The Retail Store Time Crunch

Ever since consumers started bringing mobile phones into stores as part of their shopping experience, retailers have been scrambling to keep up. Shoppers armed with smartphones now have more access to price, availability, and product descriptions than even the most trained and knowledgeable store employee. Consumers are increasingly impatient with a store experience that feels disconnected from the digital experience.

Retailers know the store experience needs to change. They have two main goals: to bring more of the digital experience into stores, and to provide tools to help employees be more productive. The more productive employees are, the more they can invest that time into the digital tools that retailers are bringing into stores, ideally to spend extra time helping customers. What retailers once saw as two disconnected investments – digital experience in stores and tools to help employee productivity – are increasingly seen as highly co-dependent. Investments in digital can’t be realized if employees don’t have the time to learn or use those tools to enable great customer experiences.

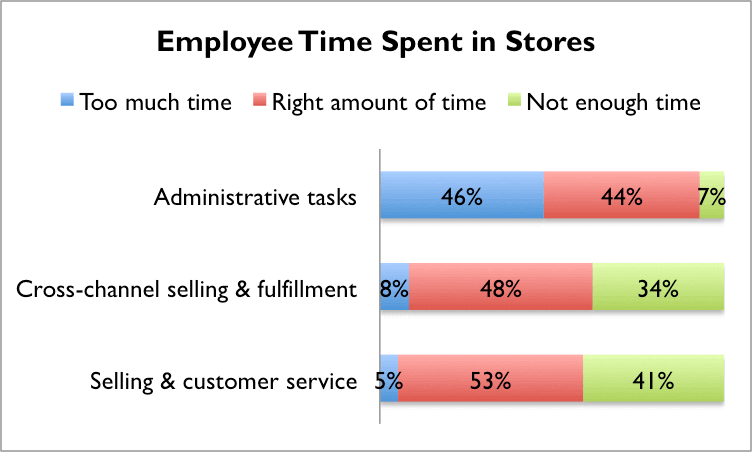

Unfortunately, when it comes to productivity, stores are notoriously over-burdened. In RSR’s last benchmark on retailers’ store strategies, we found that 46 percent of respondents reported that their employees spend too much time on administrative tasks, and large populations of respondents felt that this time was coming at the expense of selling time (Figure).

Source: RSR Research Store Survey, June 2014

The results around cross-channel selling and fulfillment are even more significant than those related to general selling and customer service, as this is a relatively new set of activities in stores. It wasn’t that long ago that there was no such thing as buy online/pickup in stores, ship to stores, or (increasingly) ship from stores.

But with these new activities come new demands on store employees. When retailers promise that items ordered online will be waiting in stores, the last thing they can afford to do is not keep that promise. As a result, the one administrative task that cannot languish is back office inventory management: receiving, reconciling, and restocking products. If the website shows items in stock in stores to consumers, that stock had better be accessible to those consumers, and not trapped in a box or the back of a truck.

As retailers struggle to make sure the inventory they promise online is an accurate reflection in stores, they rapidly find that “paper shrink ” is one of the biggest factors impacting in-store inventory accuracy. Either items were received incorrectly, sold incorrectly, or stocked incorrectly. The more complicated or paper-based the back office receiving is in stores, the more likely it is that store inventory will become more and more inaccurate over time.

Anything that makes those processes easier – anything that cuts the time employees spend on these administrative tasks, reduces paperwork, or increases inventory accuracy or on-shelf availability (or all of these above) – will pay back well beyond cost savings, especially as retailers reinvest those savings into enabling customer experiences.

More accurate inventory, better customer engagement – everybody wins.

Sponsored by Xerox. Xerox recently launched a new offering that takes a barrage of inventory reports and invoices, and uses Datawatch technology to digitize, analyze and present precise, actionable findings, like updating the price of a product to reduce paper shrink. The error-prone and costly manual steps from retail inventory management are removed, helping to reduce labor costs, streamline invoice reconciliation, and improve fill rates. Learn more about Xerox’s new Workflow Automation Solution for Supply Chain Optimization here.