Internet Of Things: Retail’s Newest Shiny Object?

If popular media is to be believed, the Internet of Things ( “IoT “) is going to either transform all of our lives as consumers and fundamentally change how the businesses we are employed by function, or destroy the last vestiges of privacy that we might have in our lives. That’s the nature of hype, of course; for every prophet promising a perfect world, there’s another one promising a new level of Dante’s Inferno.

RSR recently completed its second benchmark study on the state of IoT adoption in Retail (The Internet Of Things In Retail: Getting Beyond The Hype, October 2016), and we found that although retailers’ hopes for IoT are high, their actual experience with the technology is low.Given the “newness ” of the technology, that’s perfectly understandable. But in the last two years, retailers have started to hone in on three challenges that they hope IoT will help address: inventory visibility and accuracy, interacting with digitally enabled consumers in the physical store, and making the physical store more effective for consumers.

When it comes to interacting with consumers, retailers in the study pointed to in-store interaction as a driving motivation. Several of the big technology solutions providers (and a whole lot of newcomers to the Retail technology space) are working with retailers now to develop in-aisle marketing, tailored promotions and personalized pricing, and self-checkout capabilities for consumers on their smart phones. But what’s giving interest in consumer-facing IoT even more energy is the fact that market disruptor Amazon is offering consumer IoT devices to make online shopping even easier than it already is.Amazon’s Dash Button makes it possible for consumers to “attach ” the IoT device to any product so that the consumer can simply press the button to re-order products for direct delivery. And quick as the blink of an eye (or the push of a button?), the Dash Button already has competition with the Kwik smart button, touted as “… the very first open ‚Äòclick and deliver’ service, we can work with any brand, retailer, payments processor, or delivery service, making it possible for all brands to better understand the needs of and develop deeper direct relationships with their consumers “, according to a statement released by Kwik CEO Ofer Klein in June 2016. But retailers want to seize on the opportunity to interact with consumers both inside the store and beyond the store’s physical confines with IoT devices.

As far as inventory visibility and accuracy goes, that’s not really news – especially for any retailer that got involved in the RFID “mandate ” in 2005.But what is news is the focus, first to give consumers better visibility into available-to-purchase inventory throughout the enterprise, and secondly to give employees better visibility to where inventory actually is inside the four walls of the store. There are other benefits as well, for Supply Chain (for example, in anticipating deliveries) and Loss Prevention, just to name two.

Finally of course, there’s the issue of the efficiency of the store itself. As retailers move towards more localized assortments and more locally focused floor sets, understanding how consumers use the store and how to most effectively deploy store employees to service customers, are issues that IoT may help them to address.

These are all potentially important and interesting issues that retailers are starting to get their arms around, as is discussed in the 2016 Benchmark report. The question is, are retailers really ready to take on IoT?

Not So Fast!

All the hype aside, it’s important to remember that IoT is a broad set of technologies – without a broad set of business solutions attached to them (yet).

For IoT to be useful to retailers, there are several fundamental prerequisites.First and foremost, there’s the question of always-on connectivity in the store – do retailers have it?The answer is, “we’re getting there “, according to RSR’s September 2016 benchmark on the state of instore technology, The Retail Store In 2016: Poised For Transformation. In that report, we took the optimistic view that only 8% of retailers reported that they don’t have wireless connectivity in the stores to be a huge improvement over 2015’s 31%. But there’s another way to look at the findings in that report: while 51% of retailers report that wireless is available for “performance management, POS, and product related tasks “, another 49% don’t have that connectivity in place.And even more to the point, only 23% said that they make wireless available to customers.So even with this most basic of requirements, retailers have far to go to be IoT ready.

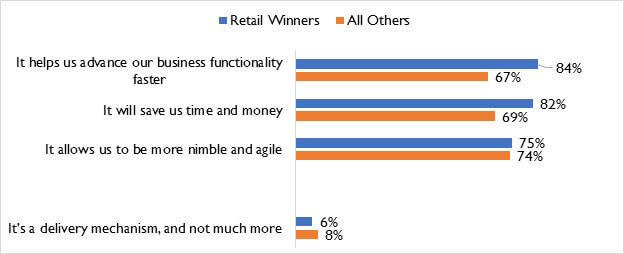

The IoT benchmark goes into a lot more detail about retailers’ state of technology readiness.For example, when we asked retailers to compare “value ” vs. “status ” of a laundry list of IoT-related technologies, here’s some of what we learned:

Source: RSR Research, October 2016

The biggest change of all that IoT is likely to demand of retailers is a new dedication to data analytics. Retailers to-date have used data analytics to retrospectively report business performance. But in the world of IoT, retailers will be looking at data (lots of data!) that reports the status of instrumented things in something approaching real-time.It’s hard to underline the immensity of that change too much.

And even if a retailer can capture and analyze all that “big ” data, then the question is, to what purpose?

To get answers to that question, the 2016 report recommends that retailers “start small &fail fast ” by experimenting to gain an understanding of the possibilities of IoT and define workable use cases, making sure that early experiments have a well-defined scope and clear “success ” criteria. Then they will be able to determine for themselves whether IoT is just the latest shiny object or a new family of technologies that offer real promise.

Read The Report

RSR’s October 2016 Internet of Things benchmark study, Internet Of Things In Retail: Getting Beyond The Hype, goes into these details further, and reveals important findings about what retailers must should do to realize IoT’s promise.