Sneak Peek At Our Brand New eCommerce Report

Our annual eCommrce report doesn’t release until later this week, but the data this year is really interesting. Normally, we get a lot of mom-and-pop pure-play online retailers to respond, but this year is different: 85% of our 97 qualified retail respondents operate stores. As a result, the response pool reflects a highly accurate representation of the current retail landscape, and provides us with a unique opportunity to examine the eCommerce challenges and opportunities specific to multi-channel retailers: in essence, the report serves to reveal the multi-channel retailer’s reality in a post-Amazon world.

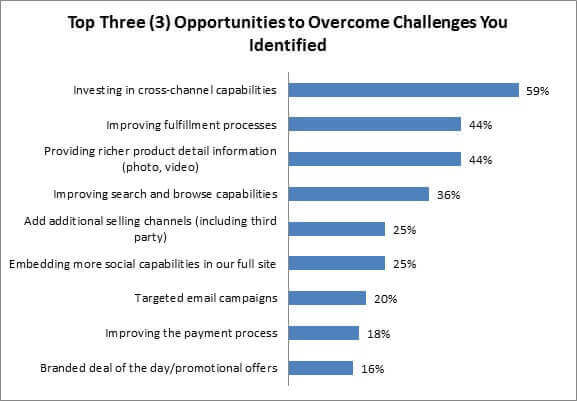

And our retail respondents are clear about their vision for the future of eCommerce: its days of operating as a separate entity within the overall organization are over. Customers are channel agnostic, and as a result, retailers must be as well; they identify their top opportunity going forward as investing in cross-channel opportunities (59%, Figure).

Figure: eCommerce is No Island

Source: RSR Research, November 2012

Winners are even more bullish about bringing their eCommerce functionality across channels:

- 71% of Double-digit Winners (and 67% of Single-digit Winners) say their top opportunity is investing in cross-channel capabilities. As we noted earlier in this report, most of our respondents to this survey operate stores, and this is the stake they are putting in the ground: this is how they plan to compete with Amazon. Regardless of your personal take on the viability of the “showrooming ” phenomenon, consumers still want — and need — to visit stores. For the best-performing and most forward-thinking multi-channel retailers, that ability to close a sale in whichever channel is most convenient and meaningful to the consumer and the way she lives is exactly how they will continue to compete with Amazon. However, this strategy only works if the paths to purchase — all of them — are completely interoperable. Winners understand this at a disproportionate rate and are investing to make sure their systems, supply chain, and inventory are aligned to make this a reality.

A Forced Hand Reveals Changes

There are also some differences in perceived opportunities this year. Firstly, we asked the question a bit differently. In years’ past, we’ve asked retailers to identify all of the opportunities that hold value for them. But this year, we asked them to choose only the three most important. As a result, a number of new trends emerge:

- The number of retailers ascribing high value to richer product detail information has dropped (56% in 2011, down to 44% in 2012). This is not to say retailers have lost interest in providing high content photos and videos of the products they sell on their sites — what it does mean is that when forced to be selective, fewer of them chose it as a top opportunity. This could also be indicative of retailers feeling they have product information “under control ” at this point in the game; it will be very interesting to see how they rate this data point in 12 months’ time. However, in a related point:

- The retailers who do give the highest value to richer product detail are those selling seasonal goods — even more so than what fashion retailers report (75% vs. 33% respectively).

- Improved payment processes take the biggest hit in overall retailers’ preferences when asked to force rank, down 19% this year from last.

- There is also a significant decline in the number of retailers citing targeted email campaigns as a top three opportunity. Does this mean the promise of targeted communications is fading and retailers are abandoning further efforts to tie content to consumer demographics, lifestyles and preferences? If performance is any indicator, no. Double-digit Winners have the strongest appetite of any retailers: 36% cite such communications top opportunity, compared to the aggregate’s 20%.

We will make sure to let all RPW subscribers know when the full report is available: I think you’re really going to enjoy it.