Traditional Challenges, Nontraditional Times

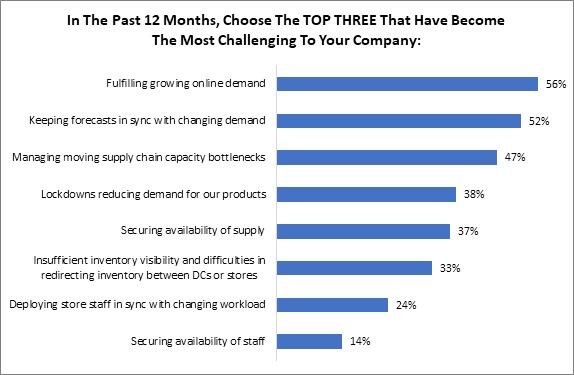

We just published a report on how retailers are adapting to constant disruption, and what makes this particular study so interesting is, in large part, its timing. We all know there was nothing “normal” about 2020, but when we ask retailers to put some definition around the very things that challenged them most since the pandemic burst onto the scene more than a year ago, their responses make perfect sense (Figure 1).

Figure 1: Traditional Challenges In Nontraditional Times

Source: RSR Research, February 2021

In many ways, it is simply unfair to ask retailers to have adapted in as many ways as the market demanded of them between Q1 2020 and Q2 just a few short months later. As an industry known far more for its glacial pace of change than its breakneck ingenuity, retailers regardless of their size, what they sold, or where they were located – were caught entirely unprepared for a world where every product gets bought online; where long-established and highly efficient trade routes with far off lands completely shut down for months on end; and where the very notion of product and worker safety was one hundred percent turned on its ear.

In fact, when we look at the data again in Figure 1, above, it’s actually quite remarkable so many retailers were able to keep their heads above water at all. It’s quite a testament to the human spirit and corporate determination.

Not So Fast!

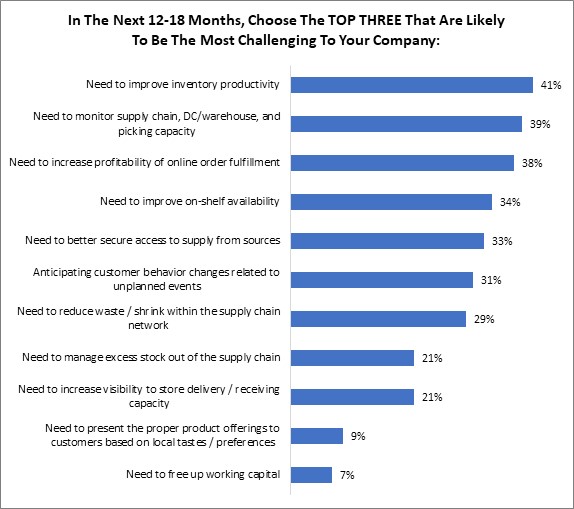

It would be a fool’s errand to start patting our industry too firmly on the back just yet, however, as we are by no means in the clear; the number of obstacles ahead is vast, and retailers are well aware of that fact. Figure 2 tells the tale of which of those roadblocks are currently keeping them up at night.

Figure 2: The Problem List

Source: RSR Research, February 2021

COVID-19 has not been the only interruption to the “normal” way of life many of enjoyed pre-2020. Although it has undoubtedly had an enormous impact on retail and hospitality, climate crises, contentious elections, tense scenes of upheaval and strife in the streets of cities across the globe only added to the sense of uncertainty. Add to this a stock market that continues to defy traditional economic indicators (unemployment, homelessness, store closings) and it should come as no surprise that retailers want to get their hands around things they can actually control right now: with improving their inventory productivity chief among them.

In fact (not pictured) General Merchandise retailers are those pushing the go-faster button most here, and after the year they’ve just had, who could blame them? With entire product segments behaving in ways no one could have ever predicted, GM retailers are homing in on the ability to get the most out of their inventory at a rate far more drastic than FMCG retailers (49% to 35%, respectively), and even more so than Fashion (33%). Of course, they risk stock-outs in pushing the needle of productivity too far, but shortages can always be blamed on “COVID.”

To further compound matters, traditional store-based retailers (especially those selling apparel) are not used to return rates of 25-35%, nor are they used to having uncertainty around what state that returned merchandise will be in when it comes back. Brand new health and safety protocols for the physical handling of a returned item – and whether it must be cleaned before being sold to another customer – are new territories retailers are being forced to navigate. This creates real inventory distortion, and frankly, 30% of seemingly sold inventory being “somewhere” creates a problem all by itself.

Looking at this data by historical performance, Retail Winners are more likely to say their ability to monitor their supply chains, DC/warehouse(s), and picking capacity is what will challenge them most in the months to come (43%, compared to average and lagging retailers’ 27%). Again, because these retailers were already doing a lot of the “right things” when COVID came along, it accelerated their path to success. However, as anyone who has ever been in a car being driven too fast can attest, going the right direction too quickly can still be a frightening endeavor.

Winners are also much more focused on increasing the profitability of online order fulfillment. Once more, after the year they have just had (selling everything to everyone online everywhere), this makes perfect sense.

We invite everyone to read the full report here. It is full of fascinating data.