No Shortage Of Supply Chain Challenges

As Brian wrote about in his article last week, we’re currently examining the data from our most recent benchmark report: Supply Chain Strategy.

It’s the strategy part that’s the killer, as retailers of all sizes (many of whom never had to spend much mindshare trying to change the juggernaut that is the supply chain) grapple with ways to react to consumer demand in ways they’ve never had to before.

As we’ve been calling it, the next big thing. But before we get to the next-gen strategy part, what does current execution look like?

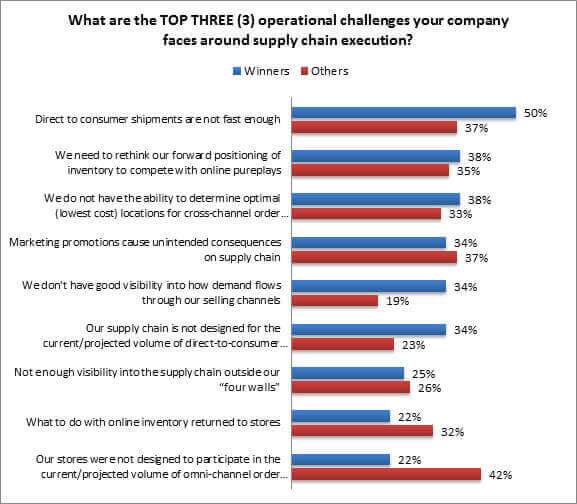

When it comes to operational issues, the best performing retailers say the biggest problem they are facing is shipping directly to consumers in a timely manner. As Amazon continues to push the limits of direct order fulfillment from two-day to one-day (to ultimately same-day) delivery, Winners are inordinately focused on at least keeping pace (50% of Winners vs. 37% of all other retailers, Figure 1).

Figure 1: The Execution Issue

Source: RSR Research, May 2014

Winners are also much less likely to blame their existing store infrastructure for their woes. Forty-two percent of average and lagging retailers say that “stores were not designed to participate in the current/projected volume of omni-channel order fulfillment “: while that may be true, it won’t earn much empathy from consumers. They’re not interested in excuses – they just want their products, and Winners are far more aware of that. Where this data becomes even more interesting is when viewed by products sold:

- Fast moving consumer goods (FMCG) retailers are most concerned about consumer shipments speeds (56% say it is their top operational challenge). While their interest in timely sales is certainly understandable, this focus on direct delivery speeds may indicate that FMCG retailers are in a much deeper reinvisioning of what their customers’ shopping experience may look like in coming years.

- Fashion retailers are most likely to blame their stores; indeed, 43% say their stores simply weren’t designed to participate in the current (and projected) volume of omni-channel order fulfillment. In fact, it is their number one operational challenge.

- And durable goods retailers’ biggest concern is that marketing promotions bring about unintended consequences to their supply chain (48%). In theory, of these segments, this should be the simplest problem to get ahead of (predicting the impact of promotions vs. quintupling the speed of the supply chain vs. reinventing the store’s role to entirely new consumers). However, retailers already know that predicting human behavior is no easy task. Durable goods retailers are going to need serious analytics and measurement tools to move forward.

This report will be out next week, and as an author, I may be a bit biased. But I think you’ll find the data to be some of the most fascinating we’ve ever seen. We’ll be sure to send you a note when it’s out.