Merchandising Technologies: It’s Time For A Change

While some merchandising technologies are relatively new, others are quite mature. For example, IBM introduced the Inforem replenishment application (now part of the JDA portfolio) in the 1970’s and it is still in use today. New planning solutions available today offer rich capabilities, but many retailers have not have changed their processes to take best advantage of them.

So it’s interesting to note that when we queried retailers about their merchandising technologies, Retail Winners already tend to be more satisfied with the technologies they have in place: in general approximately half report they have implemented them and are satisfied. All other respondents recognize they’ve got a problem. On average only about 20-25% of respondents have the same confidence level in their Merchandising technology portfolios.

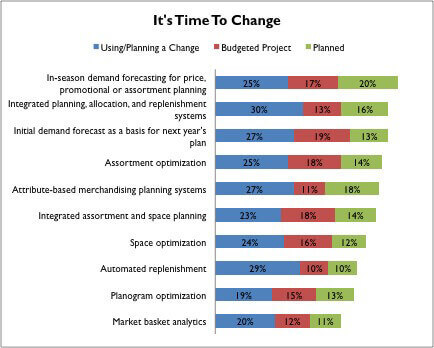

In aggregate, other retailers believe implementing or re-implementing these technologies will help them catch up, or even leapfrog Retail Winners (Figure 1).

Figure 1: Half of Respondents Planning Some Kind Of Change

Source: RSR Research, February 2015

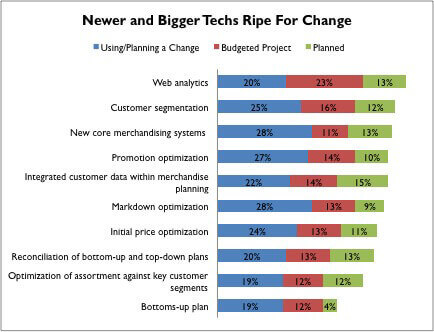

But as the pace of technology change accelerates, even technologies considered “modern ” are candidates for change. As we’ll see in Figure 10, while some are still planning their first round of implementation, others are looking for a refresh.

Figure 2: Even “Modern ” Technologies In Line For Refresh

Source: RSR Research, February 2015

A Refresh Of Core Merchandising Systems On The Horizon

Certainly “core merchandising systems ” are not new. But historically they have been either homegrown or very heavily customized commercial applications. Changing them is no small task, and requires extensive mapping of processes and business rules. Given the complexities involved, it is significant that almost half of our retail respondents are getting ready to undertake this task.

RSR believes the thought process behind these changes revolve around integration. The challenge to integrate new technologies into an archaic base is slowing down the entire enterprise. We applaud the decision to create a more solid and extensible foundation but also caution retailers to recognize the amount of work it takes to get this type of job done.

The organizational disconnects retailers identify tend to be intertwined with their old idiosyncratic merchandising systems. A massive change creates the risk of enterprise paralysis. It’s easy to blame the technology provider when this happens, but in fact, it is caused by pre-existing organizational dysfunction.

This is most important to understand, since the largest enterprises are those most likely to be planning change. Forty-four percent of retailers with annual revenue of $1-5 billion and 26% of those with revenue above $5 billion report they are in this state. This is the moral equivalent of replacing a battleship engine while on the high seas. It’s a necessary big job.

However, if you read the full report this data is sourced from, you’ll find there are very specific organizational inhibitors to improving merchandising processes. We invite you to read the full report here.