Mobile: When Words And Actions Don’t Line Up

Engage in any current retail-related conversation – whether about online commerce, the supply chain, or the store – and the discussion will quickly turn to mobile. The disruptive nature of new mobile technologies is virtually unprecedented in retail history, scaling at a pace even faster than eCommerce did, and the reason is simple: consumers love their mobile devices, and are adopting them (and their tremendous functionality) at an amazing rate.

But for all of the conversation, the truth is that retailers have been hard-pressed to know which way to take new mobile initiatives. Yes, tablets and smartphones can empower the workforce, but which mobile-armed functionalities will be the most effective, and just importantly, which will provide the greatest leverage in the field for the longest period of time? There is a lot of risk to enterprise-wide adoption of a bleeding-edge technology if its value and longevity cannot be guaranteed. Consumer-facing mobile initiatives bring even greater unforeseeable variables.

As a result, many retailers have chosen to wait-and-see, and their reticence applies not only to customer-facing mobility solutions, but those that are workforce-facing, as well. In our most recent mobile research, The Impact of Mobile in Retail, we set out to identify where retailers are in their mobile plans and just as importantly, to identify lessons for the way forward, drawn from the approaches of the best performers.

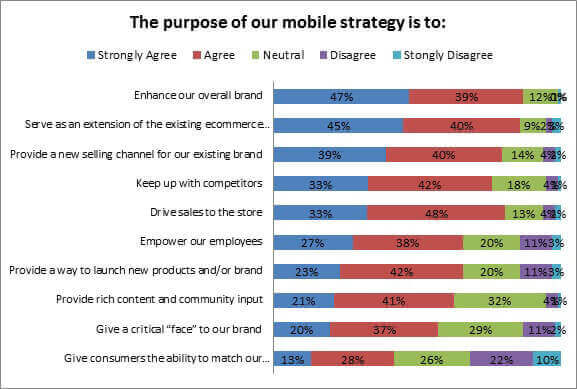

Immediately, we were presented with a paradox. When asked to rate the level they agree with various statements about mobility’s role in the retail experience, retailers’ top-rated response is that mobile’s primary ability is to enhance the overall value of the brand. (Figure 1).

Figure 1: Best Intentions

Source: RSR Research, December 2012

Unto itself, this is hardly a problem. In fact, enhancing the overall brand is precisely how retailers should be viewing the tremendous value that new mobile technologies afford. What is problematic, however, is that much of what retailers share in the remainder of the report – their actions – does not line up with this purpose. Instead, many of the findings of this research are in closer alignment to the second-most popular choice in Figure 1: that the current purpose of a mobile strategy is to serve merely as an extension of the existing eCommerce offering.

Paradox #2:

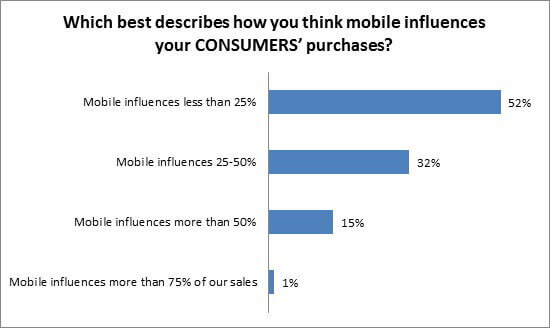

The next paradox relates to retailers’ cognizance of just how much consumers have already integrated mobile devices into their current lifestyles. We were very specific in our line of questioning, asking one question about the percentage of sales that culminate in the mobile channel (more on that in the full report), and another about percentage of sales influenced by the mobile channel. As Figure 2 shows, 52% of retailers believe that mobile devices are used – at any point along the myriad paths-to-purchase modern consumers travel – less than 25% of the time.

Figure 2: Reality Check?

Source: RSR Research, December 2012

RSR strongly believes that the numbers in Figure 2 are very low compared to the reality of mobile’s current role in the consumer’s paths-to-purchase. While it is difficult to quote precise numbers on just how frequently consumers enlist their personal mobile devices during the shopping process (including product research, reviews, availability, social network feedback and price comparisons), multiple quantitative consumer studies have gauged consumer mobile-device use. One such study is a 2012 IBM study of over 28,000 consumers in eight mature economies (Australia, Canada, France, Italy, Japan, Spain, the United Kingdom and the United States) and seven growth economies (Argentina, Brazil, Chile, China, Colombia, Mexico and South Africa). The study showed that 45% of consumers use two or more technologies to shop (usually a combination of PC-based Internet search and mobile), superseding the 40% that use only one technology (PC), and 10% that don’t use any technology. The IBM study showed that “seventy-one percent of consumers we surveyed said they were willing to shop digitally … (and) 85 percent of shoppers globally said that social networking can save shopping time by allowing them to connect and get recommendations from like-minded individ¬≠uals whose opinions they value. “[1]

The Power of Denial

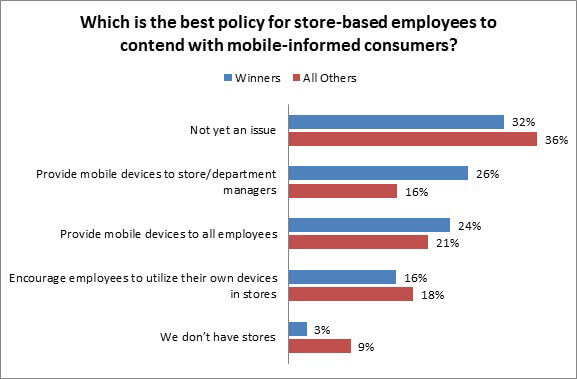

Because the vast majority of our retail respondents operate stores (85% operate stores, 83% operate online channels and 64% operate social channels while only 41% operate a dedicated mobile commerce site), we wanted to know how retailers perceive their store-based staff’s ability to service the new mobile-empowered consumer in stores. As Figure 3 shows, the most common retailer response is that is not yet an issue. Again, we disagree.

Figure 3: Can’t Fight What You Can’t See

Source: RSR Research, December 2012

However, for those retailers who do agree that their employees are struggling to meet the needs of newly-empowered shoppers, it is worth noting the differences in how they plan to make their store associates more valuable to consumers: the best performers (Retail Winners), are more likely to provide mobile devices to store and department managers than competitors with average or lagging sales (26% to 16%).

We invite all RPW readers to read the full report (available by following this link), which shines a light on many of the ways Winners plan to best these paradoxes – and which technologies will help them get there first.

[1] Winning over the empowered consumer: Why trust matters, © Copyright IBM Corporation 2012