Retailers Caught In A Crossfire At NRF’16

The underlying truth of the last five or six NRF Big Show events, held every January in New York City, is that retailers have lost sight of where and how (and why) consumers shop. In “the old days ” before we all had smart mobile devices, consumers generally did almost everything associated with shopping within the four walls of the store, and bought what retailers put in front of them. But consumers everywhere around the world revolted once they had the power of information in their pockets and purses, and ever since then retailers have been trying to figure out how consumers’ new digitally enabled shopping behaviors apply to their businesses.

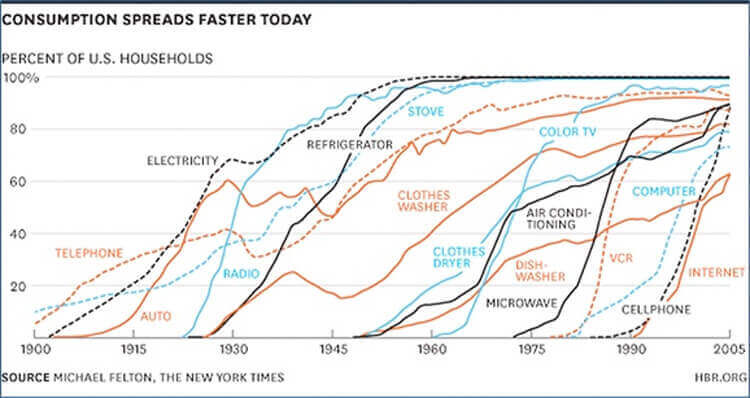

By itself, keeping up with consumer adoption of technology represents a huge challenge for the Retail industry, because of how fast adoption of new technologies happens nowadays compared to the past. The chart below, created by Nicholas Felton of the New York Times, makes this point unmistakably clear.

Retail, on the other hand, tends to be very slow to adopt new technologies, as most in the industry will admit. But retailers know they need to move faster because consumers are smarter and better informed and have a whole world of choices at their fingertips. The fundamental operational assumption of the mass merchandising age, “if we build it, they will come ” (and it’s corollary about assortments, “stack ‚Äòem high and watch ‚Äòem fly! “), is no longer dependably true.

That’s the reality that retailers have been struggling with since 2010. Companies have gone through at least some of the stages of change (pre-contemplation, contemplation, preparation, action, maintenance) at different speeds even while consumers are already moving on to The Next Really Cool Thing.

And underlying it all is the grand question, how to be profitable in this new world?

The Fundamental Challenge Isn’t News

With these things in mind, retailers once again trekked to NY in January to see marvelous technologies that would enable them to play on in the world of the digitally enabled consumer. But while retailers may continue to struggle with how consumers have integrated always-on information technology into their daily lives, it is by no means a new challenge. In fact, it was predicted (or perhaps more accurately, triggered) by technology investors. In 2008 I reported on a conversation I had with a venture capitalist friend, who bluntly stated that Silicon Valley had given up trying to get retailers to adopt technology innovations: “we look for technologies that empower the customer to be a better shopper. To do that, it doesn’t require cooperation from the retailer, and so the venture capitalists aren’t looking to retailers. We know that customers enjoy researching products, and if you can provide that kind of research and price comparison capability on a mobile basis and with geo-locational capabilities, then a consumer walking by a store or even in a store could be a much better informed shopper. That may cause the retailers a little bit of a problem! If retailers don’t cooperate, they will just lose the customer to someone else. “

That is exactly what has happened. And that is the first irresistible force that retailers are trying to cope with: consumers are more empowered with information than they are. At this year’s NRF, any dissention about whether or not consumers use the digital and physical selling environments together to find the best solutions to their needs had all but dissolved. That’s good, because while retailers are trying to figure out how best to interleave the digital with the physical, consumers believe that it’s already a done deal. Now the issue for retailers is, “where’s the go-faster button? “

The Bigger Challenge

Modernizing the retail business to be more relevant to consumers today isn’t only about adopting the latest and greatest technologies to enhance the experience. What constitutes an “enhanced experience ” continues to evolve, since it is driven by how consumers integrate each new technology into their shopping behaviors. The bigger challenge is in how to enable the business to be much more responsive to changes in those behaviorsand demand – and how to be profitable at the same time.

