Where Do Retailers See The Most Value For New Technologies In Their Stores?

We’re currently conducting a brand new store survey, and while we wait for respondents’ data to come in, it got me thinking about what we learned last time around. It was just back in April, but with everything that’s happened this year, that somehow feels a lot longer ago.

Because the list of technologies that retailers could put in their stores is so extensive, we segmented the options into three main categories: Store Management tools, Customer-Facing technologies, and those that are directly put into the hands of Store Associates to help them provide more value.

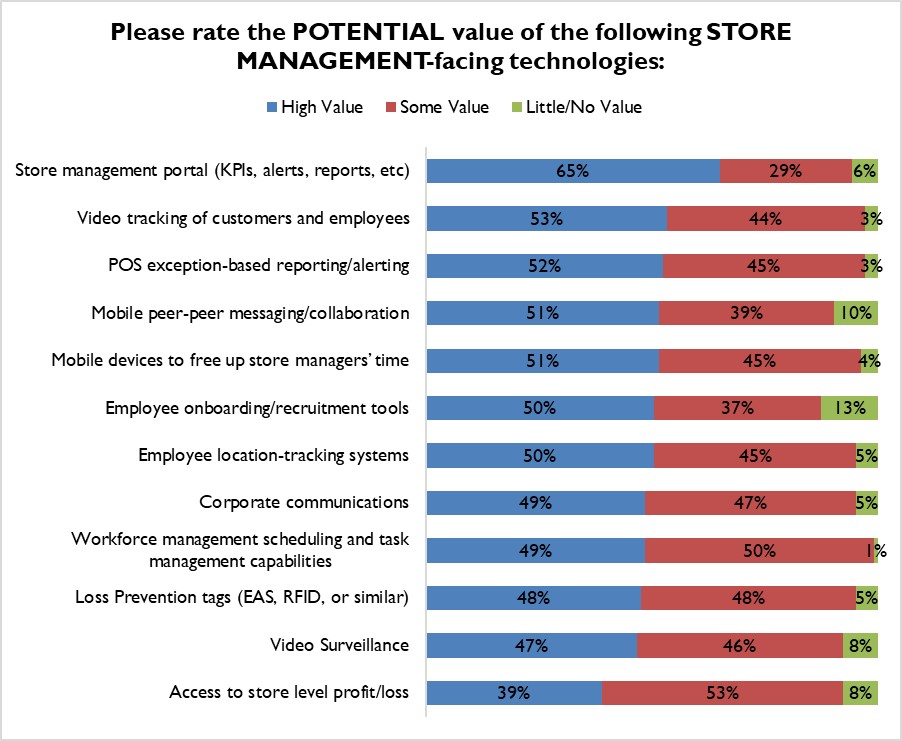

So what did we find, and what will be comparing it to in a few weeks? The figure below shows where our retail respondents saw the greatest potential to better manage their stores overall in as of that moment in time – and the name of the game was better reporting and KPIs. The ability to track customers and employees, and the ability to know when/why exceptions occur at the point of sale round out the top three priorities (Figure 1)

Figure 1: Help Me Understand What Happens In These Four Walls

Source: RSR Research, April 2024

Regular readers of RSR’s benchmark reports will see the data above as natural extension of what retailers have increasingly been telling us over the past several studies we’ve conducted. In fact, since the COVID-19 pandemic of 2020 and the tumult it brought to a comparatively-serene store landscape prior, retailers’ desire for new metrics to understand events in stores – particularly adverse events – has steadily grown. The topic is so high on retailers’ lists that RSR conducted its first ever study on the topic in 2022. From that report:

- 52% of retailers strongly agree that management is “constantly looking for new ways to measure performance” – but likely more importantly, those tools need to be easily digestible: 98% agree that “the executive team needs performance reports that are ‘short and sweet’”.

- The better a retailer’s sales performance is, the more likely they are to trust in the power of data. 76% of Retail Winners are already using and satisfied with tools that help them make sense of data being extracted from their legacy operational systems.

