Opportunities In Stores

Anyone who is familiar with our research methodology knows that every time we conduct a survey, we ask about the business challenges retailers face. These tend to be external factors, and while their impact may vary based on a retailer’s size, performance, or the type of products they sell, they tend to be very similar for all retailers. When it comes to the challenges facing modern day brick-and-mortar stores, it’s safe to say there are many.

However, it is what retailers do in the face of these challenges that sets them apart. In the best cases, they are able to convert these challenges into opportunities. And the store is no exception.

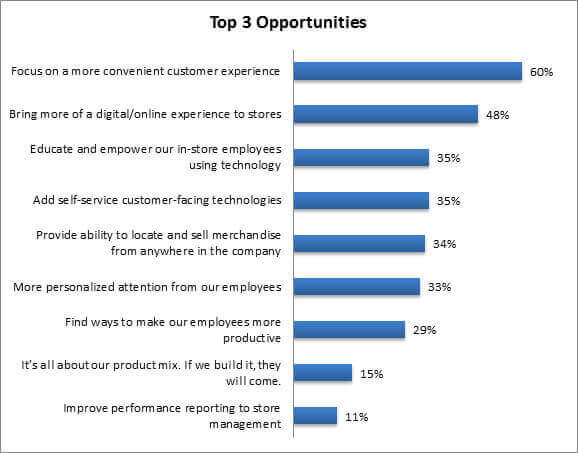

At first glance, little has changed since the widespread adoption of consumer mobile devices in 2010. In fact, focusing on a more convenient customer experience has been retailers’ top opportunity for the past three years running (Figure 1).

Figure 1: Bringing the Store Online – And Back to the Store

Source: RSR Research, May 2013

One thing that has changed, however, is that retailers want to bring more of a digital/online experience into stores. This is the first year we’ve included that option, and 48% of retailers immediately seized it as a top-three chance to improve their current stores. This is fascinating for a couple of reasons.

First, it wasn’t that long ago that retailers were trying to replicate the in-store experience on their eCommerce websites; how quickly things have changed. But far more important is who is driving this notion: for Retail Winners, it is their top identified opportunity in 2013. And mid-sized retailers ($50-$999 million in annual sales) have a disproportionate appetite to bring more of this online functionality into stores than any other revenue group (67% vs. mega retailers’ 40% and small retailers’ 26%). It is one of the key ways they plan to differentiate their stores from competitors. Mom-and-pops are less likely to have the online firepower or inventory to draw upon, while behemoth retailers will (for some time to come, at least), view stores as still representing 90% of their overall income – they prefer to wait to see what in-store technologies play best with consumers. In a lot of ways this makes sense: with increased scale comes increased cost, and few mega-retailers can afford a misstep in an enterprise-wide store tech rollout. However, while this represents a tremendous opportunity for mid-sized retailers to gain some market share by modernizing stores with crowd-pleasing technologies that leverage some of the things consumers already like about the online experience, larger retailers should take note: now is not the time for sitting on hands. The customer is already well ahead in the race, and it is well advised to be aggressively pursuing pilot programs that bring more of the digital experience into at minimum, a few test stores. If large retailers wait to see what plays well in the mid-market, the damage may already be done; loyalties may already be sworn to more adventurous, “cool ” factor-embracing competitors.

We invite everyone to read the full report, The Relevant Store in the Digital Age: Benchmark 2013, by downloading it here.