New Analytics In Retail Go Beyond Marketing

Over the past decade the drumbeat sounding the importance of customer-centricity in retail has grown more and more insistent. The rapid and pervasive adoption of always-connected consumer mobile devices has only increased that intensity. Retailers are responding to the perceived threat of increasing intolerance of impersonal shopping experiences, and that is the driving force behind the interest in targeting personalized value messages to consumers via their mobile devices. Regardless of performance, vertical, or size, retailers see that the greatest opportunity coming from analysis of consumer “path-to-purchase ” data will be to close the loop between the digital and physical shopping experiences.

While the industry has been focusing primarily on the customer (demand) side of the business for nearly a decade, an even bigger question is, what do changes on the demand side of the retail operational model portend for the supply side? An optimized supply chain remains critical to deliver strong earnings, but changes brought on by consumers’ Omnichannel expectations are subverting the operational efficiency of even the most well-oiled supply chains.

The reason this is such big challenge is because for most retailers, profitability is determined more by the cost to serve than by price. Prices are truly “transparent ” in today’s digitally enabled shopping environment, and so retailers don’t have much wiggle room (this is the single most important reason why retailers should have price, promotion, and markdown optimization disciplines in place now). Not only that, it is harder for retailers to squeeze SG&A expenses more than they have already – and consumers want more service, not less.

Consumers are balking at standardized assortments, and don’t want to be inconvenienced by a huge assortment that has no relevance to the lifestyle problem they are trying to solve. In today’s retail environment, it’s not about what a retailer wants to sell, but about what a consumer wants to buy. In response, retailers are looking towards merchandise planning processes and supply chains to enable much more localization of the assortment, more forward-positioned inventory to enable more profitable direct customer order fulfillment, and a quicker response to changes in demand.

These new business requirements require a new generation of analytics. But even before retailers start thinking about delivering new insights to the business, it’s clear that many still have work to do to clean up the basics. Take ‘inventory visibility’ as an example. In RSR’s October 2017 benchmark study on supply chain execution, we learned that there’s still work to do before something approaching real-time accuracy is achieved, even for some over-performing “Retail Winners ” (Figure 1).

Figure 1: Supply Chain KPIs

Source: RSR Research, October 2017

While visibility into current and on-order inventory is a primary requirement to be successful in today’s buy anywhere/get anywhere retail environment, ultimately retailers must know as early as possible what demand is likely to be. And that gets to another big challenge: how to better forecast demand?

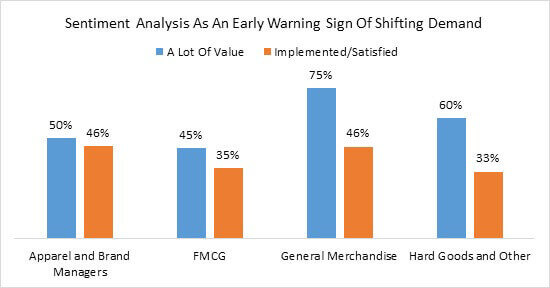

Because of the wealth of new data available today, RSR believes the time is right to update their forecasting capabilities with better information and technology. With the exception of past promotion data as an input to the forecasting process (which Winners feel even more strongly about) and weather data (which non-Winners feel much less strongly about), there is a high level of consensus among all retailers that inputs such as sentiment analyses gleaned from consumers’ digital shopping activities, new trade area data like new stores and events, and automatic feeds of competitive data, all need to be considered in demand forecasting, in addition to traditional inputs like past sales, past promotional activity, and market share metrics.

Not only is it important to improve the quality of the original forecast, but (as RSR’s forthcoming benchmark Merchandising And Pricing 2018: Life After The Merchant Prince, points out) re-forecasting on a regular basis is just as important as the original forecast itself.

New data analytics is not only impacting what retailers sell, but also where and how they sell it. In a January 2018 benchmark on location-data analytics, RSR learned that many retailers seek to use geo-location data analyses to make better store and DC site selections, to run more efficient delivery and supply operations, and to improve merchandise plan localization.

What Could Get In The Way?

What all of these new analyses have in common is that they consume non-transactional data generated by digital (and often consumer-mobile) signaling devices. The problem for most retailers is that their BI & Analytics systems are oriented towards more well-defined transactional data. Non-transactional signals generated by consumers, the competitive environment, and operations, are dynamic and ever changing. This creates the requirement for both new technologies and new skills. But our January location analytics study revealed that retailers may not have either the right analytical engines or the right data analysis expertise to get to the value locked inside in the new data.

That’s not a Winners’ story; over-performing retailers are aggressively attacking the roadblocks to progress in using new data to improve the supply side of their operational platforms. Other retailers need to pay heed.