What Stands Between Retailers And Better Business Intelligence Capabilities?

Two major trends are driving retail analytics these days: “Big Data” and how to handle it on the one hand, and atomic data needs – the real-time sense-and-respond analytics that need to be delivered in small bite-sized chunks – on the other. In effect retailers need to manage and understand macro impacts and micro impacts simultaneously. Throw in new data sources like social media and mobile, that retailers just aren’t that intimately familiar with and honestly have no idea how to apply the resulting analytics to business decisions (what does it mean if one product gets 25% more Facebook likes than others in its category? Anything?), along with explosive growth in mobile devices that make it easier to access analytics in new form factors like mobile, and you’ve got a mess.

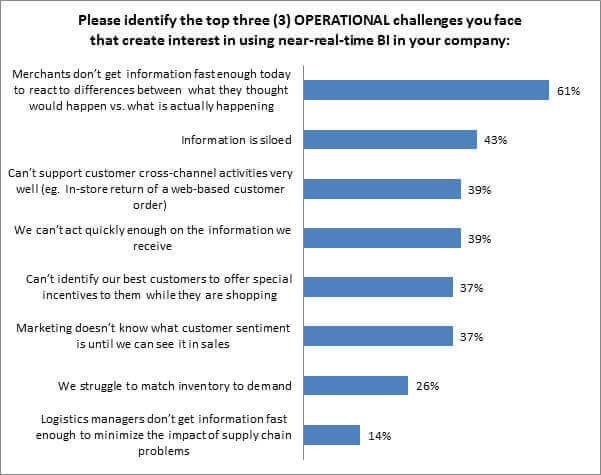

With all of these desires to manage micro- and macro-data simultaneously, retailers in our just-released Business Intelligence benchmark are in fairly strong consensus about the operational challenges they face: merchants simply can’t get information fast enough to react to the differences in what they thought might be happening vs. what is actually happening. In fact, this top challenge has escalated in importance even in the past 12 months (52% in 2011, 61% in 2012, Figure 1).

Figure 1: Time to Get Creative

Source: RSR Research, October 2012

We also offered retailers a new option to choose this year: Was the siloed nature of the way a modern retailer is set up (merchandising over here, marketing over there) plaguing their ability to share and act upon potentially valuable information? As the second most popular selection they made, we got our answer pretty quickly: 43% of retailers tell us that their attempts to utilize data across the various departments they’ve set up to “divide and conquer ” the workload has presented a significant operational challenge. It only makes sense that larger retailers feel this pain even more (55% for those with sales of $1-$5 billion, 47% for those above $5 billion): as operations scale and departments become less entwined, so too does the human nature of employees to keep to themselves. It is a problem only a handful of headline-worthy organizationally-innovativecompanies have found solutions to so far.

A Time for Reconciliation

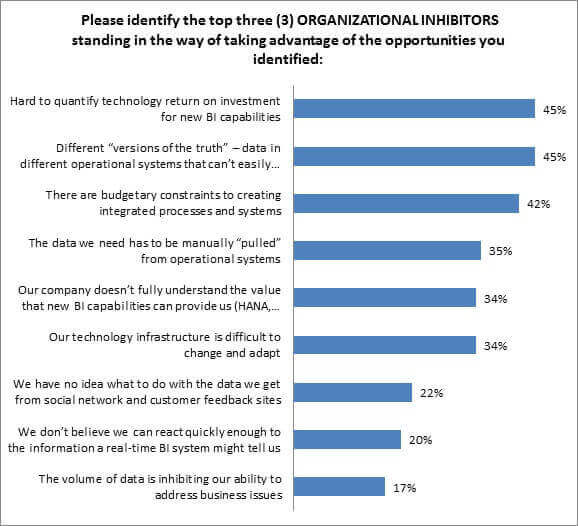

As always, budgetary constraints and ROI proof-of-concept show up in retailers’ top inhibitors to new processes and systems. However, the difficulty in reconciling different “versions of the truth ” from one operational system to another is becoming even more prevalent as time marches on (42%, Figure 2 – up from 34% in 2011). This compounds the issues retailers reported in the previous chart: not only do their different internal departments have trouble sharing information with one another, but the various systems they use in their day-to-day operations would render it difficult even if the culture to do so was in place.

Figure 2: Hurdles to Conquer

Source: RSR Research, October 2012

Winners, no doubt further along in their efforts to modernize and replace these systems, report varying points of frustration:

- 44% of Retail Winners are inhibited by their existing need to manually “pull ” data from operational systems – only 17% of laggards identify this as a problem so far

- 40% of Winners (vs. 30% of average and 17% of lagging retailers) say they don’t fully understand the value new BI systems, such as HANA, Hadoop, or Exadata, can bring to their IT efforts. This is clearly an indicator that the best performers are further along in examining next-gen BI solutions – laggards haven’t even gotten around to examine these new technologies yet

- 40% of Winners say their technology infrastructure may be difficult to change and adapt: only 25% of laggards report the same problem

Put simply, Winners are “further down the rabbit hole ” in bringing their BI systems up to date. Laggards don’t yet know what tactical challenges await.

The full report, Business Intelligence: A Work in Progress, examines many more of the challenges and opportunities that retailers perceive right now, and is available for all to read by following this link.