The Customer is King – For Real

I’m not given to boasting, but our latest Merchandising Report is really quite interesting. For example, we found disturbing trends among mid-sized retailers: Only a third report a solid understanding of merchandising tools and techniques. That’s pretty alarming.

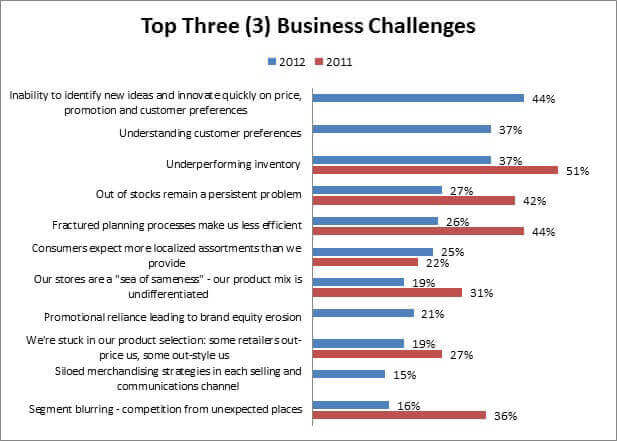

But some of my favorite data in the report comes in the Business Challenges section. In prior years we focused our business challenge question on product: inventory performance, planning efficiencies, and competitive differentiation. This year, given all the discussion about the empowered consumer, we decided to add some customer-focused options. As we can see from the figure below, these customer-focused choices completely change the color and tenor of responses.

Figure: Innovation and Understanding the Customer Take Center Stage

Source: RSR Research, August 2012

This is not to say that out-of-stocks or other inventory concerns are not major issues within the retail enterprise – certainly they are. But when asked to play “lifeboat ” and pick their top-three concerns, retailers cleave to the customer.

This is the overall picture, however, and when we dive into various cross-cuts of the data, significant differences emerge.

Business Challenges Differ Depending on Retailer Size

Some of the differences in top-three business challenges by revenue are intuitive and obvious, while others are somewhat counter-intuitive.

Intuitive and Obvious:

- The larger the retailer, the greater the concern about out-of-stocks. Only 12% of the smallest retailers (< $50 million in annual revenue) cite out-of-stocks as a top-three concern vs. 42% of the largest retailers (>$% billion in annual revenue).

- The larger the retailer, the greater the pressure to implement localized assortments. Only 18% of mid-market retailers cite consumer expectations for more localized assortments as a top-three business challenge vs. 50% of the largest retailers.

- The larger the enterprise, the more siloed and fractured planning processes: Only 18% of retailers with annual revenue under a billion dollars cite this as a top-three concern vs. close to 40% for their larger counterparts.

- The smallest and largest retailers are concerned about product selection.

Counter-intuitive and Not-so Obvious

- Retailers with revenue over $5 billion are far less concerned about underperforming inventory than virtually all other retailers – with only 17% citing this as a top-three business challenge. We can only assume that their ready access to working capital and (likely) more sophisticated forecasting technologies reduce their concern.

- The smallest retailers (annual revenue under $50 million) are most concerned about an undifferentiated product mix. More than a quarter of respondents in this revenue bracket cite it as a top-three concern vs. less than 15% of all others, and only 8% of the over $5 billion retailer. It can be argued that this is part of the phenomenon known as “The Amazon Effect. ” While the smallest retailers curate their assortments carefully, they likely do not have the mass to support development of truly unique products, potentially leaving them vulnerable to lower priced competitors like Amazon. It can also be argued that with curated assortments being core to their value proposition, the smallest retailers obsess about them all the more – these assortments are key to their survival.

If you haven’t had a chance to read the full report yet, you really should. And drop me a line to let me know what you think when you do.