The Store Paradox

Consumers no longer use stores in any kind of predictable fashion. Just a few years ago, operating a retail store, while fraught with its own unique challenges, was about competing with other stores. For as long as products have been bought and sold, buyers needed to visit physical locations to obtain the goods required to fulfill their specific needs. Questions were relatively simple: Were the prices, selection, or service across town better or worse?

On the retailer’s side there were also fewer questions to answer. Abnormalities in sales and store performance sent retailers looking at macro-economic and seasonal trends, and then to take a look at what competitors were doing. Finally, they’d look within, and examine their own store operations.

If shoppers weren’t buying in your store, you could generally be assured they were buying in someone else’s; perform a bit of competitive research and you’d have some good ideas on how to adjust accordingly.

Today, however, all of that has changed.

For most retailers, competition comes from places they don’t even know about, and often for reasons they can’t easily understand. Thanks to the internet and mobile technologies’ ability to put the global marketplace in the hands of virtually any consumer at all times, it is very difficult to gauge not only who and where your competitor is, but what makes them a competitor in the first place.

What component of the retail experience does a specific customer care most about in at any given moment? In fact, what motivates one customer to take the time and effort to visit a physical store is likely to be very different from that of the next customer coming through the door. Consumer expectations are very different than they once were.

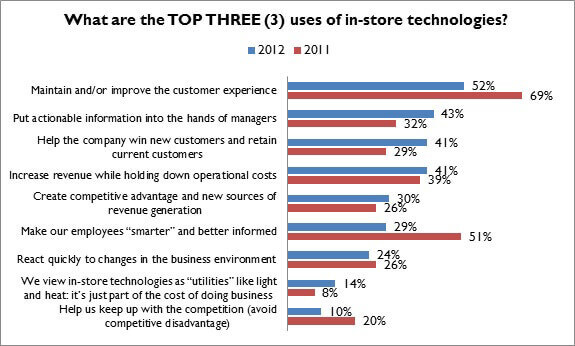

Technology is, of course, part of the in-store experience, and in our recent annual Store Report, we therefore asked retailers to self-identify the top uses of technology in their stores today (Figure 1).

Figure 1: Technology the Key to Customer-Centricity

Source: RSR Research, May 2012

While technology’s ability to help maintain/improve the customer experience and increase revenue while holding down operational costs remains of utmost importance, retailers increasingly recognize that technology also provides a chance to arm their managers with actionable information (up from 32% to 43% this year).

At first glance, we were disappointed to see the number of retailers citing technology’s ability to make their employees smarter and better-informed drop off so drastically: but when digging into the response pool, we see that this is really a story influenced by retailer performance:

- 50% of high-performing retailers agree that new in-store technologies can help improve their workforce, compared to only 6% of underperformers

It is also worth noting that the drastic increase in retailers citing technology’s ability to help them win new customers (41% in 2012, up from just 29% one year ago) is largely driven by under-performers (56% vs. 35% of over-performers).

Mobility: Source and Solution

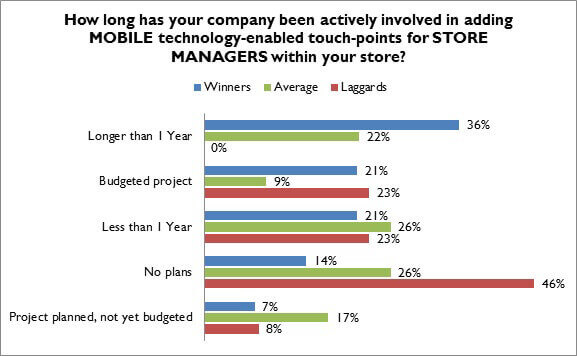

For many retailers, the lopsided nature of the customer-store technology balance has resulted in countless missed opportunities to be of real value: too many customers have become conditioned to the phone in their purses being more helpful than anyone with a nametag in the store. Mobile technologies in the hands of consumers are exactly what have put stores in the pickle they’re currently in; arming those working in stores with the same technologies equals the odds and gives them a fighting chance to be able to converse with the new consumer at her level. As always, those whose sales are outperforming their competitors’ are doing so for a reason. Retail Winners understand that mobile technologies play a vital role in returning the store to relevance at a much higher rate than do their underperforming competitors. As we’ve already seen, Winners value improved “people power ” more highly, and the 36% of Winners who have had mobile touch-points in store managers’ hands for longer than a year (vs. the 0% of laggards, Figure 2), clearly understand that the store manager’s proper role is to be a brand advocate – out on the floor, overseeing employees, helping with customer service – not tethered to a PC in the back room mapping out employees’ work schedules. The staggering 46% of laggards who report no plans to give store managers mobile access are missing a vital opportunity to improve overall store performance.

Figure 2: Winners Well Ahead in Store Manager Mobility

Source: RSR Research, May 2012

We invite you to read the full version of our annual store report, which is available to all members of the retail community by clicking here.