Retailers Share Their Latest Merchandising Opportunities

A unique combination of forces including continued economic uncertainty, the omni-channel phenomenon powered by the consumerization of IT, the emergence of a new generation of merchants, and retail’s brand globalization have driven the industry to one conclusion: localized assortments driven by customer and store attributes are necessary to support the best possible sales while controlling inventory and costs. Little doubt remains that the art and science of retail merchandising have changed irrevocably.

In RSR’s fifth annual Merchandising Benchmark Report, Optimizing Assortments to Invigorate Retail, we set out to see what progress has been made in changing merchandising processes within retail companies both large and small.

Retailers believe their merchandising processes would greatly benefit from better incorporation of customer segmentation and preferences into the planning process (Figure 1).

Figure 1: Segmentation the Key to Better Merchandising

Source: RSR Research, August 2012

The consumer’s new power is undeniable, and any insight that helps retailers predict what she’ll want more effectively – sometimes before she even knows it – is the top opportunity to improving current merchandise processes. However, this data is even more interesting when broken down by respondent group:

- Retailers selling fast moving consumer goods (FMCG) are hungrier for segmentation and preference information: 59% identify it as their top opportunity. These high-volume sellers understand that knowing more about the consumer than their competitors represents one of their only means to remain relevant, particularly when the products they sell are becoming more available (and in more unexpected places) each day.

- The best performers are far more focused on integrating planning with cross-functional teams: 47% of Winners (vs. a meager 14% of laggards) identify this as a key means to improving their merchandise processes. RSR has been a strong proponent of this strategy for as long as we’ve been conducting research. While it may be difficult to get these teams up and running, their value cannot be overstated. And though they do require time and human resources, retailers can no longer avoid them. The value is just too great.

- Mega retailers are disproportionately interested in shifting to a holistic pricing, assortment, and promotion decision-making process. In fact, interest in holistic decision making is remarkably low for most of our retail respondents, and only begins to pick up once they hit $5 billion in annual revenues (just 14% of small retailers, 13% of mid-sized retailers, and 19% of those with sales from $1-$5 billion select it as a top opportunity). If growing retailers are looking for a lesson in ways to avoid complexities as they scale, a move to a holistic pricing, assortment, and promotion process sooner than later will certainly avoid a lot of headache down the road.

But What of It?

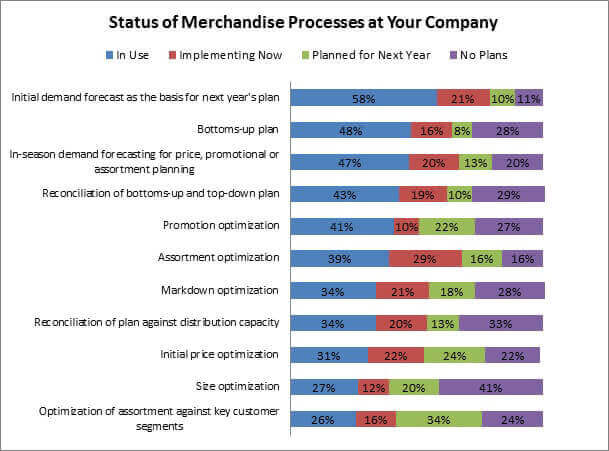

While the Technology Enablers section of this report will take a deep dive into the current and budgeted technologies that retailers pursue, those processes which retailers plan to implement in 2013 provide near-term opportunities to improve merchandising efforts. Based on what we saw in Figure 6, it comes as little surprise to find 34% of respondents plan to optimize their assortments against new key customer segments in the coming year (Figure 2).

Figure 2: Near Term Plans

Source: RSR Research, August 2012

Another 24% plan to include initial price optimization in their processes in 2013, and 22% will incorporate promotion optimization. However, as usual, differences emerge by retailer performance:

- More Winners have been employing a bottoms-up plan – and for longer – than their average and lagging competitors (52% of Winners have had this process in use for more than a year, vs. average retailers’ 19% and laggards’ 29%). What’s more, laggards seem to have little understanding that this a problem they need to fix: None are in the process of implementing a bottoms-up planning approach, only 7% plan to in 2013, and a dramatic 50% have no plans of any kind to emulate Winners’ in this area.

- Laggards are also drastically behind in their understanding of the importance of assortment optimization. While 42% of Winners are already using assortment optimization, those who aren’t already on board know they need to be; 27% of Winners are in the process of implementing right now, and another 15% have plans to do so next year. By comparison, 39% of lagging retailers have absolutely no plans to incorporate assortment optimization.

- These differences are even more dramatic when viewed for FMCG retailers, who lag in adoption of virtually every merchandise process on our list.

These data points beg the question: despite all of their interest in customer segmentation and consumer preferences, what benefit do retailers anticipatewill come of this information if they have no way to act on optimizing assortments accordingly, or even have a pre-established plan in place to adjustin the first place?

We invite you to read the full report by following this link.