What Consumers Say About Mobile

If you read our research, you know that we typically don’t survey end consumers.

Our core offering – benchmark reports – are conducted by a) picking a topic that is highly relevant to the current retail landscape and then b) asking retailers what they self-identify as the biggest challenges, opportunities, and roadblocks within that topic. We also ask them about their implementation and plans for technology solutions. However, a few months ago, we decided to try something a little different.

Occasionally, when we’re conducting custom research, a client will ask us for a 360 degree view of a topic. It’s not something we get to do a lot of, but when we do, we love it. The ability to get the “he said/she said ” viewpoint comparing retailers’ perceptions to consumers’ realities is fascinating; and the differences tend to be staggering. So when we were kicking the can around a few months back about new things to try, we thought “why not do our own 360 view of mobile technologies? “

And so we did.

We recently polled over 1,000 adult consumers in the US, and asked them very straightforward questions about how they use their mobile devices in home, at work/school, or when out in the world shopping. Much of the resulting data will appear as point/counterpoint in our ongoing Mobile benchmark reports (the most recent of which just published in February, and the next retailer survey launches in October of this year).

We’ve also provided much of the data to our friends over at Internet Retailer for an exclusive piece they published last month (If you didn’t get a chance to see it, you can find a link to that piece here). But one of my favorite data points is worth sharing here, now.

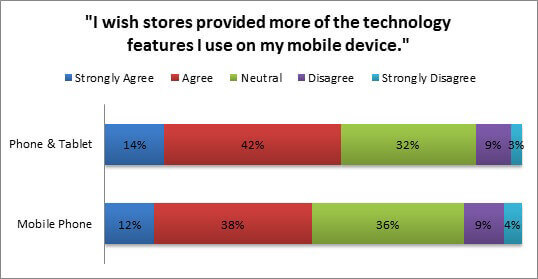

One of the things we asked consumers was about which devices they owned, and what’s really surpsising is that according to our data, the more connected a consumer is, as of today, the more likely a retailer is to let them down (Figure 1).

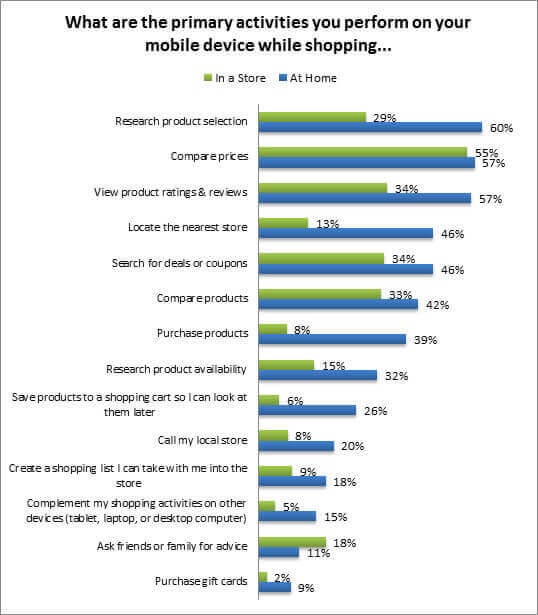

Furthermore, 43% of consumers surveyed agree that their mobile phone can tell them more about the products that they want to buy in store than any store associate can. This is a direct result of the fact that consumers use their mobile devices differently when they shop in stores than when they shop from home – they’re more likely to use their phones in stores for late-stage purchase help (Figure 2).

If retailers gear their mobile engagement towards the activities they see when consumers are shopping from home, they’re missing the boat on helping consumers in stores. That leaves consumers with only one real in-store activity: comparing prices, and that is hardly where retailers want/need to be headed. If you’d like for us to share more of these findings, please feel free to reach out via email. It’s really interesting data.