Converged Selling Channels: Just Do It

We’ve been writing, talking, tweeting, and blogging about this for years: the digital and physical selling environments are converging for retailers. RSR partner Nikki Baird’s excellent series in on “The History of Omni-channel ” (available via the RSR website) explains not only how we got here, but what to do about it.

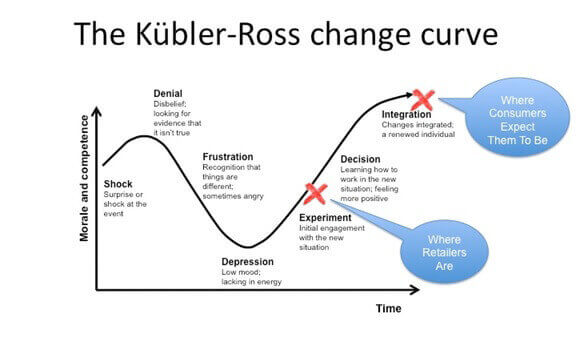

The only reason selling channel convergence (or “cross-channel “, or “omni-channel “) continues to be a subject of interest is that retailers are still trying to negotiate the scope and terms of the change with consumers who have already made up their minds. The selling channels have converged as far as consumers are concerned. The space between retailer realities and consumer expectations reminds me of the classic “change cycle ” (there are several versions of this, but I’m talking about the “personal ” change cycle, the one that we all go through when we experience a “significant emotional event ” like losing a job or getting kicked out of a relationship). Applying that change cycle to the path to omni-channel maturity looks like this:

Figure 1: The Change Cycle Applied To Retail

I was asked by a reporter the other day to comment on what I thought about JC Penney’s new CEO Marvin Ellison‘s openness concerning that company’s challenge in catching up with the consumer. Quoting the retail leader: “We have also a lot of work to do to restore JC Penney to its status as a world-class retailer. We’re going to spend a ton of time making our omni-channel a lot more effective… We are committed to become a world class omni-channel retailer. We understand the change in dynamics of retailer. We also understand that attempting to recreate a pre-2011 JC Penney would not work in this new omni-channel world, therefore are adjusting our business model and our leadership team to compete on this new omni-channel retail landscape. “

The gist of the reporter’s question was, “is it too late for JCP? ” My answer: of course it isn’t. In spite of the fact that we’ve been grappling with consumers’ new digitally empowered shopping behaviors for years, it’s still early days for many retailers, as they struggle with what RSR calls “the visibilities ” (enterprise wide visibility into inventory, product, and customer information in something approaching real time), implementing effective ways to assign the costs and revenues associated with omni-channel order fulfillment, establishing store level operational changes needed to support a higher service profile, and how to forecast demand and plan assortments in a world where (as Nikki describes in Part 7 of her Omni-channel series) demand “breaks “.

On an NRF-sponsored webinar on the subject of converged selling channels last week, I spoke with Chris Silver, the Director of Retail Technology Systems at Urban Outfitters, and he said something that really caught my attention. When discussing what “real time ” means in a converged selling environment, he said, “the store needs to be alive with the most accurate information in order to serve the customer “. What jumped out was the word “alive ” – it implied an almost organic sense-and-respond environment. In the case of Urban Outfitters, the company is systematically knocking off the things that stand in the way of such a vision, experimenting and learning, and integrating what works into the offering. They are deep into the change cycle, but it’s still definitely a work-in-progress. That is pretty much the state of affairs for even the most progressive retailers.

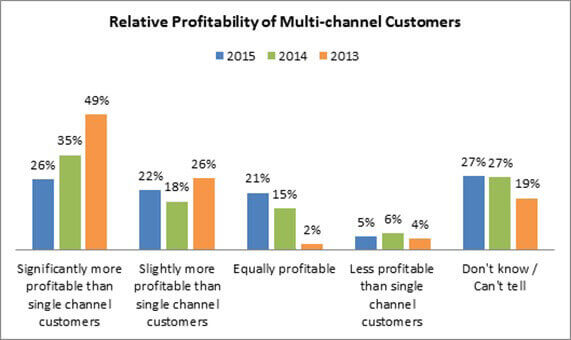

So, “no “, it’s not too late for JCP or any other retailer, but that’s not to say that you can take your time about it. And here’s why. RSR partner Paula Rosenblum and I are working on a report that updates the state of cross-channel in Retail (the report will be released in mid-September), and here’s what we see. In the past several years, there has been a great leveling off in the perceived profitability of multi-channel customers (Figure 2). Why? Because for consumers, a harmonized digital/physical shopping experience is “just shopping “. While many retailers are still trying to negotiate the scope of the changes required to meet consumer expectations, consumers expect it all to be there and working.

Figure 2: Leveling Off

If there was ever a signal to “just do it “, this is it.