More On Pricing & Optimization: Why We Think The Time is Right

Back on January 10th, we offered an early peek into some insights we are gathering for a new benchmark study intended to determine if and how retailers are using optimization techniques to improve their pricing capabilities. This isn’t a new line of inquiry for RSR; as far back as our 2009 benchmark on the state of Retail Pricing[1], we noted that increased price sensitivity by consumers ranked as one of the top-three business challenges related to pricing and promotion. So, even before the current climate of price inflation, many retailers were challenged to stay on top of everyday and promotional pricing to be competitive.

The importance that retailers place on end-to-end pricing, the value that they place on the processes and capabilities associated with price management, and the time it takes for them to manage prices and promotions, all point to the need for better data and better analytical tools. That in fact is what RSR has recommended for some time, not only to maximize the positive effects of competitive pricing and highly targeted promotions, but also as a part of a bigger objective – to become more relevant to consumers with localized or even personalized value offerings to consumers.

I was asked last week why this is such a hard nut to crack, and of course there are many reasons, both “practical” and “philosophical”.

Let’s start with the philosophical stuff first. The retail model as has existed for decades is designed to push as much of an assortment through the selling channels as possible. For most retailers – and certainly the largest ones – it’s a product centric, volume driven game. So, the objective of pricing strategies is to find that fulcrum point between covering all the costs to bring products to a market and delivering a decent profit to the bottom line.

On the other hand, customer-centric retailing is all about winning as much of consumers’ share-of-wallet as possible. That model is infinitely more complicated, because the focus isn’t the product- of which there might be thousands, but instead the customer – of which there will hopefully be millions. But this isn’t as hopeless as it sounds; product-centric retailers really can manage categories of products, and customer-centric retailers can manage categories of customers. And technology is really good at helping achieve either one of those objectives.

What about the practical stuff? The biggest challenge to digital+store retailers is in how prices are managed in the physical store. For most retailers, that involves labor, and that’s not going to change anytime soon. For example, in my state of California, the law says that “It is unlawful for any person, at the time of sale of a commodity, to do any of the following: (1) Charge an amount greater than the price, or to compute an amount greater than a true extension of a price per unit, that is then advertised, posted, marked, displayed, or quoted for that commodity.” California county weights and measures regulators routinely audit store to look for errors between the advertised or label price of products, and what the point-of-sale system rings up.

A 2019 article in Chain Store Age described the operational challenge really well:

“Store prices are prone to be changed from week to week, which means that store associates must perform manual matching on data prices versus displayed prices for thousands of SKUs. If stores rely on staff to manually ensure that displayed prices match those in the store database, they are practically inviting errors and mistakes at alarming rates.”

The reason that’s a problem (besides being an irritant for consumers) is that states and counties consider errors to be consumer fraud, and the potential fines are enormous.

On top of these challenges is the consumer’s point of view: shoppers are extremely well informed about competitive prices by virtue of ever-present and always-connected mobile devices, and they are extremely disloyal – because they know they can get whatever they are looking for at a price they are willing to pay via the Internet. So, its consumers, much more than competitors or the availability of new data and new tools, that are the driving energy behind any retailer’s effort to modernize its pricing capabilities.

But are retailers really changing? RSR has been advocating “modernization” for 14 years, and still there are a remarkable number of retailers that are reluctant to or don’t feel the need to change. For example, we learned in the forthcoming study that 33% of fast-moving-consumer-goods retailers (grocers, drugstores, convenience stores) believe that spreadsheets will still be the tool of choice a year from now!

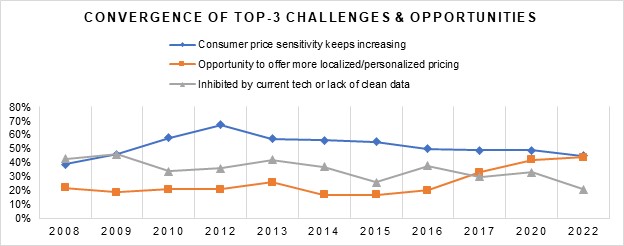

Nonetheless, we are confident that change is finally coming, and here’s why (chart):

Looking over retailer responses that span several years, we can see that “consumer price sensitivity” has been a consistent top-three challenge – most recently, it has hovered at around 50%. But during the same time span, more and more retailers have come around to the idea of localized and/or personalized pricing. We’ve felt that as more consumers switched to digital-first shopping, this was going to be inevitable. But in the meantime, a couple of the top inhibitors to change – old technology and poor quality data, have steadily diminished in importance.

Retailers are practical. Consumers are pushing the price agenda and retailers have been pushing back to counter price sensitivity “forever”. As we pointed out in the January 10th Retail Paradox Weekly piece, “A good price will never be good enough if the value proposition isn’t relevant. So continuously finding ways to improve the total value proposition (including price) is critical to winning.”

Now, the conditions for taking that issue off the table look right.

[1] Going Local: Emerging Best Practices in Localized Pricing and Promotions, RSR, January 2009