Walmart Worries about 1Q Sales: Should Everybody Else?

One of the things I learned in my tenure as a corporate exec was this: don’t memorialize things in e-mails that would embarrass you if they were discovered. I don’t know how many times that particular lesson has to be re-learned, but the latest gaffe comes by way of Walmart’s VP of Finance and Logistics Jerry Murray. Bloomberg News somehow obtained internal Walmart e-mails and reported that in a Feb.12th exchange, Murray commented that, “In case you haven’t seen a sales report these days, February MTD sales are a total disaster… The worst start to a month I have seen in my 7 years with the company. ” This early indication of how February might turn out followed a disappointing report from the giant retailer for January.

The Walmart exec then went on to blame the rise in the U.S. payroll tax as the probable culprit. What he’s e-mailing about is this: a temporary payroll tax for Social Security contributions got a “holiday ” of 2% from the default rate of 6.2% (taking it to 4.2%), as part of President Obama’s 2010 economic stimulus package. It was supposed to expire after 2011, but was delayed one year by Congress to take it off the table as an election year issue. It finally expired effective on 1/1/2013 after the latest “fiscal cliff ” deal between Congress and the White House failed to extend it further (bringing the rate back to the default of 6.2%).

Loose Lips and Sinking Ships?

Aside from scratching your head at the foolhardiness of putting “forward leaning statements ” into an e-mail- let alone letting them slip out of corporate control, one has to wonder: is anyone surprised that the tax break expired? But following the Walmart leak, the news was full of hand wringing about the effect of the 2% increase on consumer shopping, with headlines blaring words like “plummet “, “hit hard “, and “weighed down “. The question remains however: were (and why were) corporate planners surprised? It starts to feel like an excuse.

And while all eyes were on Walmart, not everyone was so downcast. January is “clearance month ” on the retail calendar with serious markdown prices, and yet the Census Bureau reported that retail sales rose 1% from December (which of course is the golden month for most retailers). Here’s a list of some of the January-to-January comp sales figures reported (chosen because these retailers presumably appeal to the same bargain-hunting consumers that Walmart does):

- Costco: +4%

- Target: +3.1%

- Ross Stores: +4%

- TJX: +3%

A More Interesting Discussion

As far back as 2007, my RSR partner Paula Rosenblum has said that the day of the “supply chain masters ” is drawing to a close, as evidenced by Walmart’s struggles to maintain growth in same store sales. At the time, she wrote, “Thus was born the notion of a’post Walmart’ world. In a post Walmart world, retailers could not differentiate on operational efficiencies, or selling commodities. Walmart owned that space. “

And that’s pretty much what has happened. The model of the supply chain masters is simple in concept: the better you are at “buying “, the more aggressive you can be on price on the “selling side “. But RSR has been saying for some time that consumers are more-or-less in open revolt against the “push ” model for anything but the necessities of living, especially now that pricing has become so transparent across channels and geographies and consumers have so many new choices. New-competition retailers have figured out how to survive in the “post Walmart world “. As another of my RSR partners, Nikki Baird, often says, “it’s not about what retailers want to sell anymore – it’s about what consumers want to buy. “

When we talk about “stagnant ” sale growth, we mean “in comparison to overall sales growth “. It would be easy to assume stagnation in the U.S. retail market as a whole; times have been particularly trying for this consumer driven economy since 2008. Here’s a graph of U.S. sales growth in the last 10 years:

The Great Recession is plainly in evidence in the U.S. Census Bureau data, with the nation’s retail sector trending worse than -10% in 2009. More interesting is the overall 10-year trend line, showing that U.S. retail sales are slowly but inexorably trending south, from just short of 5% to below 4%. In fact, it’s pretty stagnant!

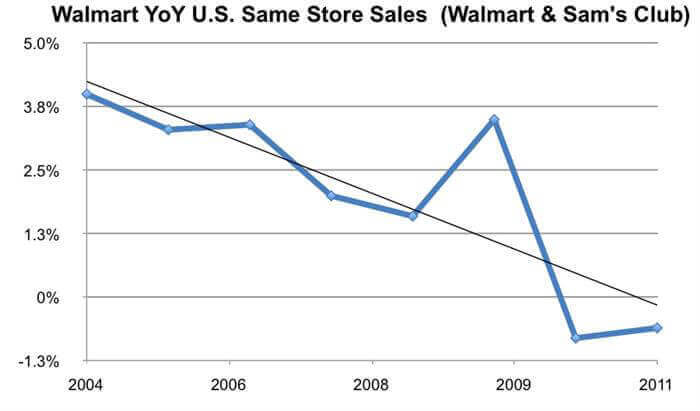

By comparison, here are Walmart’s U.S. same store sales year over year comparisons (including both Walmart and Sam’s Club same store numbers, taken from the company’s annual reports):

What the graph clearly shows a few things: first, that Walmart was able to take advantage of the Great Recession with their promise of “Low prices. Every day. On everything “; secondly, that while the economy has improved, the company hasn’t been able to maintain the gains it earned in 2009, and that the 10 year trendline isn’t just stagnant (as total U.S. sales seems to be), it stinks. And finally, it shows that the 2010 payroll tax “holiday ” didn’t help Walmart all that much… therefore, it’s a little threadbare to blame soft sales now on the fact that the holiday is over.

What Can Be Learned

None of this is meant to trash Walmart. It’s invariably the case that “the higher you fly, the harder you fall ” – just ask the folks at GM. And just as was likely true at GM, there are probably people right now in Bentonville figuring out what the next big breakthrough will be (although I’ll bet that unlike GM, they won’t wait to hit bottom before doing something about it). But this story does point to some necessary learnings. Here’s what comes to mind:

- The financial and popular press need to look past Walmart to get a sense of what is going on with consumers

- People need to separate political opinion from factual information. This is increasingly hard to do, in the U.S. at any rate. The cable “noise ” networks would have you believe that we’re going to hell in a handbasket (and who is to blame depends on whether you watch Fox or MSNBC). Blaming poor sales on something or somebody before the facts are in, either in the boardroom, in the press, or at the dinner table, isn’t a good idea. (So, is the U.S. going to hell in a handbasket? The facts don’t suggest that. U.S. per capita GDP remains the highest in the World, over 9% better than its nearest competitor, Germany -according to the World Bank)

- If U.S. retailers don’t already know it, they’d better get a clue: growth lies beyond the borders of the over-saturated U.S. market;

- People DO adjust, and they will adjust to a return to the pre-stimulus payroll tax rate.