Marketing’s Big Moment

As retailers work hard to fulfill the cross-channel brand promise consumers have come to expect, the role of marketing is steadily becoming even more important. In fact, the way retailers communicate to consumers is on the cusp of becoming something completely different: digital marketing is poised to have a breakout moment.

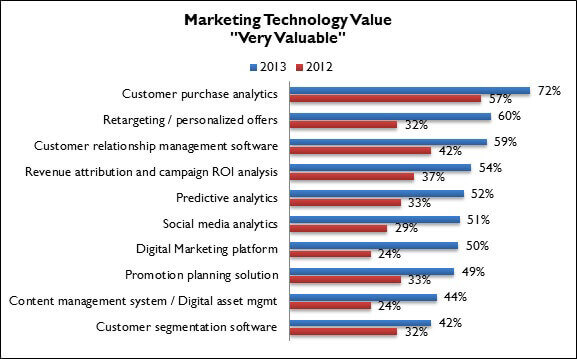

As a result, the increase in perceived value of virtually all marketing technologies is somewhat staggering; another clear indicator of the impending sea-change. In this year’s marketing report, for the most part, the order of priority for individual technologies remains fairly constant from years past (with customer purchase analytics, retargeting, and CRM software winning top honors): the scale of magnitude of this interest, however, has skyrocketed in the last year alone (Figure 1).

Figure 1: The Value Stampede

Source: RSR Research, August 2013

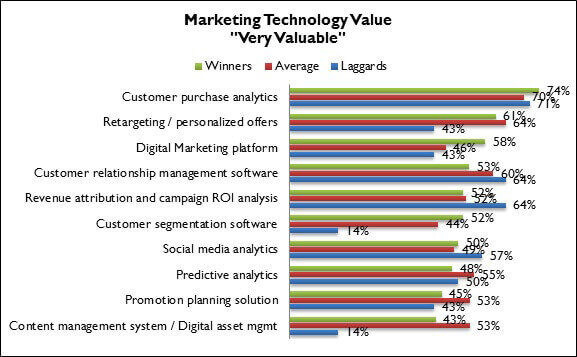

But when viewed by performance, some serious indicators of what’s to come arise (Figure 2, below).

Winners are far more interested in the value a digital marketing platform could provide (58% to laggards’ 43%), even though very few have yet to implement one. Winners are also much more interested in customer segmentation software (52%): they know in order to attain their earlier goals of delivering targeted messages across channels it’s going to take more insight – and ways to segment those insights into actionable information – to get there.

Figure 2: Winners Have a Different Value Emphasis

Source: RSR Research, August 2013

But laggards place an inordinately low value on these same customer segmentation tools (14%), begging the question, “How can one expect to deliver a targeted and personalized message to shoppers when you can’t even segment those shoppers on the most basic level? ” It is a prime example of how laggards tend to prioritize the end goal (a more relevant and differentiated customer experience) over the required means to attain it.

What all of this data tells us is that when it comes to the next generation of technologies designed to take retailers from old-world marketing into the digital age, technologists won’t have a very hard time leading them to water – it’s the getting them to drink part that will be the challenge. Per usual, Winners already have a jump start on their competitors, putting higher priority on more useful technologies, making sure their internal marketing departments have the required ability to take on new systems, and in small part, they’re already starting to roll those technologies out. What will be interesting to see next year is this: If retailers’ perception of the economic outlook finally has turned a corner, will the loosening of budgets serendipitously line up – timing wise – with the other half of the equation: the unavoidable easing of internal challenges (consolidation, culture, and old-world marketing processes) that must occur in order to facilitate real progress?

If that answer is indeed yes, we may be looking at a brand new, digitally-enabled world of marketing sooner than we anticipated.