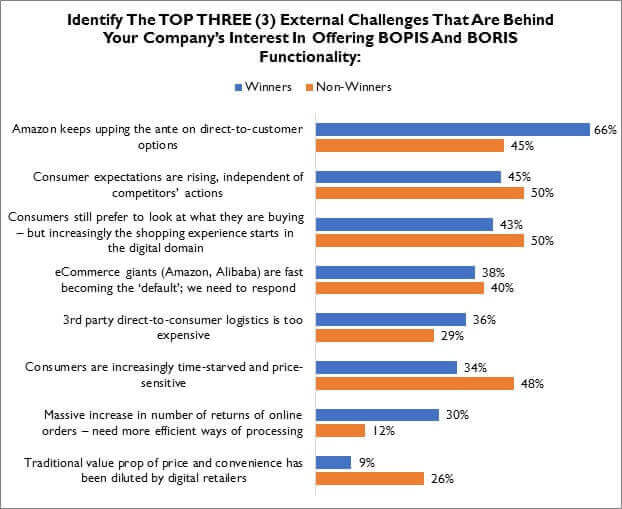

But let’s be clear: retailers have been moving toward BOPIS and BORIS for years, as a response to the explosive growth on the digital marketplaces, especially Amazon. The threat isn’t only that the eCommerce giants are determined to win a larger share-of-pocket. Amazon is also adept at raising the barriers to successful competition. Over-performing Retail Winners are particularly sensitive to this dynamic (Figure 1).

The dominance of Amazon in eCommerce has risen for the US market in the last 5 years from 34% in 2016 to 37% in 2019[1]. According to U.S. government figures, eCommerce accounted for over one-half of the sales gains the total retail industry achieved in 2019, and over 55% of the growth achieved by eCommerce came from Amazon. But US retailers have successfully pulled some eCommerce business away from Amazon in the last year, when it dropped from almost 50% of the total eCommerce market in 2018, perhaps the result of 35% growth in Walmart’s eCommerce business in 2019.

Figure 1: Pureplay Pressure- Greater Than Consumer Expectations

Source: RSR Research, April 2020

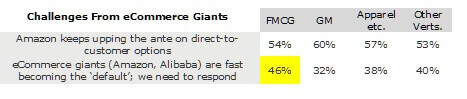

While retailers may believe that they can offer an attractive counterpoint to Amazon’s (and Alibaba’s) value proposition, many are concerned that the eCommerce giants are becoming the default for consumers, in other words: the first place they look for products. While there seems to be a high level of agreement between Winners and others on this point, examining the question by retail vertical reveals different concerns (Figure 2).

Figure 2: Trying to Overcome The Default?

Source: RSR Research, April 2020

By offering BOPIS and BORIS to consumers, retailers know that new processes both in-store and in distribution centers will necessitate new labor. But underlying this challenge is the realization by some retailers that consumers “began demanding these functions in store before we could anticipate their popularity.” In other words, retailers’ adoption of BOPIS as a defensive measure against customer dissatisfaction is behind how quickly they’ve come to accept those as must-have capabilities.

A Glimpse Of What’s To Come

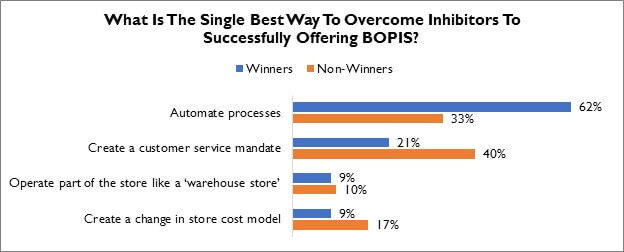

Winners are certain: if they are going to successfully embrace Buy Online/Pickup In Store and be profitable at it, it’s going to take some serious rethinking – and retooling – of their current processes (Figure 3).

Figure 3: Knowing: Still Half The Battle

Source: RSR Research, April 2020

“Knowing” is only half the battle. According to the new study, Winners have a clear leg up on everyone else when it comes to implementing BOPIS options. Over-performers really are years out in front of the competition.

This Is Just The Start

COVID-19 – and its effects on consumers – will no doubt linger for quite some time to come. Will people want to leave their house the moment the “All Clear!” is announced? Certainly. But their behaviors irrevocably have changed, and in many cases, in significant ways. No one can predict exactly how just yet, but it is a safe bet that shoppers may not be as inclined to spend unlimited time in stores – particularly stores that are light on the “wow” factor. As a result, the trends revealed here on our first ever study on BOPIS and BORIS likely only hint at how much more popular these features will become in the very near future. Shelter-in-place orders have caused virtually everyone to embrace creative ways to buy goods online that – just a short time ago – they would have visited a store to pick out. When the outbreak clears, much of that online fulfillment is bound to remain – with a trip to the store only necessary in to grab the goods right now – or return the ones that didn’t quite work out.

Time will tell, but it certainly seems like BOPIS and BORIS are just warming up and becoming a consumer staple.

EDITOR NOTE: RSR’s newest benchmark report, BOPIS & BORIS: Good Or Bad For Retailers?, is sponsored by Envista, and will be released on April 23, 2020. As always, the report will be free for download.

[1] https://www.digitalcommerce360.com/article/us-ecommerce-sales/