Retailers Cling To Physical Growth Strategies

The need to grow the business is a constant theme for every company. None other than James Cash Penney (founder of JC Penney) once said that, “no company can afford not to move forward. It may be at the top of the heap today but at the bottom of the heap tomorrow, if it doesn’t.” What fuels this belief are market dynamics; a company can only maintain a no-growth position if costs and revenue remain stable and predictable. But no retail market anywhere is stable and predictable, and so the pressure for growth is always there.

Retailers look at growth from two angles: physical growth (farther reach and deeper penetration into markets), and more consumer share-of-pocket. But when it comes to physical growth in mature markets such as the United States, there are only so many “A ” locations available, and a lot of “B ” and “C ” locations that retailers actually want to get out of (just think of your nearby strip mall with a Taekwondo center, a nail salon, and a storefront church). And when it comes to physical growth into new markets, the issues only get bigger, because of global economic and geo-political uncertainty.

So physical growth is… complicated, expensive, and extremely risky. As my RSR partner Paula Rosenblum writes in our soon-to-be-pulbished benchmark report (Growth Strategies: Chasing The Consumer With Technology), “Notwithstanding somewhat ample proof that in many countries the retail market is saturated, retailers and stock analysts maintain the hope of more growth. To make matters even more complicated, after several years of hoopla around the ‚ÄòBRIC’ countries (Brazil, Russia, India and China), three out of four are experiencing significant economic challenges with no end in sight. “

That leads right into the other strategy: more consumer share-of-pocket. RSR has written extensively about how retailers need to extend the Brand’s value out beyond the physical four walls of the store into the digital domain, where consumers frequently investigate and select products and services to fit their lifestyle needs. The new benchmark study shows that retailers almost uniformly believe that a combination of stores and digital commerce and an integrated digital and physical selling environment, are the most important growth drivers available to them.

But here’s where retailers get physical: all of these improvements to the total selling environment are in the context of physical store growth, according to retailers. In fact, retailers are much less inclined to believe that stores need to be de-emphasized in favor of “digital growth “, but instead believe more firmly than in our previous study on growth strategies (2015) that they need to pursue more physical stores in new locations. And by “new locations “, retailers don’t mean “new markets “; the US, UK, and Europe are still overwhelmingly the markets of choice for most retailers.

All of this forces retailers to refocus on the value of the store as an integral part of the shopping experience. And underlying that is the realization that store-based retailing is more profitable than direct-to-consumer retailing, plain and simple.

Consumers Behaviors Are Driving Growth Strategies

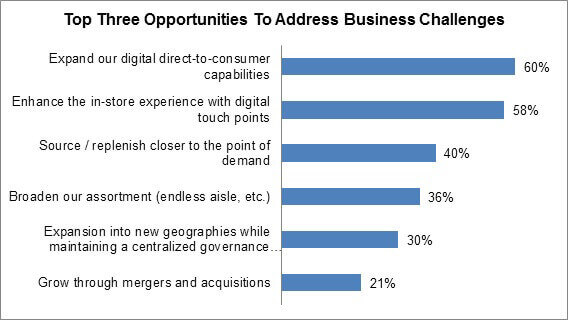

In the report, the most frequently cited business challenge identified is the fast pace of change in consumer technology. So it’s not surprising that the most frequently cited opportunity for retailers is to expand direct-to-consumer capabilities. But with the overarching view that the store remains an integral part of the customer experience, it makes complete sense to blend the digital and physical in the store. As the figure below shows, this is exactly how the study’s survey respondents see their way past the challenges they face.

Figure: Digital Alone and Digital In Stores Hold The Key

Source: RSR Research, June 2016

The bottom line when it comes to growth is that retailers see their best opportunity to grow as they have always done, with new stores. But the study shows there’s a big change inside of that opportunity – it must include investments in technology that meet consumer adoption trends as well as a much more flexible operational model that can efficiently adjust as consumers adopt new technologies in the future.

But it’s still very early days when it comes to making that a reality. The report shows that Winners are far ahead of the pack when it comes to recognizing the importance of technology enablers, but even they have a long way to go to adoption.

Read The Report

RSR’s latest benchmark report, Growth Strategies: Chasing The Consumer With Technology, will be available on June 16, 2016. The report discusses the challenges and opportunities associated with growth in retail. As is so often the case, over-performing Retail Winners give us some clues as to how to address the “growth ” agenda with a blend of physical and digital strategies, and the report makes a series of go-forward recommendations based on those winning behaviors.