Supply Chain Transformation: SMB Retailers’ Unexpected Challenge

Compared to other retail functions, supply chain tends to evolve more slowly. It’s not that innovation is slow, as much as that the pieces involved in supply chain tend to be less flexible than in other parts of the business.

Unfortunately, retail supply chain’s history of evolutionary-style changes is running headlong into retail’s transformation under the pressures a global economy and cross-channel consumers create. Between the three inter-related challenges of globalization, localized assortment, and cross-channel, retailers continue to grapple with supply chain basics while at the same time they must rapidly enable much more sophisticated supply chain capabilities than they have had to in the past.

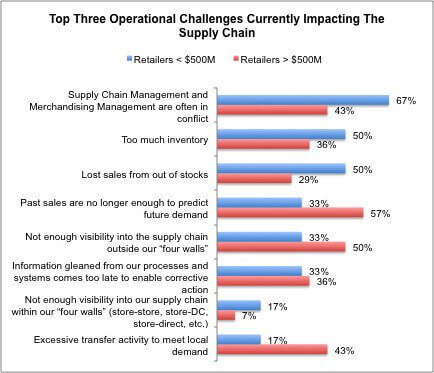

In our March 2012 study entitled Retail Supply Chain 2012: Globalization, Localization, and Cross-Channel, RSR Research highlighted retailers’ #1 operational challenge to re-aligning their supply chains to meet the challenges created by consumers’ omni-channel shopping behaviors: that past sales are no longer enough to predict future demand. But looking inside the numbers, we found that that concern is largely driven by retailers with annual top line revenues of more than $500M (Figure).

Retailers whose top lines are less than $500M ( “SMB retailers “) are much more challenged by an internal issue: organizational friction between the merchants and supply chain operators. Given this friction, it’s perhaps not surprising that “too much inventory ” and “lost sales from out of stocks ” are also top challenges for these retailers.

The Impact of Buy Anywhere/Get Anywhere

Most retail supply chains were developed largely for a “uni-channel ” fulfillment model, i.e. the stores are the point of customer order fulfillment. But that was before the days of consumers’ buy anywhere/get anywhere mindset. Now, consumers are disrespectful about the notion of “channels “. More Retail Winners (those retailers that outperform the competition) understand that their internal functions need to better align to that reality, and that means collaboration at the line-of-business level is the order of the day. Regardless of the revenue tier they are in, Winners recognize that organizational conflict between Supply Chain and Merchandising gets in the way of a rapid response to shifts in consumer demand, particularly as it relates to fulfilling in a buy anywhere/get anywhere world.

The reason that “organizational conflict ” is such a big challenge for SMB retailers in particular comes into better focus when we look at responses from a July 2012 RSR study entitled Executing on the Promise: Retail Fulfillment 2012. In that study, we noticed that by far the biggest inhibitor to addressing consumers’ cross-channel shopping behaviors was that “our supply chain is not designed for omni-channel fulfillment “. But unlike larger retailers, fully 50% of SMB retailers reported that “lack of active top level support for a cross-channel strategy ” (compared to only 19% of larger retailers) is an obstacle to moving forward. In other words, many retailers are allowing the conflict between supply chain managers and merchants to fester.

The Real Challenge

Winners are addressing the challenge of organizational friction between Merchandise Management and Supply Chain Management by implementing cross-function metrics that improve communication between them. Reducing the organizational barriers between the two warring departments is important, since many SMB retailers think a redesign of the supply chain is required. According to the July study, most SMB’ers reported that their current fulfillment comes from a combination of “mixed fulfillment ” and “dedicated direct-to-consumer ” facilities. But what the majority of SMB retailers want is “fulfillment type or product category-specific distribution with flexible fulfillment to any channel ” – in other words, a different supply chain design than the one currently in place.

Ultimately, this challenge can’t be resolved at the “department ” level. It will take top-of-company leadership, since the buy anywhere/get anywhere selling model that has emerged forces a re-think of the retail operating model. For most retailers, that means redefining the stores’ role in the supply chain, from being purely on the receiving end to being an active participant as both a destination and a source for inventory.

Because the real challenge is to re-think the company’s operating model, the entire executive team needs to get engaged. The CEO needs to know that the supply chain supports the go-to-market strategy. The CFO needs to bring money-management expertise to the table to ensure that inventory, which is after all nothing more or less than money in another form, is being leveraged profitably and with minimum cost. The Chief Merchant needs to know that merchandise plans consider the true cost to land that merchandise. The Chief Marketing officer needs work with the supply chain to ensure that demand-generating campaigns can be supported. The COO needs to make sure that all the selling staff at the point of interface with consumers has what it need to do satisfy customers. The CIO needs to know what service levels are required throughout the demand fulfillment chain and position information technology resources accordingly. All of these executives need to be at the “Supply Chain Roundtable “.