To be more responsive, retailers need to understand so much more than just what products are selling, but what problems consumers need solved and how best to solve them. Relevance implies insight, which has to be based on communication between the consumer and the retailer, and which is then followed up with the right response based on the insights gained from that communication.

At this year’s NRF, technology companies were demonstrating not only how to integrate the digital and physical shopping experiences (technologies that they’ve been showing off since at least 2010), but also how to engage in a virtual dialogue with shoppers by “listening ” to the “digital breadcrumbs ” that consumers leave behind with the new technologies, gaining insights from them, and then responding. My partner Paula Rosenblum has called this “scalable intimacy “, and that captures the opportunity perfectly.

The good news: today’s information technology works. Beyond integrating consumer technologies into a “converged ” selling environment, new data analysis technologies can take retailers beyond just shortening the reaction time between consumer demand and retailers’ response, to being able to predict. Data driven insights can inform merchandising and marketing systems in new ways, making it possible for retailers to adjust much more quickly to changes in the marketplace. All of that was on display at NRF’16.

An Even Bigger Challenge

Thinking about all the changes that retailers need to make to (1) modernize the shopping experience for consumers, and (2) change all of the planning and execution systems that support the selling environment, the total picture gets pretty difficult to absorb. There is so much process redesign and technology reinvestment to do that retailers would be excused for feeling more than a little anxiety about the future, especially when new entrants like Amazon base their entire operational model on a technology-first strategy. But the biggest challenge of all given all the changes needed to respond to consumers’ buy anywhere/get anywhere demands, is can the retail business still be profitable? The days of thinking that “a good gross margin covers a multitude of sins ” are gone.

What’s eating away at the narrow net margins that the business used to deliver isn‚Äòt limited to the amortizable capital costs associated with retooling the business (in fact, for many retailers, those costs haven’t even hit the books yet!). The operating expenses associated with serving the customer in a buy anywhere/get anywhere selling environment have to be accounted for – all the new logistics costs associated with omni-channel fulfillment and all the labor costs associated with a higher service profile, and all the costs associated with an increase in returns that go along with “click & collect ” customer orders. And remember: retailers can’t recover those costs with higher prices, because consumers are incredibly price aware – thanks to technology!

More good news for retailers: technology companies have been thinking about this too, and there were solutions on the NRF’16 Expo floor that demonstrated how to use information and technology to optimize activities associated with omni-channel order fulfillment in order to maximize the profitability of each sale. But just as it is true for modernizing the selling environment, fulfillment optimization can only be addressed if retailers invest in efforts to redesign their business processes and new enabling technologies.

Caught In A Crossfire

So, retailers are caught in a crossfire of different but related strategic challenges. The first one isn’t new: consumers expect retailers to serve them they way they want to be served, in a converged digital/physical selling environment. As RSR has said many times, consumers don’t see “channels “.

But that’s just the start. Retailers know that they can’t just continue to merely react to shifts in marketplace, but must be able to predict those shifts and be ready when they occur. That requires a whole new way of thinking. And finally, retailers have to accept that succeeding in the new age of retailing will be driven by information more than anything else.

The thing is, the technology companies know this, even if retailers are still trying to negotiate their way through the change process. After all, it was technology that caused these changes, just as my venture capitalist friend predicted back in 2008. So on the NRF’16 floor, the “vibe ” wasn’t about new whizz-bang stuff (although there was some of that there), but more about getting down to the hard business of making the changes.

And as I said earlier, that’s good, because consumers believe that it’s already a done deal.