On Coronavirus, Tariffs, And Supply Network Agility

In this week’s Retail Paradox Weekly, my RSR partner Paula writes that when it comes to the supply chain, “nimbleness should be the word of the day. Complacency is the enemy.” That is certainly the case in the retail supply chain today. RSR has been touting the need for supply chain agility for several years now as a response to the important changes that have occurred on the demand (consumer) side of the business. The shorthand version of our message is that retailers and their suppliers can no longer depend on the fact that demand and supply will “always” meet in the store. Demand can be triggered wherever the consumer is, and supply has to go to wherever that consumer wants it to go. This new reality has (probably forever) changed how retailers think about their supply “chains” – that is, they are really networks that behave more like an ecosystem than a train.

Given that many retailers’ supply networks are global in nature, those networks have to be built in ways that enable them to be more responsive to (often unexpected) shocks. The news is full of some recent shocks that have the potential to be long lasting and profound, whether we’re talking about pandemics, the imposition of tariffs, or severe weather events. The coronavirus (COVID-19) is the most recent event that is sending shockwaves through China-dependent networks, and it was the hardest to predict, since by outward indications at least, the Chinese government did its best to contain the news.

While retailers and their partners can model the long-term effects of tariffs, and can look at long term weather trends, pandemics hit hard and fast. There’s an interesting piece on that subject in last week’s Economist that is well worth the read. What struck me in that article is that notwithstanding the need for greater supply-side agility to deal with increasingly hard-to-predict demand, retailers could take it too far.

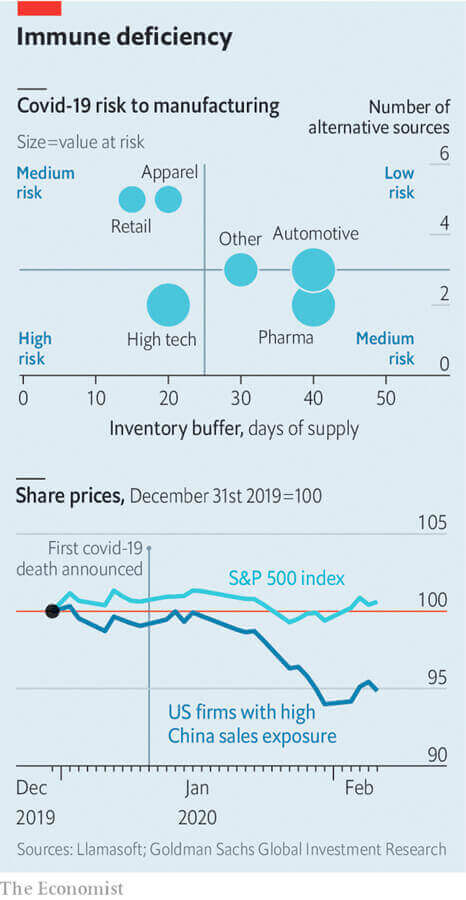

What brought that to mind was a chart in the article, shared here:

What the chart says is that industries that have fewer days-of-supply in the supply chain have less of a buffer against sudden disruptions. And not surprisingly, Wall Street hates it when that happens and reacts in its typical knee-jerk way. So those industries that are most impacted (in this instance, general Retail, Apparel, and hi-tech) get hit twice: with the disruption itself and with lowered stock prices.

There’s an important balancing act that has to be performed; retailers don’t want too much inventory in the network in the event that consumer sentiment shifts, but they want enough to survive a shock that affects the source of goods in some remarkable way. It would be impossible to consider all the variables without some help of strong analytical capabilities.

The good news is that solutions companies (such as LLamasoft, the company that helped the Economist develop the chart above) are figuring out how to use next-gen analytical tools to help their customers model future scenarios in order to be prepared not just for the expected future, but unexpected futures as well. The two instances I can think of where AI-enablement could help most (other than “personalization of the offer” on the customer-facing side) is in demand forecasting and supply chain modeling, the yin and yang of global supply networks.

We have mentioned before how AI-enablement is now a reality (and highly featured at the NRF 2020 event last January). In the coming weeks, RSR will launch a new study that will look closely at the challenges and opportunities associated with an AI-enabled supply chain. Look for the announcement in your e-mail – we’ve love to get your point-of-view. Our going in hypothesis is that the time is right for retailers to consider using advanced modeling capabilities to be ready for whatever shocks the world has in store for the industry. It should be a fascinating study!