People Don’t Change At The Pace Of Moore’s Law

I have to give Paula credit for planting the seed of this notion. It came about during a discussion at SAP’s Analyst Base Camp last week (which Brian is reporting on). Paula and I were discussing the challenges inherent in merchandise planning these days, particularly around how to truly integrate a customer orientation into a product-focused planning process.

Part of the challenge is that the technology has evolved, but the processes and the people have not. RSR has heard all about the potential of high-performance computing – HANA is one of a handful of solutions that tech companies are targeting to address the potential – but when we discussed this kind of opportunity with a retailer in the design phase of a new merchandise planning solution, the idea that this retailer should design a process that starts with a forecast for every SKU and that this should seed the plan was met with outright incredulity. “No way!” Forecast every SKU? Impossible. Is it?

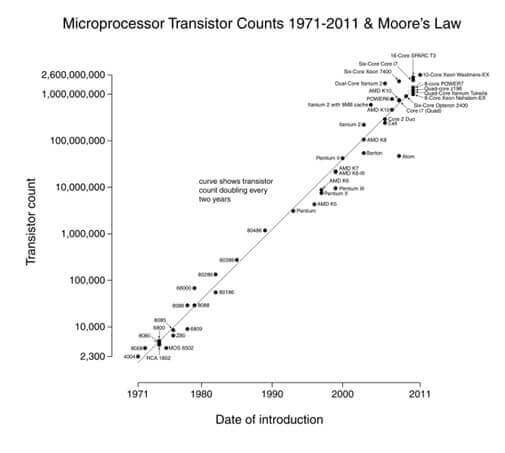

When people draw a picture of Moore’s Law, they almost always draw a straight line:

http://en.wikipedia.org/wiki/File:Transistor_Count_and_Moore%27s_Law_-_2011.svg

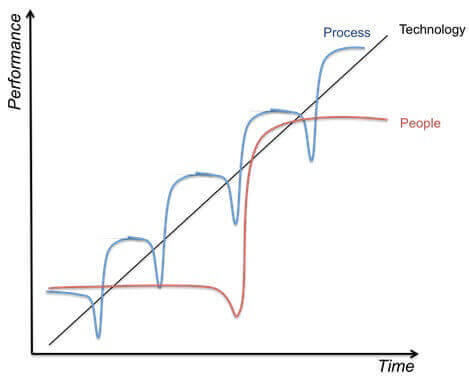

But processes don’t change like that. In fact, I would argue that processes follow something like a series of S-curves:

http://stevenmsmith.com/ar-satir-change-model/

And people are on an even longer timeline – the rule of thumb that I was always told while at PwC was that cultural changes take a minimum of 5 years to really take effect.

When you put all three together onto one chart, you get something like this:

Technology just keeps on changing, and those changes incrementally make their way into the enterprise – though I would argue that the pace of technology adoption in the enterprise has received a serious jolt to the chest thanks to the consumerization of technology – the rapid adoption of smartphones and tablets. Processes, more tied to technology than ever, don’t change at nearly the same frequency. But, at least in retail, we are at a significant dip in the process change curve.

To use Steven Smith’s model above, mobile devices have introduced a foreign element into the process, and retail is living in the depths of chaos as the industry tries to get a handle on how it will change their customers and ultimately their business processes. In merchandising specifically, I would even argue that planning processes are at the foreign element phase – the foreign elements of consumer data as part of the planning process, alongside the performance improvements that radically change the level of granularity that retailers should now be able to plan at, are about to trigger chaos. But most of what we’re seeing right now is simply resistance. “Impossible!”

Which takes us to the third curve, and the slowest frequency of change – that of people’s behaviors. More often than not, that dip on the people curve isn’t from a group of people suddenly waking up one morning and deciding they need to change. Instead, there’s either a crisis of performance that is acute enough to inspire people to step up and make significant changes, or there’s a turnover of some kind – either in leadership, or the natural turnover of one generation giving way to the next. I don’t think it’s a coincidence that I’ve heard several people say that it will take retirement (or the much less charitable opinion of “death”) and a turnover at the executive level before retailers truly embrace either customer-centric thinking or the omni-channel transformation that is already eating away at their process and technology alignment internally.

Retailers have had to undergo transformation before. The last one of significance on par with omni-channel seems to be the supply chain and scale transformation that put Walmart and other “channel masters” at the top of the industry. It’s no coincidence that the foundation of their success is the seed of the next wave of transformation: channel.

But the focus of omni-channel transformation has been primarily on process – the shopping process, and retailers’ internal processes in responding to customers’ behavior changes as they crash across those highly efficient and carefully constructed channels. But all of this is happening in the context of some step-level changes in how technology is made available and used in enabling processes.

I fear that too often, these are looked at separately and not together – omni-channel transformation and enterprise technology transformation. And the risk on the people side is two-fold. First, that even the IT people in a retail enterprise don’t recognize how much things like mobile and cloud and high-performance analytics will impact their own processes – forget about the business. And second, lacking that understanding, they’re not going to be able to do the best job of explaining to their business partners exactly how all this change – process and technology – is going to change the business.

And so the reaction is predictable: “Impossible!”

I know that every transformative period feels like it’s the most disruptive one to ever exist – especially while you’re in the midst of it. But omni-channel in retail really does feel like a bigger disruption than “typical” because it’s not just about getting process to catch up with technology – that, I would argue, was what the channel master revolution was all about. This time around, it’s not just process that needs to catch up – it’s the technology too. And as far as technology goes, we seem to currently be at a point where people, on a transformation curve, are only at the “foreign element” phase – where their initial response is resistance.

This is a long way to say that my primary take-away from two days spent with SAP is that the waves of change hitting the retail shore right now aren’t just business model change – which is agonizing enough. It’s technology model change. SAP is but one of several solution providers I’ve spent time with over the last four months that not only recognize this, they are feeling it in their own business and changing their model to respond.

The big question is, how many retailers grasp this? And how long until “Impossible!” turns into “How quickly can we do this?”