More Musings about Growth

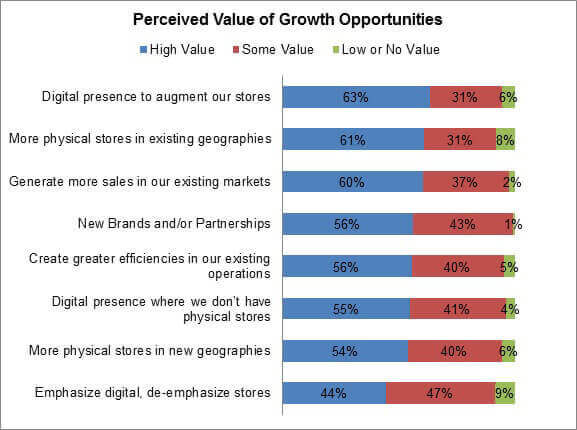

My RSR partner Paula Rosenblum and I both mentioned in last week’s Retail Paradox Weekly that we’re collaborating on a benchmark report regarding retail growth strategies. Paula mentioned in her column (Shark Tank Goes Omni-Channel and Finds a Great Growth Strategy on Target, 9/30/14) that we were surprised by the finding that in general retailers most valued opportunities lie in existing markets. Here’s the data that led to her comment:

Source: RSR Research, October 2014

The data is pretty clear; retailers want to augment their current store offerings with a digital presence as well as have more physical stores in their existing geographies, all to (hopefully) generate more sales.

This got me to thinking: are there more new sales to be had? In my Retail Paradox Weekly column (U.S. Retailers Feel The Need To Grow – But How?), I discussed that from a real estate perspective, growth in new retail construction seems to be focused on replacing old and tired stores, not necessarily to create additional new selling space. But what about from the consumer angle? Do consumers have more to spend, or are retailers just taking business away from each other?

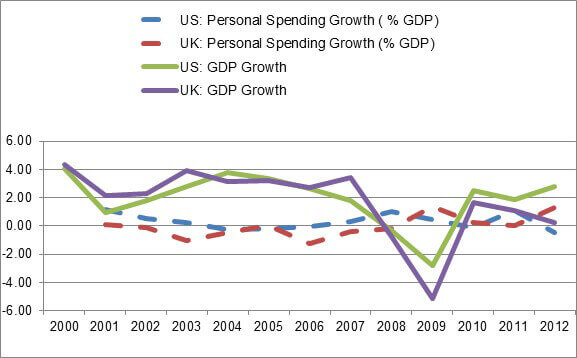

World Bank Data

It’s amazing what you can find on the Internet – and some of my favorite sources are from governmental and quasi-governmental data banks. Since most respondents to our Retail Growth Strategies survey came from the US and UK, I decided to look at what the World Bank has to say about personal spending as a percent of the national gross domestic product (GDP) and compare it to the growth in GDP itself, over the last ten years. Here’s what I found (the vertical axis is “percent “, the horizontal one is “year “):

Source: World Bank

With the oft-used caveat that “I’m not an economist “, what this data says to me is that consumer spending, as a percent of GDP, isn’t changing much, if at all. The UK’s was slightly up in 2012, while the U.S.’s was slightly down – but they both hover between one and zero.

So what does it mean? It means that in those mature markets the best way to physically grow or to grow “share of wallet ” is at the expense of competitors, and not to waste a lot of time looking for net new growth in existing markets. I guess that’s that the “dollar store ” intrigues are all about.

There are also macro-economic things to consider. If spending of real dollars (or pounds) is so closely tied to the GDP, then things like the quality of jobs, the “wage gap ” and the demise of the middle class, and the fact that a big part of the population in both countries is aging and headed towards fixed incomes is something to be concerned about.

For retailers, though, the issue is more about how to “up ” the switching costs of consumers that are currently engaged with the Brand, and how to lower the costs of consumers buying into the Brand for the first time. And nowadays, that means being “relevant “, and relevance is defined as providing the right solution to whatever the “lifestyle problem ” is (whether its putting a healthy meal on the table or looking great for the opening gala of the Opera season), whenever, wherever, and however the consumer wants it.