Pricing Benchmark: Early Findings Surprise

I’ve started looking at the results from this year’s Pricing benchmark. I must say, early analysis of this data has yielded some surprising results. Continued uncertain economic conditions and increasing consumer price sensitivity has shifted industry focus dramatically. Respondents are far more apt to ignore the wealth of customer data available to them and look instead to competitors’ prices to make pricing decisions than they were just a year ago.

For example, last year, 63% of retail respondents reported customer purchase history as a very valuable input to facilitate price setting. This year, the number dropped to 37%. The number highlighting the importance of competitor’s prices rose slightly, from 61% to 63%. We would intuitively assume this is driven by price transparency and the consumerization of IT, but the data tells a different tale. It’s true that the number of retailers feeling the impact of price transparency has doubled from 10% to 20%, but retailers seem to believe consumers are simply responding to the barrage of promotions being thrown at them. After all, 38% of retail respondents continue to significantly increase the volume of price changes they send to stores and other channels.

It’s interesting to note that even as the number of price changes continues to rise, the percentage of retailers who are able to understand the impact of their pricing decisions has declined quite a bit. Last year, 50% of respondents cited this as a top-three operational challenge. This year that number has risen to 64% of retail respondents. By now we’ve all heard the JC Penney story. When Ron Johnson joined the company, he actually had someone do the math: 590 promotions run in 2011 resulting in an average of only four customer trips per year…meaning that 586 didn’t do much to turn customers’ heads. How many of us have done the same kind of math?

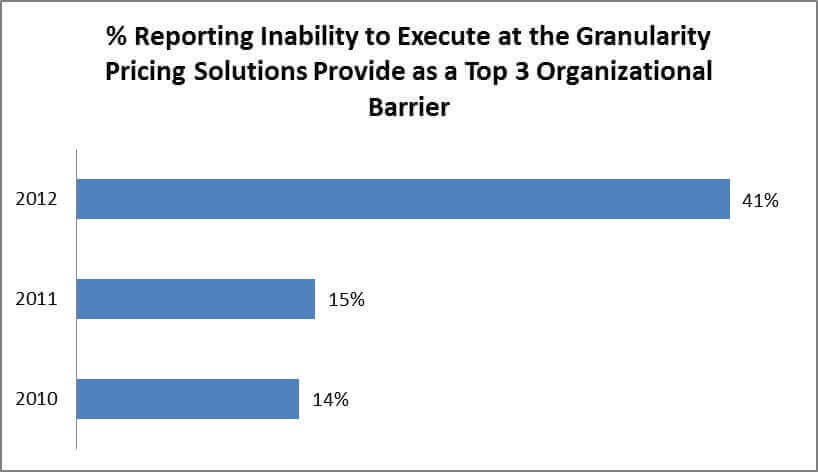

It appears another part of the challenge lies less with a lack of technology tools and more with a lack of education. Over the past few years we’ve seen adoption of pricing technologies rise. We noted this both in our merchandising and pricing benchmarks: retailers have aggressively pursued lifecycle pricing solutions and price optimization. Now many seems to have the tools available, but don’t quite know what to do with them (figure below).

This has moved into center stage as the most frequently cited organizational barrier to setting better and more compelling prices, trumping organizational resistance to change, technology infrastructure issues and data cleanliness.

We wonder whether budget concerns, and the inability to capitalize education costs, have led retailers to scrimp on training and spend more on implementation instead. Perhaps our going-in belief is that commercial applications are now as easy to use as those found on our tablet computers and smartphones.

Overall, I must say I’ve been really surprised by these results. We’ve heard a lot of talk about “Big Data, ” but apparently not a lot of us are actually doing anything with it. We know the explosion of channels have everyone spinning, and door busters are an evil that get bigger and “badder ” every year. Have we returned to old fashioned “Markdown Chicken, ” where consumers and retailers stare each other in the eye until one blinks? Just with a front end of really low prices to set the bar?

Our pricing benchmark will remain open for another week or so. If you haven’t yet, why not take the survey and let us see where you’re at? The larger the pool of respondents, the more directionally accurate our data is. Just click on this link or paste the following into your browser: http://www.zoomerang.com/Survey/WEB22EKM4UXADT/ . We want our benchmarks to be as representative of your point of view as possible.

So far the data looks really interesting. Just different.