Supply Chain 2018: Grocers, Convenience, & Drug Stores Are Feeling The Pressure

In RSR’s just-published study on the state of the retail supply chain (Supply Chain Management 2018: In Service Of The Customer, December 2018), we made this observation:

“FMCG retailers (primarily grocers, drug stores, and convenience stores) are feeling the heat from Amazon’s acquisition of Whole Foods and recent Amazon Go! store openings… In this study’s revelation that retailers are focusing their supply chain efforts on the ‘last mile’ considerations of faster fulfillment with improved cost controls, <FMCG’ers> are the now most concerned about developing the new metrics required to get their hands around the cost issue. “

While that’s certainly true ( “Quantifying labor & shipment costs for cross-channel fulfillment ” was rated the top operational challenge by 45% of the non-FMCG retailers, compared to 70% for FMCG’ers), that’s only part of the story. Those retailers’ responses to the questions in our survey indicate that many of them are operating in a no-man’s land between knowing that consumer omnichannel shopping is really starting to affect them and recognizing that their store-centric processes and systems will need some fundamental revisions.

The “tell ” is found in two questions RSR asks in every survey; first, “what are the top three organizational inhibitors that prevent retailers from addressing identified business challenges and opportunities? “, and secondly, “what are the top three ways to overcome those inhibitors? ” The top inhibitor for non-FMCG retailers is that “perpetual inventory rarely matches actual inventory levels ” (51%). While that is certainly an issue for FMCG’ers too (45%), it is superseded by two closely related problems, “lack of active top-level understanding of supply chain issues ” (50%), and “there is no internal appetite to redesign our supply chain to meet current business challenges ” (50%). And when it comes to ways to overcome those inhibitors, FMCG retailers’ top choice is that “the company needs to understand that there is no ROI involved – this is a critical strategic initiative ” (60%).

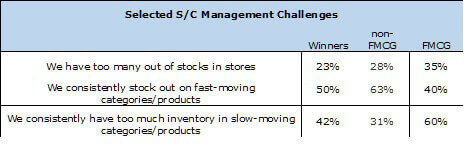

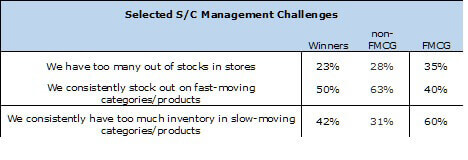

Self-awareness is a good thing – if the Retail industry had a 12-point program for 21st Century readiness, that would be step one. Beyond these admissions, however, FMCG retailers seem conflicted. For example, consider this: nine out of ten FMCG respondents indicated that the supply chain “helped our company performance ” (90% compared to 74% of other retailers). But take a look at how these retailers’ rate certain supply chain management challenges compared to others:

What these findings tell us is that while FMCG retailers are better than either non-FMCG retailers or Retail Winners in general at managing fast-moving products, they are far worse at managing slow-moving products, and that negatively affects how they rate their overall ability to manage out-of-stocks. These management challenges are the result of problems that retailers have with demand forecasting, and the study reveals that FMCG retailers are challenged by pressures directly related to new consumer shopping behaviors that affect the forecast:

All indications are that grocers, convenience store operators, and drug stores, while perhaps last to jump onto the “Omnichannel ” bus, have finally joined in. And as we’ve already said, that’s just in time, because like the general merchants and fashion and specialty retailers that have come before them, they now have to battle fierce competition, not just from relative newcomers like Amazon, but also from those Tier-1 operators like Walmart, Target, and Kroger, who have all moved aggressively to address the new competition.

As we stated in our recent study on innovation in the Retail industry (2018 Ramping Up Retail Innovation, September 2018): “FMCG is the single most conservative vertical. While this is understandable on one level, it also underlines just how hard it is for retailers to overcome their cultural bias towards caution and face disruptive competitive forces proactively “. Now these retailers are feeling the pressure, and will be compelled to address their top inhibitors, having to do with cultural resistance to the changes that are happening all around them.

Read The Report

Our annual supply chain benchmark, Supply Chain Management 2018: In Service Of The Customer brings us some clarity around the full impact. It turns out the main pressures come from both competitors and customers, but that just scratches the surface. In this report you will find:

- 22 data charts

- 25 pages of in-depth analysis

- 6 pragmatic recommendations for all retailers to consider

This report is available FOR FREE to all registered users (registration is required and also free), and is sponsored by Symphony RetailAI.