Retail eCommerce In Context: The Next Iteration

A digital storefront is table stakes for retailers today. According to Google[1], 63% of all shopping journeys now begin online. The COVID-19 lockdowns in 2020 only pushed consumers further into digital-first experiences, resulting in breathtaking increases in ecommerce sales for leading retailers.

The unprecedented acceleration of the shift from physical stores to online shopping because of the COVID-19 lockdowns over the past eighteen months has prompted new consumer demands and amplified existing challenges for retailers. While the shift to digital-first has happened across all industries, retailers are facing the limitations of their aging technology portfolios to deliver new and differentiating new value to consumers, such as new order fulfillment options, social commerce, new payment methods, subscription programs and more.

Retailers are recognizing that the customer experience matters today more than ever. To differentiate themselves, companies recognize they need to make shopping easy, intuitive, and personalized. But as ecommerce functionality has (at least from the consumer point of view) become more commonplace, retailers are looking to up the ante by differentiating with new, faster, and easier-to-use features, functions, personalized content, added integrations, and more ways to shop.

A closer look at overperforming retailers in RSR’s most recent benchmark study on the state of eCommerce in Retail (Retail eCommerce In Context: The Next Iteration, June 2021) reveals that these “Retail Winners” have a more pronounced belief that supporting new digital touchpoints, improving the checkout experience and testing new customer experiences, is important to their future success, compared to average and under-performing competitors. The new benchmark shows that the more successful retailers are, the more they are emphasizing the digital storefront. Less successful retailers, by way of comparison, continue to de-emphasize the digital world in favor of the physical world (i.e., stores).

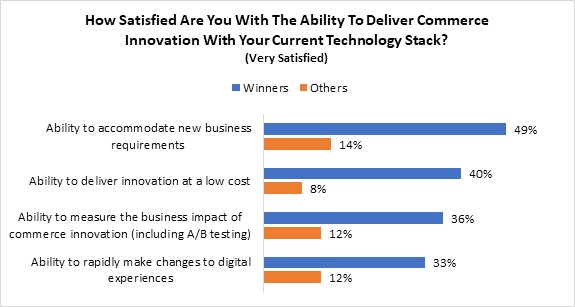

However, there’s a real challenge for all retailers, regardless of performance: their ecommerce solutions predate modern technologies that enable differentiation. Winners’ satisfaction in their ability to accommodate new business requirements (49%) and to deliver innovation at a low cost (40%), clearly separate them from average and under-performers (Figure 1).

Figure 1: Winners Are More Confident – To an Extent

Source: RSR Research, June 2021

While almost one-half of Winners are confident that their current platform can keep up with new requirements triggered by consumer adoption of technology, the remaining Winners – and over 80% of average and under-performers — are not. And even fewer retailers believe that they can make changes at a low cost. How do retailers plan to address the challenges and take advantage of the opportunities they see in a timely and cost-effective way?

Consumer expectations for a more convenient and seamless shopping experience in the context of a unified digital and physical shopping journey is the driving force causing retailers to consider big changes to their current digital commerce offering. In the report, we examine the extent to which retailers sense a need to be much more agile in their response to consumer demands, as well as how confident they are that their eCommerce solutions are up to the challenge.

The good news for retailers is that the new generation of solutions assumes the continued proliferation of customer touchpoints and new shoppable moments and they are developed specifically to make it possible for retailers to keep up with consumer expectations and more agile competition. While the rate of touchpoint proliferation will vary based on the industry and business model, the report makes it clear that the majority of retailers know that consumer demands for a more convenient and seamless experience will trigger new spending to modernize the eCommerce offering. The question is, which strategy will retailers employ: stick with what they have, bolt new capabilities onto their current systems, or replace existing systems with next-gen eCommerce solutions?

Read The Report

The events of 2020 and early 2021 have forced retailers to become more adaptive. Many brands’ ability to alter their shopping experiences to meet changing customer demands in the face of dramatically changed consumer shopping patterns has been nothing short of amazing. Features and functions that would have been “nice to have” just 18 months ago – curbside pickup, home delivery, online “concierge” tours of physical stores, creative checkout processes that make critical shopping as painless as possible – have been implemented years ahead of industry expectations. And while many were thrown together quickly so that retailers and their customers could navigate through the COVID-19 pandemic, efforts to refine both the systems and operational processes be more efficient – and profitable – are now underway.

RSR’s goal in this study was to understand how well retailers have been able to pivot to a digital-first world, what challenges they face, what new opportunities they see in the new marketplace, and how well their technology portfolios are able to support these shifts profitably.

Retail eCommerce In Context: The Next Iteration, sponsored by Bold Commerce, features 18 charts across 25 pages of in-depth analysis.

Like all RSR reports, it is completely free of charge to registered users. Registration is also free, and only takes a moment.

[1] www.thinkwithgoogle.com/consumer-insights/consumer-trends/trending-data-shorts/