Retailers Hedge Their Mobile Bets

The evidence is everywhere, for all to see. Mobile technologies have become ingrained into people’s daily routines. As those routines relate to shopping, consumers use their mobile techs to find the best solutions to their lifestyle needs by searching for content about products and services within the context of the need, checking what the community of like-minded shoppers has to say about their potential purchases, and finally by engaging in commerce (the exchange of money for goods & services) with the selected retailer. These activities can (and often do) happen in concert with web searches at home and in-store browsing. Mobile isn’t so much a selling channel as the glue that brings all the other legacy selling channels together into one (hopefully) consistent shopping experience.

In any current retail-related conversation – whether about online commerce, the supply chain, or the store – the discussion will quickly turn to mobile. The disruptive nature of new mobile technologies is virtually unprecedented in retail history, scaling at a pace even faster than eCommerce did. And here’s why we are comfortable making such a statement: while the traditional retail model is built on the assumption that consumers begin and end their shopping experience in the store, consumer mobile technologies have enabled more complex paths to purchase. Now, consumers carry the store in their pockets and purses. Armed with information available anytime and anywhere, it’s a whole new ballgame, with consumers firmly in control of the dialogue- and retailers know that they ignore the new reality at their peril.

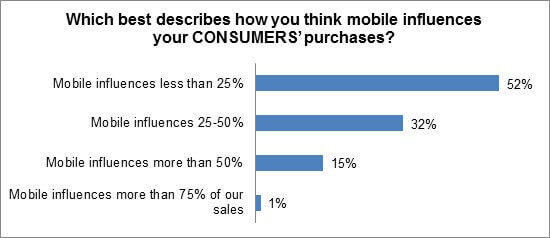

But its hard for business people to accept that they don’t control the adoption curve for these new technologies. Companies like Samsung, Apple, Google, Nokia, and others are more likely to affect the compelling case of mobile adoption, than anything that gets decided in the retailer’s executive suite. And RSR’s new study on mobile in retail (to be published this week) shows that retailers are also under-estimating mobile’s influence on consumers’ buying decisions, perhaps thinking that they have time to meaningfully address the challenges and opportunities associated with the new consumer technology. As the chart below shows, 52% of retailers believe that mobile devices are used – at any point along the myriad paths-to-purchase modern consumers travel – less than 25% of the time.

Notwithstanding what retailers tell us in the study, external data from quantitative consumer studies show conclusively that consumers are using mobile as an important tool to making many or even most of their purchase decisions. Retailers should assume that all of consumers’ purchase decisions will be made with the influence of information made available on mobile devices.

Gaining Insight into Consumers’ Complex Paths-to-Purchase

One of the more interesting differences in how retailers see the opportunities is that almost 40% more Winners than all others (53% vs. 38%) see mobile as a way to better understand consumers’ new paths to purchase. This finding tees up what RSR thinks will be one of the top issues of the next two years- the “harmonization ” of digital marketing with more traditional marketing in the omni-channel retail model. In new generation marketing, retailers need to understand consumers’ paths to purchase – which often begin outside of the store and often traverse several “channels ” for a single purchase decision, so that they can intersect them at the right moment with the right value offers. This may be the #1 reason for retailers to develop a downloadable mobile app.

But even though Winners want the insights that come from mobile, they may not fully grasp mobile’s true potential. The study reveals that most retailers – including Winners – prefer “an ecommerce site optimized for mobile access ” vs. “a downloadable mobile app ” as the best way to empower consumer mobile capabilities. While a website that is optimized for a mobile screen may work for transacting, it doesn’t capture the geo-location information that mobile technologies can generate, as a mobile app can. That limits retailers’ ability to send location-specific messaging to consumers along their path to purchase.

Other Report Highlights

- Winners have much higher expectations of Mobile shopping’s influence in the next three years.

- A surprising number of respondents have no plans to implement “barcodes to check price or availability “. Price transparency is real, thanks to Amazon’s Price Check and Ebay’s RedLaser applications; retailers clearly need to embrace the capability.

- While most Winners are most in favor of enabling WiFi access for employees (72% vs. 50% for all others), Wifi access for customers continues to be a very low priority for ALL retailers.

- The majority of retailers are putting a lot of faith in what a streamlined technology platform – across all channels – will ultimately do for them. Winners are even more bullish on the value.

- Only one-quarter of retailers in the study say that are preparing to deal with the complexity of mobile application deployment. Twenty-four percent identify the most valuable component of any new mobile initiative is that it be on a “write once/deploy many mobile development platform ” (24%). And 21% of retailers are budgeting for device provisioning and management services.

Read the Report!

The Impact of Mobile in Retail contains analysis of the business drivers, opportunities, and organizational constraints surrounding new mobile systems and practices being used in retail today. It publishes this Thursday, January 10, and we’ll make sure to email you a link as soon as it is available!