The Problem With The Modern Customer Experience

If you read our stuff regularly, you know we’ve been ranting about the customer experience quite a bit lately. And we don’t shy away from the word “rant”: just like you, we’re consumers. And as consumers, we’ve all had some shopping experiences lately that have left us feeling not so great. Just consider what our partner Paula wrote last week.

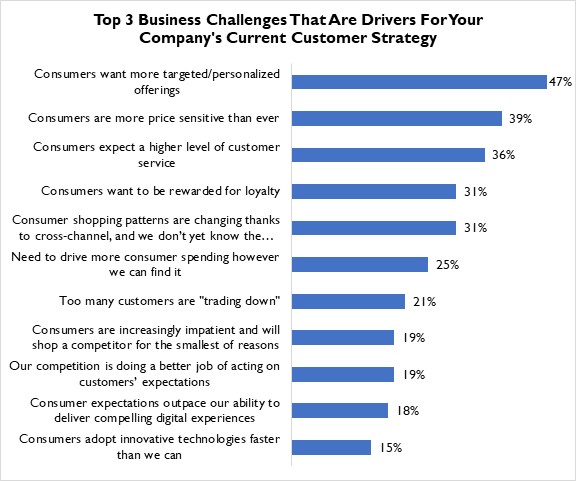

But where are retailers on all of this? They see the world in terms of challenges and solutions. And also as always, retailers have two distinct types of challenges: those they have control over (internal challenges), and those pressing in on them from the outside world. While retailers have little control over these external challenges, we can see from the chart below from our latest Customer Experience Research that they have a very clear view of what they think customers want – and in which order they believe customers want them.

Figure 1: According To Retailers…

Source: RSR Research, February 2023

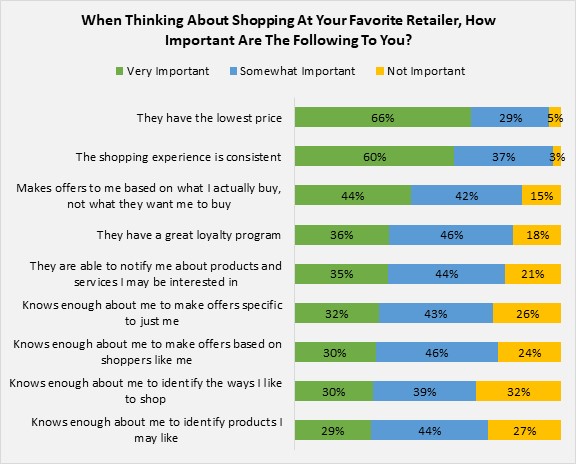

The problem is that retailers are only half correct in their assumptions about what consumers desire. Do shoppers want more targeted offerings? Yes. But only if those communications provide access to the lowest price possible. In the consumer survey RSR conducted as part of this study, 66% of the over 1000 consumers we surveyed rated “lowest price” even over a “consistent experience” (Figure 2).

Figure 2: Meanwhile… According To Shoppers

Source: RSR Research, February 2023

But shoppers do want a consistent experience, and not just across channels. While they tell us they have a moderate interest in localized products later in our line of inquiry, they are much more bullish on being able to navigate a store (or website) with ease – even when visiting a store that’s not their “home store”. They also want offers made to them on the products they actually buy, not on what a retailer may want to sell (86% “very” or “somewhat important”). And more than a third say it is very important for retailers to notify them about products and services that they may not yet be aware of. However, as responses so clearly show, a retailer’s ability to offer the lowest price trumps all.

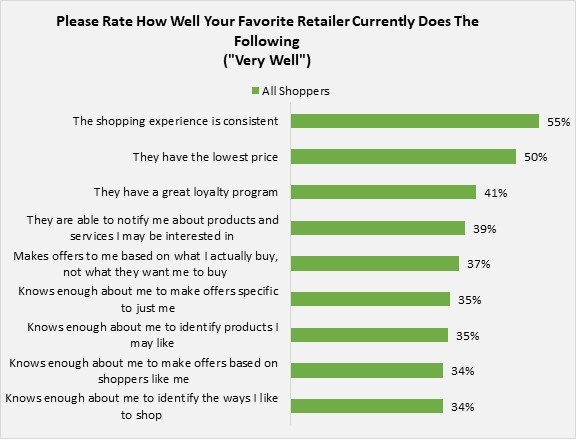

The bad news? When asked how well retailers can fulfill these expectations – even when thinking specifically about their favorite retailer – consumers say brands are falling short (Figure 3).

Figure 3: Not Quite There

Source: RSR Research, February 2023

The good news from Figure 3 is that shoppers do believe retailers are providing a consistent experience – 55% say their favorite brands perform very well, and another 42% (not pictured) say they do it “somewhat well”. But according to shoppers, retailers fall short in their abilities to deliver a great loyalty program, or in their ability to make relevant offers. And at their core, retailers are not perceived as knowing enough about consumers to identify the ways people like to shop. There is a lot of room for improvement here.

Perhaps the most telling data in Figure 10, however, is that only 50% of customers believe even their favorite retailer can provide the low prices customers want. This puts 50% of their potential purchases up for grabs.

If price is that important to shoppers (and as we’ll soon see – it is), retailers have a 50/50 shot of keeping their shoppers from shifting loyalty to whomever has the lowest price. These – to put it mildly – are not great odds.

We suggest everyone read the full report here.