Sneak Peek At The 2012 Merchandising Study

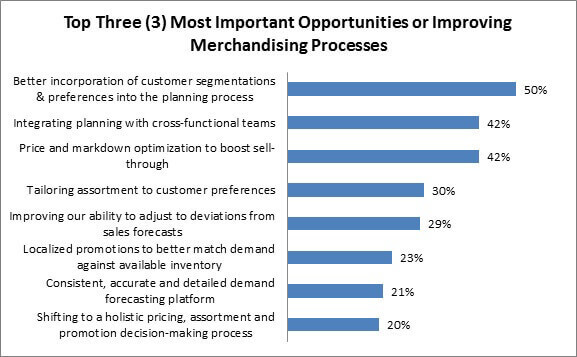

Our newest report on the state of Retail Merchandising won’t be available for a few weeks still (look for its full release on August 8), but the data isvery compelling, and I thought I’d share a bit of it with RPW readers here. When it comes to the opportunities retailers perceive, merchandising processeswould greatly benefit from better incorporation of customer segmentation and preferences into the planning process (Figure).

Segmentation the Key to Better Merchandising

Source: RSR Research, August 2012

The new consumer’s power is undeniable, and any insight that can help retailers predict what she’ll want more effectively – before she even knows it – is the top opportunity to improving current merchandise processes. However, this data is even more telling when broken down by respondent group:

- Retailers selling fast moving consumer goods are even hungrier for segmentation and preference information: 59% identify it as their top opportunity. These high-volume sellers understand that knowing more about the consumer than their competitors represents one of their only means to remain relevant, particularly when the products they sell are becoming more available (and in more unexpected places) each day.

- The best performers are far more focused on integrating planning with cross-functional teams: 47% of Winners (vs. a meager 14% of laggards) identify this as a key means to improving their merchandise processes. RSR has been a strong proponent of this tactic for as long as we’ve been conducting research – despite the frustration that invariably results from getting these teams up and running, their value cannot be overstated. And though they do require time and human resources, no retailer can shun them based on the price tag.

- Mega retailers are disproportionately interested in shifting to a holistic pricing, assortment, and promotion decision-making process. In fact, interest in holistic decision making is remarkably low for all retailers, and only picks up once they hit the $5 billion annual revenue mark (just 14% of small retailers, 13% of mid-sized retailers, and 19% of those with sales from $1-$5 billion select it as a top opportunity). If growing retailers are looking for a lesson in ways to avoid complexities as they scale, a move to a holistic pricing, assortment, and promotion process sooner than later will certainly avoid a lot of headache down the road.

We’re very excited to release the full report, and will make sure to let you know the moment it is available in full.