Who’s Affected By The Pressure Of 2020?

The long-subscribed-to retailer/employee model isn’t really working right now. It’s pretty hard to view employees in a churn ‘em and burn ‘em fashion when a global outbreak has rendered them a) quite necessary and b) very much at-risk. So we launched a custom bit of research for our friends at Ceridian recently. We wanted to understand how retailers are changing to meet the times – or, at the very least – how they plan to. And to do so, we first needed to understand just how much retailers are feeling the pressure of a changing world, and who, exactly, is feeling it the most.

Within, our retail respondents are clear: the top challenges they currently face all relate to consistency. They know that the accurate and efficient delivery of customer orders for store pickup is vital, they know it requires organizational visibility in order to bring that promise to life, and they know that any directives they undertake from here on out must be consistent across the entire chain (Figure 1).

Figure 1: Across All Retailers…

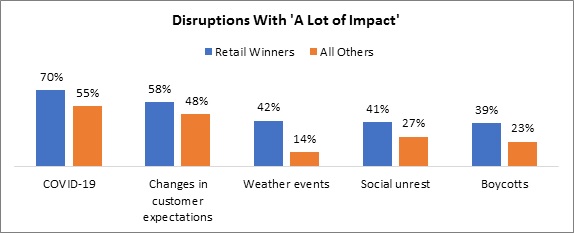

However, while retailers may be in agreement in prioritizing overarching challenges, when we scratch a bit deeper some telling differences appear (Figure 2).

Figure 2: … But Not All Retailers Are Impacted Equally

In a world on fire, Winners feel the heat most. Whether due to the pandemic, or climate change, or contentious political battles, or social issue-related protests/boycotts/riots – Retail Winners have been disproportionately affected by these disruptions. This makes perfect sense: those who are currently experiencing the highest volume of sales will no doubt be the most likely to feel the effect during a truly unprecedented era, one where myriad adverse phenomena have coincided to create a giant cloud of uncertainty. But we can find uncertainty across other dimensions beyond retailer performance:

- The smaller the retailer, the more they report being affected by changes in customer expectations. For example, 63% of the smallest retailers who took our survey (<$500 million in annual revenue) report this as an issue, compared to only $48% of Tier 1 retailers (>$5B in annual revenue). Mom and Pops have a real problem here, as they rely on their ability to know their customers better than larger retailers can – it’s a significant part of how they differentiate and compete. With the world swirling as unpredictably as it is, it’s becoming increasingly difficult for them to be able to identify what it is their customers want and to then meet that demand. This is not good news for small retail.

- By geography, European-based retailers are much less likely to be challenged by changes in customer expectations. They also report far less impact from things like social unrest, as well. However, while retailers based in the UK and EU report COVID-19 to be their biggest challenge (which we also expected) we are somewhat surprised to see that weather events are the lowest on their list (a meager 13%).

- Grocers are the retailers most affected by social unrest. Sixty-three percent of retailers selling Fast Moving Consumer Goods have been impacted by such matters. Consider that only 20% of hard goods retailers say the same, and it becomes immediately apparent that the very nature of selling food is the cornerstone of the “essential” in essential businesses. Grocers have had to stay open, far more so than any other vertical, and while they have enjoyed groundbreaking sales (and profit) numbers, it has not come without cost. Broken windows, stolen goods, in-aisle mask disputes, skirmishes over inventory, sick employees – it is important to keep in mind the pressures these retailers feel during trying times.

If you haven’t read the full report, we invite you do to so now. Within, we feature another 17 charts of analysis – and get down to what retailers plan to do in the face of all this upheaval.