Inflation & Retail: Trouble Ahead, Trouble Behind

Much has been written in the popular media lately about the effects of price inflation on shoppers’ overall perception of the market and its current trajectory. In theory, the rise of inflationary pricing should not have an automatic negative impact on shopper confidence, as inflationary trends have been present (and often rampant) during some of the most prosperous eras of mass consumption. The boom of the Reagan-era 1980s is just one such example.

However, customers have been through a lot in the past few years. Lockdowns, social isolation, difficulty finding products due to supply chain woes: all have a cumulative effect. The stock market may be doing well, and unemployment may be approaching historic lows, but that doesn’t seem to affect how shoppers feel. Rising prices have them on edge, and retailers are incredibly sensitive to this fact.

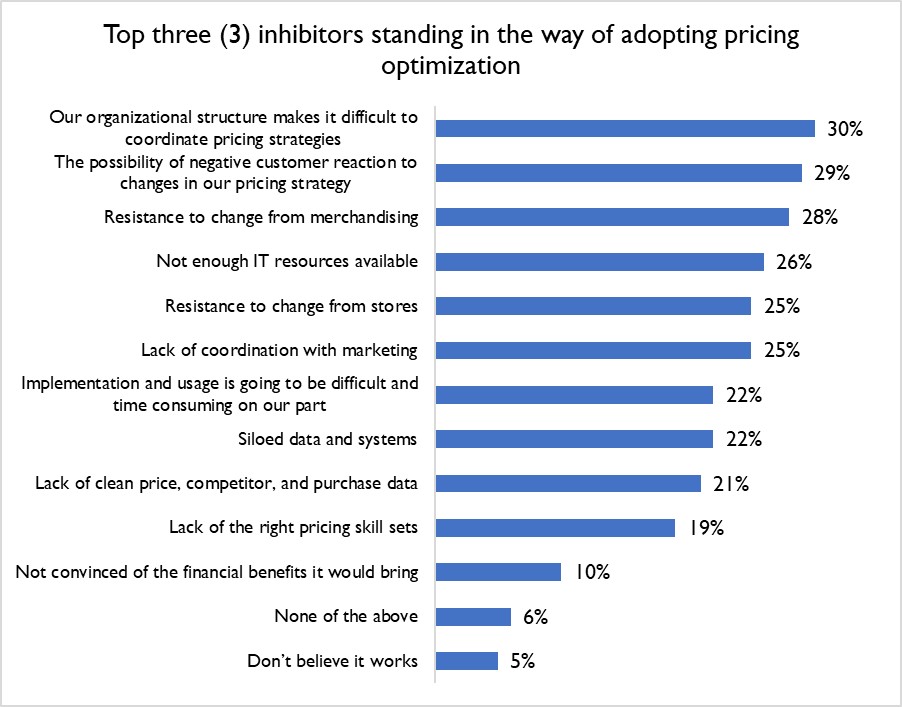

So much so, that when we asked retailers in our latest research to identify the biggest inhibitors to adopting new pricing tools – a space normally relegated to gripes of internal matters (lack of human resources, interdepartmental miscommunication, etc.) – it is an outside factor that bubbles to the top. Nearly 1 in 3 retailers (29%) is fearful that any change in prices could bring about a negative reaction from customers.

Figure 1: Customers Are On High Alert

Source: RSR Research, March 2022

Perhaps the best news to result from Figure 1, above, is that so few retailers are skeptical of pricing and promotional solutions’ efficacy: only a handful report needing convincing that these tools would bring some financial benefit. What this really means is that although the industry believes in what these tools can do, many are concerned about customer backlash. This paints retailers into an unenviable position, where their costs continue to rise (skyrocketing supply chain costs are finding their way from manufacturers to retailers more each day), and yet they are afraid to pass these hikes along to shoppers.

All the while, the usual list of suspects – a broken organizational structure, resistance to change from stores – still looms large.

It is not an easy time to be in the business of selling goods to consumers.

People? Tech? Both

It is vitally important, then, to ask the question how: How do retailers think they can get themselves into a better position than the one they are currently in?

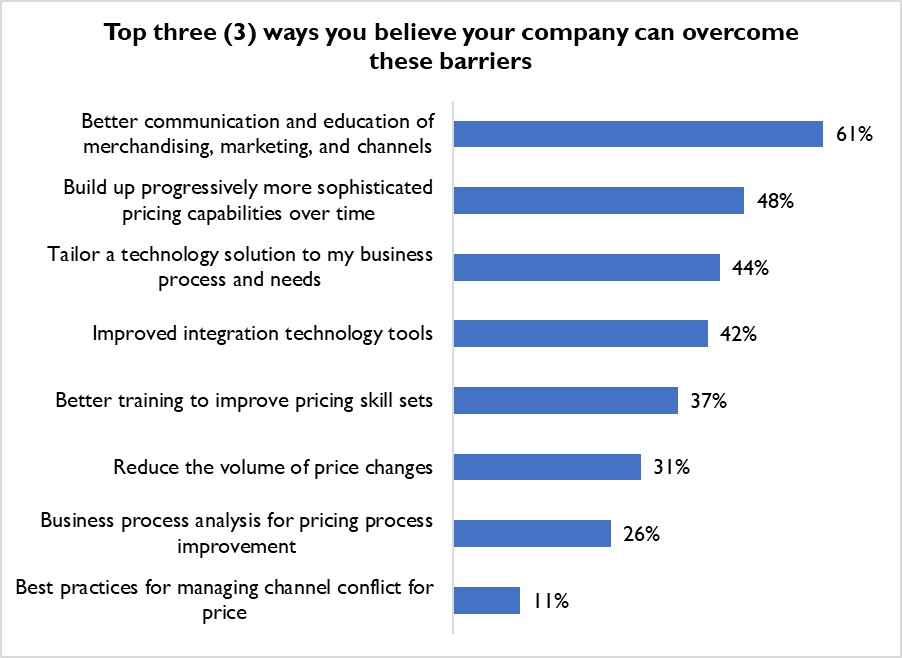

As we see in Figure 2, the answer is just as much about process as it is technology.

Figure 2: Communication Breakdown

Source: RSR Research, March 2022

For several years now, retailers have identified better coordination between merchandising and marketing as a key piece to their future success in the face of competitors like Amazon and Walmart.

Today, 6 out of 10 retailers report that their best hope for brand-wide improvement lies in educating their merchandise and marketing teams of how critical it is to get this right – and then believe that a build-up of a more progressive pricing strategy over time will play a key factor in their potential success.

Retailers recognize that it’s not just about the technology; people and process are just as important.

We invite everyone to read the full report.