The Mobile Reset Moment

The retail industry is in the throes of a reset moment triggered by the massive consumer adoption of smart mobile technologies that has driven not only consumers’ anytime/anywhere shopping behaviors, but also their eagerness to participate in a dialogue with communities of like-minded consumers and companies to find just the right solutions to their lifestyle needs. According to market studies, the rate of smart mobile device adoption since the introduction of the Apple iPhone in 2007 is 10X faster than that of the PCs in the 1980’s, twice as fast as consumer adoption of the Internet in the 1990’s, and 3X faster than that of recent social network adoption.[1]

After the last reset moment – which RSR contends happened in the late 1980’s with the adoption of barcode scanning that in turn made it possible for retailers to achieve supply chain efficiencies and perfect product-oriented strategies – retailers have focused mostly on structure and operational efficiencies. While these are important, they deliver more value to shareholders than to consumers. But now, consumers are demanding much more, empowered by technologies that enable a fundamentally different shopping experience. Simply put, instead of the consumer coming to the shopping place, the shopping place comes to the consumer.

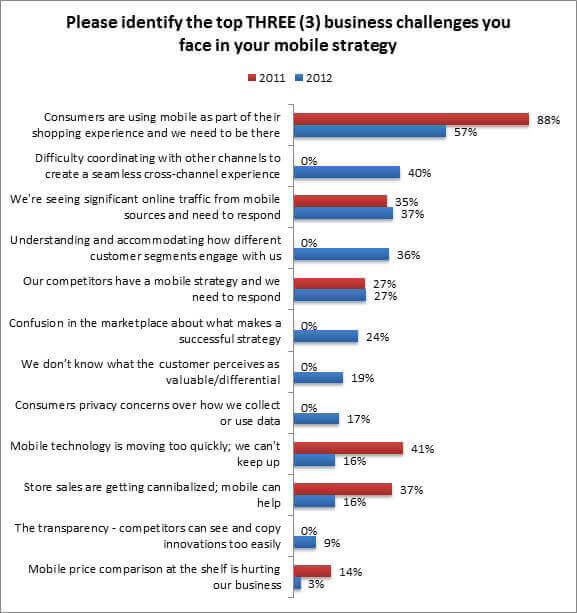

In RSR’s first look in 2011 at the challenges and opportunities associated with mobile in retail, it was clear that retailers were responding to the dramatic shift in consumer behaviors. According to the report, “the primary reason they are addressing a consumer mobile strategy is because they see that consumers are already there and using it as part of their shopping experience “[2]; in other words, “the consumer made us do it “. In the 2011 study, over twice as many retailers rated that as the top business challenge (88%) compared to the 2nd choice ( “Mobile technology is moving too quickly; we can’t keep up ” – rated at 41%).

In the time since our 2011 report, consumer mobile usage has only accelerated, and retailers have had to absorb the implications of mobile in the context of the overall Brand experience. Consumers now routinely use technology to investigate and select products and services before they go to a store and while they are in the store, and increasingly, mobile technologies are becoming the “first screen ” that the consumer uses to start a dialogue with retailers. But mobile permeates the entire shopping experience. Recent consumer research by the Nielsen Company shows that the top four uses of smart mobile device for consumers are finding a store’s location, checking price, researching an item before purchase, and reading a review of a recent/future purchase. “[3] According to Nielsen, “it’s no secret smartphone owners bring their handsets just about everywhere they go, and Nielsen found that mobile shoppers like to use their devices for in-store activities. In fact, 78 percent of mobile shoppers say they’ve used their smartphone to find a store, and another 63 percent have checked prices online while shopping. “

Settling Into the Reality

Comparing results from our 2011 mobility study to this year’s look at the top business challenges, we can see that retailers are settling into a more sober and nuanced view of the challenges associated with Mobile (Figure 1).

Figure 1: A Maturing Understanding of the Mobile Challenge

Source: RSR Research, December 2012

While the challenge that “consumers are using mobile in their shopping experience and we need to be there ” is still tops for all respondents of this study, other issues that are indicative of current state of retailers’ attempts to deploy a mobile presences vie for attention, including “difficulty coordinating with other channels ” and “understanding how consumer segments engage “.

Interesting, there is little difference of opinion between Retail Winners and all other respondents about the top challenge. But for the #2 challenge, we see a different story: 40% of average and under-performers are concerned that “our competitors have a mobile strategy and we need to respond “, whereas that choice is important to only 13% of Winners. On the other hand, the #2 challenge for 50% of Winners is “difficulty coordinating with other channels to create a seamless cross-channel experience ” (compared to only 32% of non-winners). This difference underlines where these retailers are in the development of their mobile strategies. Winners are the competitors that average and laggard performers are so concerned about – they started earlier, and are farther ahead in their adoption efforts.

One aspect about mobile strategies is clear for virtually all retailers now; most are no longer as concerned that the technology is advancing faster than they can understand it. While in 2011, 41% of our respondents felt that “Mobile technology is moving too quickly; we can’t keep up “, now only 16% do – and that is true from both Winners and all others.

We invite you to read the full report to learn more of the mobile challenges and opportunities retailers perceive, which is available by following this link.

[1] Source: Flurry Research, August 2012

[2] Keeping Up with the Mobile Consumer, 2011 Benchmark Report, September 2011, © RSR Research LLC

[3] Mobile Devices Empower Today’s Shoppers In-Store and Online , Neilsen Wire, December 4, 2012