The Next Big Thing

There’s a big debate in the little world of retail research & analysis about the phrase “omni-channel “. Like any buzz-phrase, it’s been used as an umbrella term for a whole bunch of things. And so (inevitably) the whiplash reaction now goes something like this: “look, ‘retail’ is ‘retail’! Exactly how retailers service consumer needs has changed but the fundamentals of the value proposition haven’t! ” While that’s true in a certain sense (retailers and manufacturers bring products to market, and consumers buy them), there is a fundamental difference from ages past, and it can’t be ignored, whether you call it “omni-channel ” or “aardvark “. That is, the consumers are using the power of information delivered anytime and anywhere in a digital format to make better decisions about purchases based on their lifestyle needs, and they use one or more of what retailers have called “channels ” to make a single purchase decision. A perfect example: many consumers now routinely check information about a product (reviews or competitive prices) while they are standing at the shelf edge in a store, using their smart phone!

That consumers use mobile technologies when shopping is no longer a new dynamic – in fact it’s been the obsession of most retailers since 2010. The omni-channel discussion has moved from marketing (how to get appropriate value messages to the right consumers at the right moment in time in the right way?), to store operations (how does the store service a customer interaction that began outside of the store in the digital domain?), and is now focused on the supply chain (how do we support multiple fulfillment models profitably?).

The Next Big Thing

The RSR team has been banging the drum for several years that the next generation supply chain (in support of new consumer behaviors) is the next big thing – something that will keep the whole industry busy for some time to come. There are several reasons for this, but the biggest one is that the current supply chain may not be appropriate for the task of serving the new anytime/anywhere shopper. It has been hyper-optimized over the last 30 years with the underlying assumption that the vast majority of customer orders starts and ends in the store, and that order fulfillment is usually executed by the consumer (i.e. there is very little store labor cost associated with it).

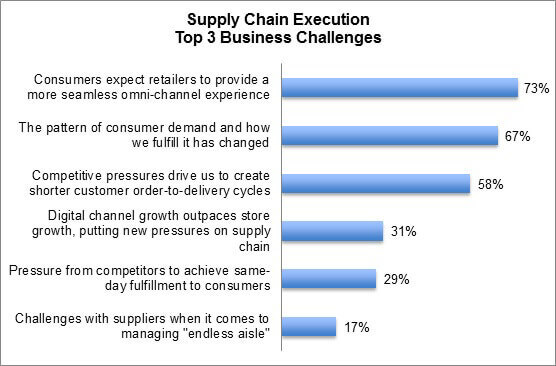

Until recently, alternate order and fulfillment schemes were really nothing more than a rounding error – the volume was not worth paying a lot of attention to. But two things have changed, lending urgency and depth to the transformation that new consumer shopping behaviors are bringing to the supply chain. First, while retailers are still focused on customer expectations and delivering one single brand experience across all selling channels, they also are facing a world where customer demand comes at them from every angle, and must be satisfied no matter where the inventory currently resides. Secondly, retailers are also feeling competitive pressure to meet this omni-channel demand faster than ever (Figure 1).

Figure 1: The Supply Chain Shift

These combined pressures are forcing retailers to crack open the supply chain, turning what once were end-points in a very well-established chain into nodes where inventory moves in all directions. Retail supply chains that once assumed that customers would travel to stores and acquire whatever inventory happened to be there are now obsolete.

So how are retailers doing in addressing the next big thing? To get to the answer for that, my partner Steve Rowen and I are examining responses to a recent survey RSR offered on supply chain strategy. Although we’ve conducted several supply chain execution studies over the years, we’ve only offered one study on strategy, and that was in 2012 – ostensibly before any discussion of profitable fulfillment in the context of omni-channel selling was really happening.

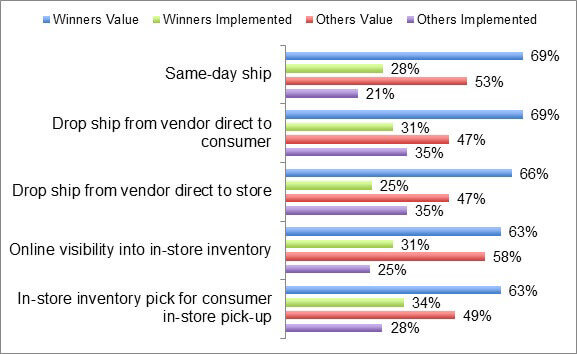

What we’re seeing is that there’s a huge opportunity gap between what retailers say is important, and what they can actually do- even over-performing retailers ( “Winners “) (Figure 2):

Figure 2: Value vs. Status Of Customer Order Fulfillment Processes

Obviously, there’s a lot of work to do! And that is before we get to the question of optimized processes on the supply chain side within the context of these new requirements.

Watch This Space

In a lot of ways, the benchmark that we’re developing now on supply chain strategy will establish the baseline for our studies in the next several years. The industry is at the beginning of a fundamental shift in the supply chain – because of changes on the consumer side of the retail business, everything that went before needs to be re-observed and measured. So as it is said in the news industry, “watch this space “. RSR will publish its first “omni ” supply chain strategy benchmark in the coming few weeks, to provide that invaluable baseline for future discussion on the scope and difficulty of supply chain re-design.