The Supply Chain’s Past Is Hopefully Not Prologue

In the midst of the most uncertain year most of us have ever experienced, the newness of AI as a viable solution for our particular industry presents a unique set of roadblocks for retailers. None more so than the fact that supply chains have – for a very long time now – been focused on efficiency at the expense of flexibility.

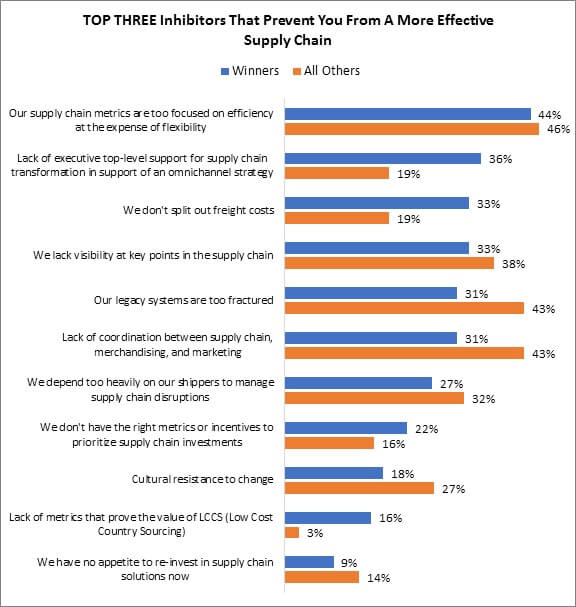

It’s something we’ve spent a lot of 2020 talking about, and it graphically comes to life in a question from our recent benchmark research, The Case For An AI-Enabled Retail Supply Chain (Figure, below).

Figure: Consensus – And Then None

Source: RSR Research, June 2020

Regardless of performance level, all retailers know this to be the case. However, the fact that nearly one out of every two retailers immediately points to it is as a primary inhibitor can be seen through a positive lens: had this study been conducted a year or two earlier would this have been the case? We think not – and we have nearly 15 years of annual supply chain reports to lean on to support that thesis.

For far too long, too many retailers have been chasing a “Walmart-esque” supply chain model – where efficiency drives every decision – only to find that there’s a reason Walmart can pursue such a supply chain: because it (and a very select few of its peers) has the might to drive vendors into deals of such “efficiency”. For most of the rest of the world (despite well-intentioned legislation to protect smaller retailers), this type of leverage is simply not feasible.

Now, at least, retailers recognize that this singular focus has left them in an untenable situation –particularly in a mid-COVID world of uncertainty – and that it is flexibility, not efficiency, that may well be their most important point of differentiation in bringing products to market and getting them sold. If knowing is half the battle, we are pleased to see retailers at all performance levels are at least beginning to explore a different means of attack.

After the rigidity caused by decades of attempting to wring every last inefficiency out of the supply chain however, a different picture starts to emerge. Retailers at difference performance levels find little common ground.

- For Winners, the two most frequently cited issues have become the lack of top-down leadership required to bring the change required to transform a channel-based supply into one prepared for a “channel-less” world (an uppercase “SC” supply chain issue, for certain), as well as the inability to split their freight costs from first cost. The latter, in and of itself, is no small challenge. Winners’ desire to split freight costs is long-standing, and a clear indicator that their efforts to identify places where they are leaving money on the table have yielded very specific opportunities they hope to address in time.

- It is the former, however, which reveals how much further along the maturity curve Winners really are. Without executive level support, the types of dramatic changes required to modernize the supply chain in a meaningful way are simply not possible. Winners are in the fight – and much of that battle still needs to be fought within their own four walls.

- For average and under performers, the hit list is much more diverse and provides a glimpse into how different their current reality is. They have a harder time determining where their goods are, they lack coordination between their merchandising, marketing, and supply chain professionals, they rely too much upon shippers to manage inevitable disruptions, and they have more difficulty with fractured legacy systems preventing forward progress.

Quite simply, no one is without real problems here. The full report is available to all.