RSR Benchmark Preview: The Imperative For Supply Chain Agility

This week, the RSR team will release our latest look at the state of retail supply chain, entitled Retail Supply Chain: Navigating Through Rough Waters With Improved Agility. The report, sponsored by Blue Yonder, is a call to action for retailers to make the investments necessary now that will enable a more agile response to market conditions without sacrificing efficiency. When we last looked at supply chain planning and execution in early 2020, retailers were already telling us that they understood the need for greater agility to support an omnichannel selling environment. Now as we approach the end of 2021, the changes in retail supply chain processes and supporting technologies that retailers viewed as important just a year ago have become critically important.

Shockwaves

It has taken retailers more than a decade to absorb changes in the customer-facing “demand” side of their businesses. On the “supply” side, most retailers have only recently begun to make the changes necessary to offer more localized and relevant value in the stores, to offer new direct-to-consumer options, and to be able to respond quickly to sudden changes in demand.

Retailers acknowledge that the retail supply chain as it exists was built primarily for operational excellence and economic advantage, not agility. But retailers know that they can no longer depend on shoppers either beginning or completing their shopping in “the store”. As the demand (customer) side of the model continues to modernize, the supply side has had to change with it – and by 2020, retailers were well aware that they needed to enable a more agile response to a dynamic and increasingly unpredictable marketplace.

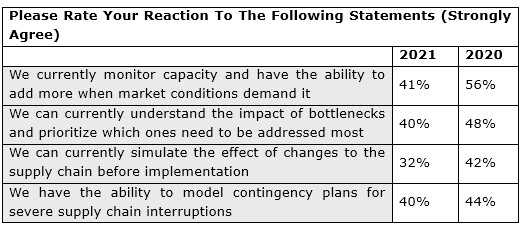

But for the most part, in 2020 retailers were not confident in their abilities to either see supply chain conditions in real time or to model contingency plans so that they could respond more effectively when disruptions occur. And after a year of continued buffeting, what confidence they had has only eroded further (Figure 1).

Figure 1: Less Confidence Now

Source: RSR Research, October 2021

RSR’s readers know that we identify over-performers as “Retail Winners”. Over the 15 years that we have been benchmarking retailer attitudes, we have consistently seen that Retail Winners have different thought processes than their under-performing peers. For example, a look at Walmart’s earnings increases shows how a set of technology decision-making processes can help a company be far more agile than it would otherwise be. This is a true hallmark of Retail Winners.

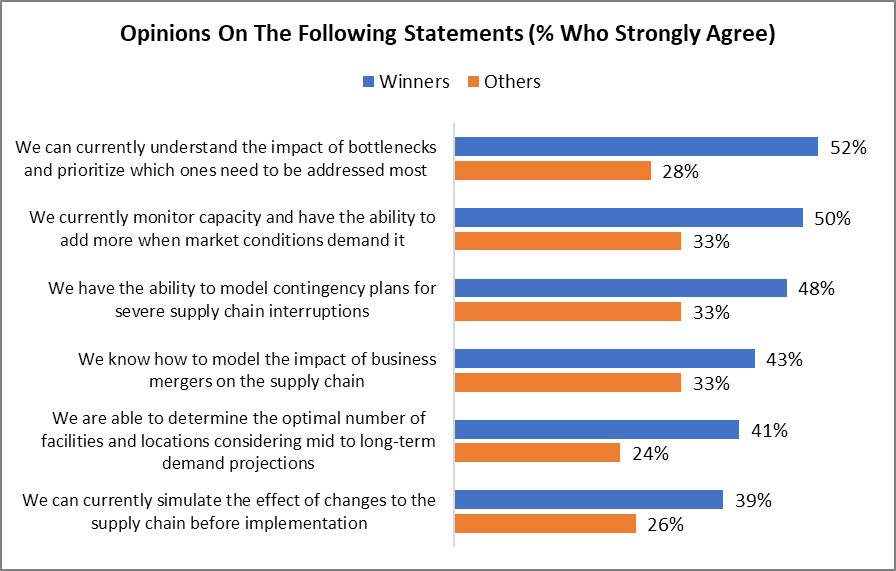

Responses to our survey show clearly that Winners are far ahead in their ability to monitor supply chain capacity, to model contingency plans, and to simulate the effect of supply chain changes before implementing them (Figure 2).

Figure 2: Monitoring And Modeling – Then Acting

Source: RSR Research, October 2021

But even Winners are less confident in their abilities this year than last. For example, in 2020 73% of Winners they strongly agreed that they could “monitor capacity and have the ability to add more when market conditions demand it”. Now that number stands at 50%, a significant drop.

When we asked retailers to identify the opportunities that they see to improve both supply chain efficiency and agility, the differences between over-performers and everyone else jump out again. For example, Winners are particularly focused on capabilities that will help them to see and eliminate problems that affect their ability to meet service level requirements (unexpected supply shortages that could affect supplier performance, inefficient suppliers, supply chain inefficiencies). Non-winners top choices have to do with being alerted to and responding to disruptions when they occur.

The differences are important. While both Winners and their competition are equally eager to get past disruptions, over-performers haven’t given up on their relentless search for new efficiencies. Winners are focused on processes, while non-winners are focused on events. In fact, achieving “operational excellence” a core strategy for Retail Winners, and recent disruptions on both the customer and supplier side of the operational model hasn’t changed that at all.

Look For The Announcement

The pandemic has been hard on everyone, and it has only accelerated changes needed in the supply chain to meet the dramatically new and different ways that consumer shop. In our new report, Retail Supply Chain: Navigating Through Rough Waters With Improved Agility, we examine how retailers are responding to the challenges and opportunities that they see, and which technologies they believe to have the greatest value to their businesses going forward. RSR concludes the report with several practical recommendations that retailers can act on now to either overcome the challenges identified or seize the opportunities that those challenges create.

As always, our benchmark reports are FREE, requiring only a simple registration.