RFID: Hiding In Plain Sight

Veteran retailers undoubtedly remember all the industry-wide tumult surrounding Walmart’s RFID (Radio Frequency Identification) mandate in the early 2000’s. To briefly recap those times, in ’03 the giant retailer announced that its largest suppliers would tag pallets and case packs with RFID chips by 2005, to streamline the flow of goods into the retailer’s DC’s. Suppliers were pressed to invest in the new technology to comply, but challenges with costs and issues with its ability to work around certain physical constraints (for example, problems associated with the ability to read tags through metal and liquids) were major stumbling blocks. Ultimately by ’07, Walmart and its partners quietly shifted away from the mandate.

But RFID never went away, as more and more companies found good uses for the technology. The first mention RSR made of RFID was in 2011, when our partner Paula Rosenblum wrote:

While RFID on cases and pallets was mostly akin to a solution looking for a problem, item-level RFID for items selling for $5 or more holds a LOT of promise… A store with every item carrying an RFID tag could … provide a REAL view into what’s where in the store… RFID really can <also> help control, quantify and sometimes deter shrink as it happens — in a very practical and non-intrusive way. So, I’ve bought into that as a near-term opportunity for apparel and other products.

American department store Macy’s began using tags at the item level to better track its inventory, and in 2016 the company announced that its merchandise would be 100% tagged by 2017, touting a 50% reduction in out-of-stocks and a resulting 18% rise in sales. Inventory visibility and accuracy was -and remains – the top use-case for RFID adoption.

It’s important to keep in mind that by the second decade of this century, inventory visibility and accuracy were becoming major concerns for retailers as consumers demanded more visibility into what inventory was available for purchase and where it was. As we’ve reported many times, inventory visibility and accuracy has remained a top-3 challenge for retailers for over 10 years. It’s not an easy problem to solve by traditional means, and many retailers are still challenged. In fact, every consumer everywhere has a story about how a retail website promised that an item would be in stock in the store, only to be proven wrong when the consumer goes to the store to buy it (full disclosure: it happened to one of the RSR partners this week!).

In the meantime, RFID chip and reader technologies have continued to improve. For example, there is a proliferation of purpose-built readers happening right now, with wearable devices, fixed location readers, and embedded readers (e.g., in a point-of-sale system). A lot of this activity is a direct result of industry-wide chip standards adoption.

Retail requirements for inventory visibility/accuracy and the availability of RFID tags and reader technology seem like a perfect marriage of a problem and a solution. Some retailers have been quick to seize on the opportunities created. One well-known example is Nike: in 2019, then-CEO Mark Parker commented during an investor call that, “RFID gives us the most complete view of our inventory that we have ever had… It’s quickly becoming the most precise tool in our arsenal to meet an individual consumer specific need at the exact right moment.” The implication was that RFID was much more than just a tool for better controlling inventory but is viewed as a key element in the company’s ability for its supply chain to respond much more quickly to changes in consumer demand.

And that brings us back to Walmart. Nearly 20 years after kickstarting the retail industry’s interest in the technology, the company recently announced that it is once again mandating that suppliers become RFID-compliant by September 2022, only this time it’s for item-level tags on home products and some hardlines. This is on top of the company’s decision in 2020 to tag apparel merchandise in its stores. The objective then was to “<improve> our ability to ensure product is available for our customers, leading to improved online order fulfillment and customer satisfaction“, according to Shelly McDougal, Walmart’s senior director of merchandising.

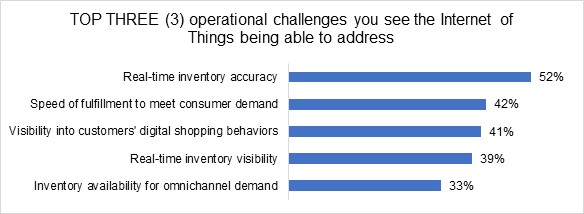

Are retailers following the leaders on RFID? In 2019, the last time RSR benchmarked retailer attitudes about IoT (“Internet of Things”) in general, retailers were more interested in security sensors, loss prevention sensors, and cameras and video analytics, than they were about RFID. But times change, and so do retailers’ attitudes. Responses to a recent RSR survey suggest that the use cases to drive adoption are compelling:

And what about the sour taste that the 2005 mandate left in retailers’ mouths? Now, only one-third of retailers in our survey “strongly agree” that “early experiments with case and pallet-level RFID tainted our opinion of the efficacy of the technology”. Times have changed indeed.

RSR will be publishing a new report on the state of IoT in Retail, in mid-March. The report will provide insights about how retailers view RFID to solve nagging problems and create new opportunities. Be sure to be on the lookout for the report in mid-March!