Supply Chain Management 2020: Will The Pandemic Push Retailers To Solve Fundamental Issues?

At RSR, we’ve written a lot recently on various angles to the COVID-19 crisis and how it has affected retailers and consumers alike. This week, RSR partner Paula Rosenblum writes about a problem she’s having as a consumer to find a reliable source for grocery products. She concludes with a plea, “…for the industry at large, a little flexibility would have gone a long, long way. You really have failed your shoppers.”

There’s an underlying technical issue that grocers – and other retailers – are tripping over. It is “inventory visibility”, and it’s undermining a good customer interaction. Here’s why: consumers – especially now while we are all living through a quarantine – are using retailers’ eCommerce sites to find what they are looking for and arranging to either pick it up in-store (that’s what upswing in BOPIS – “buy-online-pickup-instore” – activity is all about) or have it delivered directly to the home. But if consumers can’t “see” available inventory, retailers can’t sell it. And that’s only the beginning of the problems that lack of real-time and accurate visibility causes. The problem also affects the forecast, allocations, and replenishment, often resulting in one of the industry’s most nagging problems: too much of the wrong stuff, too little of the right stuff, or too much or the right stuff in the wrong places. In the COVID-19 age that can only exacerbate customer dissatisfaction.

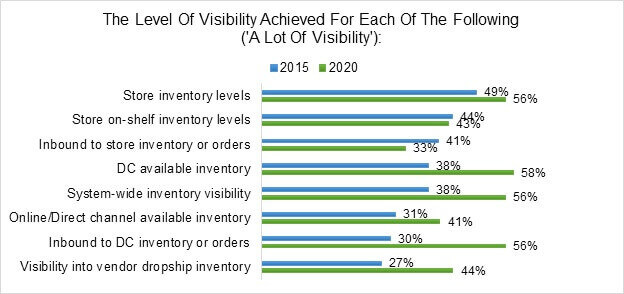

We’ve been highlighting the visibility issue for a decade, and still retailers tell us in our benchmark surveys that the problem persists for a surprisingly big number of them. In our latest benchmark on the state of the retail supply chain, The Retail Supply Chain: Designing New Ways To Satisfy Demand (March 2020), we uncovered a “good news/bad news” status. The good news is that retailers continue to plug away at enabling better visibility; the bad news is that the industry still has far to go. The chart below gives a sense of how much of a problem it still is, and how long retailers have been chipping away at it:

Figure 1: Still Far To Go

Source: RSR March 2020

In the 2020 Supply chain benchmark, we remarked:

“When discussing supply chain performance, the first and most important must-have capability for retailers is to be able see inventory in something approaching real-time with a high degree of accuracy… without accurate and real-time visibility into available-to-sell inventory throughout the enterprise, retailers have some poor choices to fall back on when it comes to omnichannel selling: either to risk losing a customer by over-promising availability or to intentionally over-inventory…

But even though retailers are well aware of the importance of achieving a high level of visibility across the supply chain, that objective remains incredibly difficult to achieve… this is almost entirely due to the legacy systems and processes that retailers implemented as far back as the 1980’s… While those systems are now approaching 40 years old and the business requirements for them have changed dramatically, they are difficult and expensive to replace.”

Will the Pandemic Push Retailers To Solve Fundamental Issues?

Here’s the question in the context of the pandemic: is this latest dramatic shift on how consumers interact with retailers the final “push” to cause them to solve the problem? In our opinion, it should be, because accurate and timely visibility to information assets (inventory, customer, and product) is foundational to a truly integrated “digital+physical” shopping experience, as well as being foundational to profitable retail operations going forward.

History repeats itself. The eCommerce channel was created in the late 1990’s and into the 21st century, but before the Great Recession and the almost simultaneous introduction of always-connected mobile devices in 2007, volume was measured in single digits of total sales. But consumers grabbed on to the power of information to make smarter shopping decisions when money was really tight. It took retailers a decade to absorb what consumers’ “omnichannel” shopping meant to them.

Now, consumers are getting hit again, perhaps even harder. And so they are making new demands on retailers, and ratcheting up digital shopping behaviors to a much greater percentage of total retail sales. Retailers are struggling to keep up with the new volume, and their patchwork integrations between the newer digital channel and the older physical channel are letting them down, and (as Paula says) are failing customers.

But retailers don’t have a decade to figure it out. Failure to act strategically will likely be fatal. Just as it happened after the Great Recession, consumers are unlikely to revert to “the way it used to be” once we all come out of the pandemic. And so the volume of omnichannel shopping that has strained legacy systems and processes to the breaking point now (whether it results in BOPIS or direct-to-consumer fulfillment), is just the start.

ED. NOTE: We welcome you to download RSR’s latest benchmark report on the state of the retail supply chain. While it remains the next big thing in retail, new challenges in supply chain execution are rapidly driving retailers to find new and better supply chain strategies to support fulfillment-from-anywhere.

The brand new report features 22 charts across 29 pages of in-depth analysis of the challenges, opportunities, internal inhibitors, and technology enablers affecting today’s supply chain. It also takes a hard look at retailers’ current – and planned – investments. It is sponsored by Symphony RetailAI, and like all RSR reports, it is completely free of charge to registered users. Registration is also free, and only takes a moment.