Retail IT Spending: Does Your Company Know Where The Money Goes?

My RSR partner Paula Rosenblum and I spent years in IT before our RSR days, and I think we can both attest to truth to the old rock’n’roll lyric when it’s applied to Retail IT: “I was glad to come, and I was glad to go, but while I was there I had me a real good time. “

Most industry observers know that retailers have always had a love-hate relationship with Information Technology. Even though IT has been a key enabler of the kinds of mammoth retail enterprises we see today, it has also been viewed as an irritating expense to be closely scrutinized by the Chief Financial Officer in the name of “keeping expenses under control. ” As Paula wrote in our most recent benchmark report (IT Spending In Retail 2018, February 2018), “as IT project budgets have moved into the lines of business, IT has become thought of as “plumbers ” rather than business partners…. “

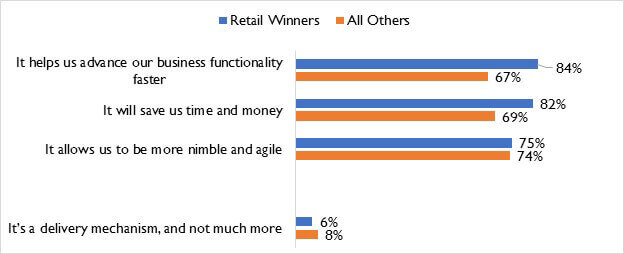

In the benchmark study, we conclude that attitudes are finally changing, driven by the pervasiveness of always-connected mobile consumer devices throughout the world. In essence, retailers are being forced to modernize their IT infrastructures and business applications portfolios because consumers expect retailers to have at least the same information and capabilities as they do. That is triggering the shift in how retailers perceive the value of information (and the technologies that deliver it). You can read all about it in the new report.

But does your company actually know what it’s spending in total on information technology? I’ll bet it doesn’t, and here’s why. Consider the following two charts:

Source: RSR Research, February 2018

These numbers fly in the face of conventional wisdom about how much retail corporations spend on IT. For as long as I can remember, that conventional wisdom has been about 1% of revenue from a profit & loss perspective (i.e. charged to operating departments), and 2% of revenue on a cash basis. But very clearly, total spending is much higher. Sixty percent of the retailers who responded to our survey think that total corporate expenses for IT-related line items are somewhere between 1.5-4.0% of revenue.

That’s real money in anyone’s book. And so the fact that only 32% of responding retailers indicate that more than 75% of that spend is controlled by the IT budget – and the rest is probably outside of the IT governance process – should be cause for real concern, right up to the Board of Directors.

The Need For A Governance Process

The last time RSR conducted a study on “IT alignment ” was in 2010 (Pandora’s Box? The Impact of New Technologies on Retail IT, November 2010), and we identified the same elephant-in-the-room issue that had forced its way front and center in our previous studies – IT Governance:

“In our 2009 study, IT and Business Alignment in Retail, RSR recommended that businesses “…ensure all line-of-business (LOB) demands for IT services are considered within the context of the total corporate strategy “. That recommendation still stands above all others… Keeping track of outstanding projects and discriminating between wish lists items and nice-to-haves from need-to-haves is virtually impossible without true IT business governance. There is no substitute for an IT Executive Steering Committee, especially given the explosion of selling and product information channels, and the particular and unique challenge of the rise of social networks. The lack of an IT governance structure has moved beyond an organizational inhibitor to a true business challenge. ”

At the time, Paula and I agreed that to bring this recommendation up yet again was like beating a dead horse, and so we left IT spending/alignment off the benchmark agenda for seven years.

But here we are again, and the new IT study shows that over-performing Retail Winners are just as concerned about IT governance as we are. In fact, Winners’ #1 operational challenge affecting their IT spending is that “IT related spending happens throughout the corporation, often authorized or controlled from outside the IT governance process “.

So while Winners seek to modernize their software development tools and processes to be able to implement innovative new solutions, their #2 tactic for removing organizational obstacles is to rein in on the amount of spending that goes on outside the IT governance process, to ensure that all IT-related expenditures are closely aligned with business objectives.

Why is that a big deal? Of course, there are lots of good reasons, most having to do with the “need for speed ” – the market-driven requirement to keep up with the pace of consumer-driven innovations. But the more pragmatic reason is because the amount of money being spent throughout the corporation on IT may exceed the amount of after-tax profit that the company delivers to stockholders. So while Retail Winners are working to rethink IT from being an expense to an enabler, it’s still a big, big expense that screams for governance.

And that is why our final recommendation in the new report sounds a lot like the top recommendation we made in the 2010 study:

“Over the past twenty years, the Retail IT function has been pushed further into the backroom, while line-of-business leaders have added money to their budgets for the technology solutions that they need. As a result, retailers are spending more on technology than they have probably realized, much of it outside the IT governance process. Retail Winners want to pull technology investment plans back into the IT governance process, to ensure that money being spend aligns well with overall corporate objectives. We think that’s a good idea! “

Read The Report

Attitudes are changing when it comes to IT spending, as companies increasingly use information to create differentiating value to consumers. IT is being elevated to a strategic function within the enterprise.

Still, this begs the question: How much are retailers spending on IT? Do they view information as a strategic asset? Has Cloud Computing enabled better responsiveness? And given that Amazon continues to spend buckets of money on Research and Development (and most recently, retail acquisitions), how will retailers respond?

Download the new report for a candid deep dive into the topic. If you don’t have the time to read the full report, be sure to check out the e-Book summary!

The report is sponsored by JDA and is presented in partnership with Cathy Hotka & Associates.