Returning To The Subject Of… ‘Returns’

Last summer, I wrote a piece for RSR’s Retail Paradox Weekly about the importance of being able to meet consumer expectations when it comes to returns handling. Let’s face it – returns of online orders are going to continue as long as it’s fairly effortless and free.

Retailers have recently been trying to bend the upward trajectory of the volume of returns with a variety of tactics, with some apparent success. For example, last year the National Retail Federation reported that in 2022, the U.S., returns equaled about 16.5% of the total across all verticals and selling channels. But for 2023, the NRF reported a slight improvement; as a percentage of sales, the total annualized return rate was 14.5%.

That being the case, it’s still nothing to be happy about. As we highlighted a couple of weeks ago, eCommerce sales in the U.S. equal about 16% of total retail sales. Easy math tells us then that virtually everything that retailers gain by offering digital shopping options to consumers is undone by returns. That’s a sobering thought!

This brings us to some new benchmark findings we will share in the forthcoming report on the state of the retail store. RSR’s research shows that retailers are working hard to integrate the digital and physical selling channels together. Some pundits have called the strategy “phygital retailing”. If you haven’t heard the term, it’s defined by the website ScienceDirect as a “marketing term that describes blending digital experiences with physical ones.”

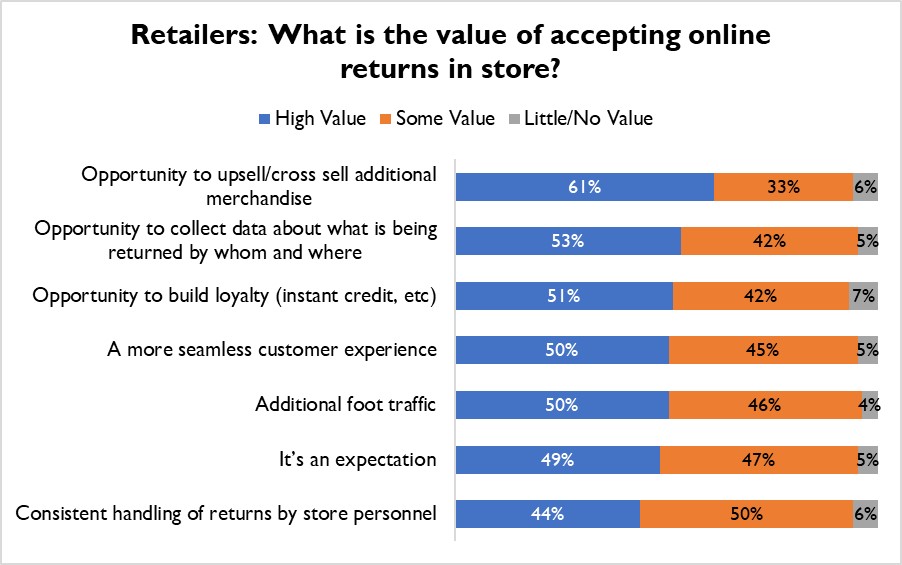

One way that retailers are attempting to blend the digital with the physical is to encourage shoppers to bring their online order returns to the store (Figure 1).

Figure 1: Another Reason To Go To The Store

Source: RSR Research, February 2024

The list of retailers that offer this option is long and growing – companies from Abercrombie & Fitch and Apple to Victoria’s Secret and Walmart.

The reasons for accepting online order returns in the store are varied, depending on retail vertical. For Fashion and Hardgoods merchants, it’s all about generating more foot traffic in the store. For general merchandisers and FMCG retailers, it’s all about creating upsell opportunities. But looking at this by performance, Winners and others agree that creating upsell opportunities is the top reason to take in online order returns.

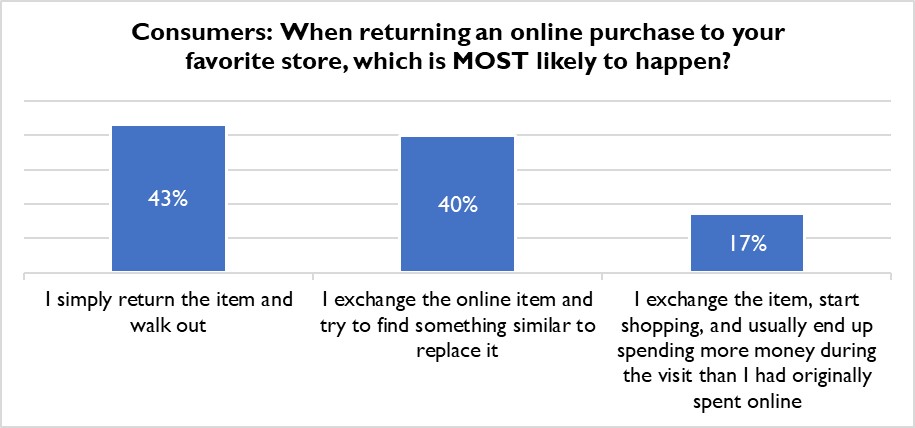

But according to the consumers we surveyed in a November 2023 study, retailers’ hopes that handling online order returns in the store will create upsell opportunities faces resistance (Figure 2).

Figure 2: Upsell Is Hard

Source: RSR Consumer Study, November 2023 (n=1132)

Retailers have a high hill to climb to realize their hopes of offer instore returns handling as a way to make up for the costs associated with returns with cross-sells/up-sells. But there are things that retailers can do right now to mitigate the challenges created by returns handling in the store. Here are several suggestions:

- “Free returns” may not be a sustainable policy for all retailers. There must be a tradeoff, e.g., using the returns policies as an incentive, by offering rewards that reinforce desired behaviors.

- Train employees on how to handle returns. Should items be returned to stock? Sent back to the warehouse? Recycled? Asking store clerks to make these decisions without guidance is bound to be error-prone (and thus costly).

- Retailers should think more about returns prevention. We discussed this opportunity in a Retail Paradox Weekly blog in May 2022. To summarize, of the ten top ranked reasons[1] that shoppers return goods, only two (“bought to try”, and “product no longer needed”) are outside of retailers’ control. The remaining eight should be corrected to reduce the rate of returns (“poor product quality”, “color not as described”, “product fit not as described”, “wrong item”, “damaged”, “product arrived late”, “product didn’t work”, “better price found elsewhere”).

- Automation can help control returns handling. Automated returns portals, automated voice assistants, automated returns authorizations and “printerless returns”, instant refunds at first scan – all these capabilities and more can help.

Finally, returns data can help in future merchandising decisions. In a sense, returns are the voice of the customer; they are often an early and important sign that something is wrong with the products being sold.

[1] According to Gartner and Coresight Research