Uncharted: Fun In The Store

In Brian’s piece this week, he talks about why retail is about so much more than just being hassle free. It fills many needs in society beyond getting “stuff ” – especially since we don’t actually need the majority of that stuff anyhow. The psychology behind why we convince ourselves that we do is worth a lot more than the word count of this newsletter would allow, but it’s fair to say it extends well beyond “frictionless transactions “.

Due to similar word count restrictions, there’s some data that from our latest Store research that didn’t make it into the final report. And it has everything to do with what Brian was talking about – in this case, why stores need to be fun.

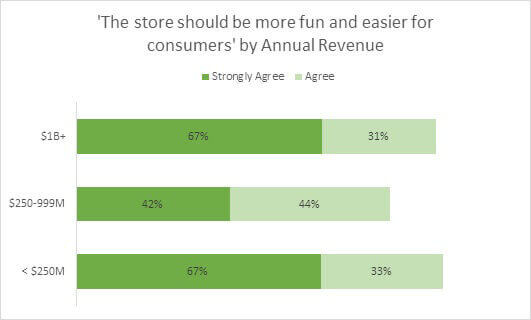

Within the survey, we asked retailers to rate how much they agreed with certain statements. One was “The store should be more fun and easier for consumers. ” We didn’t put a lot of detail into what would comprise that fun (or ease, for that matter), because we weren’t expecting it to get as much agreement as it did. Among nine other options (including things like technology needing to keep pace with consumer trends and the need for localization and personalization of products in stores), retailers far and away called “fun ” their top option: 94% of retailers agreed, 59% of them strongly. Who knew?

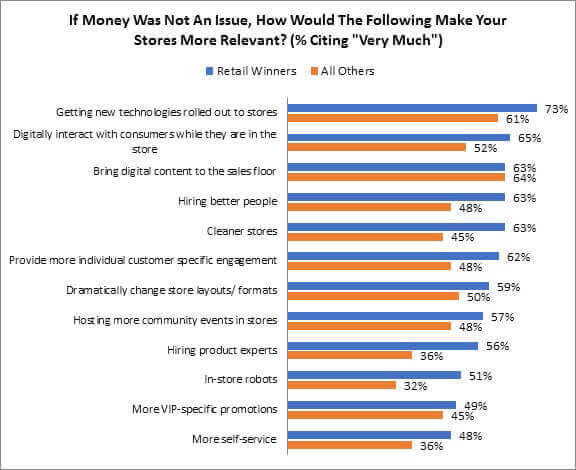

Further, within the report itself, we pointed out that this new strategy was clearly a winning behavior, as these numbers are even higher for the best performers (Retail Winners) than for those whose sales are either average or struggling to keep pace. Today I’d like to share some more detail that we couldn’t get to – where that line lies by the products retailers are selling and by their annual revenue. Take a look at the first uncharted piece (Figure 1).

Fashion retailers are the most bullish here, and rightfully so. Most people have clothes that would suffice, the key is convincing them that their collection needs to be added to and improved. Turns out making that experience enjoyable is a huge part of it, and next year, we’re undoubtedly going to include more questioning about what components go into that – across all verticals. In essence, in a world where increasing numbers of shoppers are redefining how they interact with the physical world via their smart mobile devices, what makes for fun in a store? And how is it changing?

Similarly, we’re going to want to know these redefining characteristics are affected by retailer’s size and revenue, as well, because from this year’s data, it seems the mid-market is the only segment not convinced that a more entertaining store environment is the best way forward (Figure 2).

What did retailers with annual revenue between a quarter of a billion and billion dollars value more? Technology that evolves faster as shopper tastes change, technology that creates competitive advantage and new sources of revenue, and technologies that make their retail employees smarter. For them, it appears much easier to point the finger than the thumb. But we are very eager to dig more into this notion of fun – and what it means to retailers going forward – in the retail store.

If you’d like to read the full report it is available here.