Tilted Tables: What Consumer Devices Are Really Doing To Stores

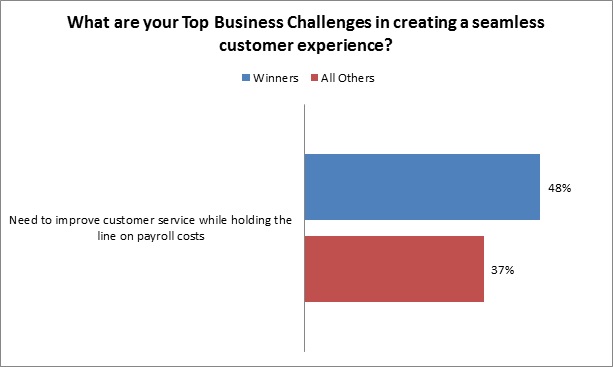

There is no shortage of ways consumer-grade technologies stand to benefit consumers during the shopping process; it is genuinely unfathomable how powerful – and cheap – these tools have become. However, whereas many retailers have historically done everything they can to discourage/ignore the use of these devices (often embodied by the reticence to provide consumer-access to wi-fi networks in stores), the tide has clearly started to turn. Virtually all retailers recognize that the devices consumers love so much hold tremendous opportunity for the brand to get in front of consumers where and how they live. Furthermore, anecdotally, many of our retail clients have told us they think of the consumer-owned smartphone as a way to outsource hardware costs for future consumer-facing initiatives. However, in our most recent research, Retail Winners already have a much greater understanding the consumer’s position of power. It is they who recognize that consumers are presently “hacking ” their store experience; retailers don’t yet provide enough of a digital/online experience in stores, so consumers are supplementing the experience with their own mobile devices. But Winners also know that if they can get in front of consumers on those devices they have a much better chance of engaging with them (albeit mainly via promotions) in the meantime (Figure). It’s a stop-gap way of thinking: not a “retailer-in-control ” solution, but for forward-thinking retailers, it’s the best they believe they’ll be able to do to stay relevant for the near-term future.

Figure: The House Always Loses – For Now…

Source: RSR Research, June 2015

By way of comparison, average and lagging retailers display an inordinate amount of interest in making the customer do her own work. Nearly one in three expresses interest in adding self-service customer-facing technologies into the store – not outsourcing the hardware, but ironically insourcing it. This is a notion that has already been proven a non-winning strategy by several high-profile chains in recent years. Some interesting data also presents itself when viewed by retailer size:

- Mid-sized retailers ($250 – $999 million in annual revenue) are most interested in improving cross-channel capabilities for the consumer (45%), far outstripping the interest of any other revenue band. This shines a light into the way these retailers are strategically thinking about the future. If they can use their more-nimble nature to achieve a consistently seamless experience for consumers across channels before their larger competitors they stand to steal away significant market share.

- The smallest retailers (< $250 million) believe their best chance to differentiate will be via personalized offers (68%, miles ahead of any other group). In a way, this makes perfect sense, since these retailers have historically been most adept at “knowing ” their customers’ desires. However, as retail analytics become more powerful to retailers both large and small, the window for this opportunity is closing – quickly – on the little guy. It is also worth noting that in a world gone promotions-mad, smaller retailers would do well to focus more on value-added offers to their shoppers, rather than just jumping into the “race to the bottom ” pricing war that will invariably hurt them far more than their larger brethren.

- The largest retailers (those whose sales top $5 billion annually) are inordinately focused on three main areas that will work in perfect unison: more personalized attention/service from employees, a store that is enhanced by the inclusion of more digital touchpoints, and the ultimate outcome resulting from proper execution of the two – a focus on a more convenient customer experience. These are “big picture ” goals befitting of large-scale chains, and should they get there before small and mid-sized retailers can achieve their goals, these behemoths will be difficult to combat.

We invite you to read the full report to learnmore.