Stores And Relevance: The Employee Divide

In our most recent Store Report, we see that all retailers face similar external challenges, but as always, the best performers look at these challenges from a slightly different perspective. As Nikki so boldly pointed out last week in her Retail Paradox Weekly, the store must evolve, and that means it’s going to be a significant challenge to ensure new store-based technologies do not operate in a vacuum.

The best performers understand this best. Consumers don’t care about “channels “, and new store systems will only be of value if they interoperate with all the other “channels ” retailers operate. For the worst performers, this challenge may prove difficult enough to phase them out completely. Laggards’ problems are only further compounded by how little importance they place on an educated, helpful staff in stores: only 13% (compared to Winners’ 38%) identify hiring good people as a top priority.

Alpha and Omega

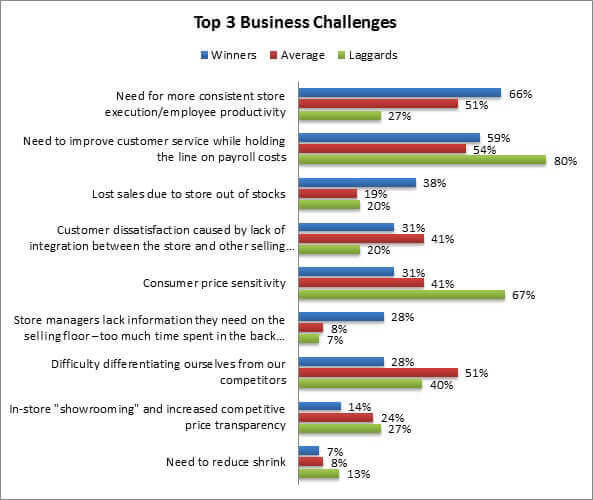

As you can see – same problems: different reaction (Figure 1). Figure 1: A Tale of Two Cities

Source: RSR Research, May 2013

Winners know their store employees are a key component to giving consumers more reasonto visit their stores; 66% say their top challenge is more consistent store execution and employee productivity. Customers demand a more relevant store associate than most retailers currently provide, and technology holds much of the key to fixing this problem. Laggards, on the other hand, look to the bottom line before they consider the impact; 80% say they’d like to improve customer service, but only if it doesn’t cost them anything more in payroll. As the saying goes, this may be penny-wise, but in the end: pound foolish. Recall that laggards already report hurting sales. They have few plans to open any new stores and plan to close existing stores in the near future. Is this a coincidence? Hardly. Winners know that a hallmark of winning behavior is to put the customer at the epicenter of each business decision. If a store environment has little value to offer beyond the ability to touch and feel a product, those stores will continue to falter.

The Pricing Conundrum Continues

To further compound matters, laggards are inordinately focused on consumer price sensitivity. This has become a recurring theme in much of our recent research, despite a lack of evidence to support that consumers are actually becoming more price sensitive. It is a dangerous (and baseless) assumption to make, as addressed in our most recent pricing study:

“Those who over-perform on year-over-year comparable sales are far more likely to stay the course in their pricing strategy than their competitors. Their competitors continue to up the promotions ante, yet they don’t get the sales or margin kick that they crave… Winners are far more concerned about protecting their brands’ pricing image, whether they think of themselves as the ‘low-price’ or ‘premium product’ leader. Laggards, on the other hand, worry about competitor pricing aggressiveness and new competitors emerging in unexpected places.”

You can read thefull report by following this link.