- When it comes interfaces, executive dashboards already hold the most appeal to retailers. 97% say these are the most valuable tools currently available, and 54% are not only already using such tools, but report that they are very happy with the results so far.

- Retail Winners are also already far more reliant on things like natural language interfaces, exception alerting tools, and role-based mobile access, often-times at an implementation rate of more than 2 to 1 over their average and underperforming peers.

Put simply, retailers want to know what’s going on in stores. The better the retailer, the more they want new tools to help them get that information – and to get it in both a simple and actionable fashion.

Can’t Get No Satisfaction

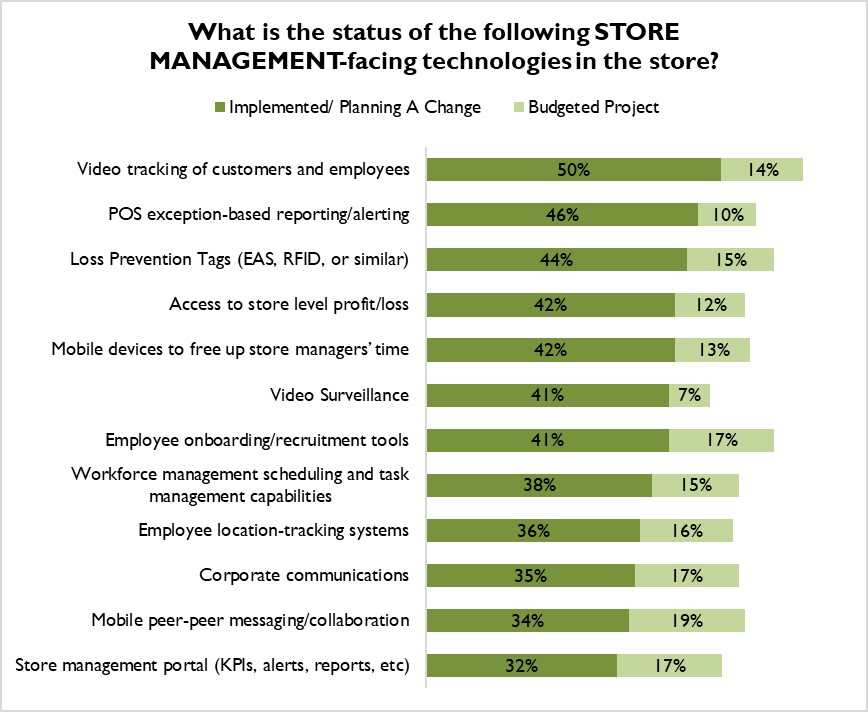

However, understanding the potential value of these store management tools is one thing; understanding what retailers think of the investments they’ve already made in such tools something else entirely. As Figure 2 clearly shows, retailers are not particularly happy with the implementations they’ve rolled out so far.

Figure 2: A Lot Of Dissatisfied Customers

Source: RSR Research, April 2024

Typically, we do not see data like this. For example, more retailers are unhappy with the video solutions they’ve installed (50%) and planning a change than are happy with the investment they’ve made to date (44%, not pictured). The same trend extends to investments in POS exception-based reporting and alerts: 43% of retailers report satisfaction with their current solution, while 46% tell us they have implemented such tools but are not satisfied with them.

What makes this data so unusual is that while a large portion of retailers are dissatisfied with the solutions we asked them about – video tracking, for example – a relatively small number of retailers who have yet to invest in this category have put budget aside for net-new investments (only 14%). This trend extends across all of the technologies we put forth (the highest net-new investment solution on offer is mobile peer-to-peer collaboration at 19%), and thus begs the question: are retailers simply going to reinvest in the areas where they are dissatisfied – or will they be turning their investment dollars elsewhere?

We cannot offer a definitive answer. What we are able to ascertain, however, is that when it comes to the technologies retailers value the most – those that afford them a more granular understanding of what is happening within the four walls of their stores – a very large swath – at least as of a few months ago – is not particularly happy with the results to date.

Will this pattern continue? We don’t know yet – but we will in time for the NRF Big Show in January. Stay tuned!