eCommerce in 2012: Train Keep ‘A Rollin’

We’re nearly five years into our existence as a company, and I think I speak for all of the partners when I say that we get every bit as excited each time we release a new research report as we did with our very first RSR-branded benchmark. And last week we put forth our latest eCommerce report, which to me, brings some very strong definition to the story of how retailers are reacting to the ways they’ve been forced to rethink how they’ve done business for eons.

Consider this: back in 2008, retailers self-reported that the biggest challenge they faced in their eChannel was keeping product information and availability up to date, an issue that is much less of a blip on their radar screens today. In just a few short years, the challenge has migrated from how to use a relatively new channel to do what’s always been done (show customers what you want to sell them) into something far more complicated: how to provide ways for consumers to connect with each other through the eChannel, while your brand serves as the conduit between them. This is no small change, and it’s not easy to process and adapt to — successfully — overnight.

Couple that data with one of Retail Winners’ top challenges in 2012 — keeping up with consumers’ evolving shopping patterns (social networks and mobile), a non-issue in back in 2008 (or 2010, for that matter) — and you start to get a sense of how much control the customer has seized in the buyer/seller relationship in a very, very brief period of time.

What’s interesting is that the technologies retailers find most promising to help them adapt as needed have barely changed at all. In 2008, online behavior tracking was far and away the most popular choice among all respondents to help keep customers engaged. In our brand new research, online analytics retain top honors. So what we can draw from this is that:

- consumer wishes, behaviors and requirements have morphed tremendously even since we’ve started benchmarking the topic, but that

- retailers still need intelligent ways to quantify these behaviors and demands before they can respond appropriately. So the logical question becomes what can they do next? From this year’s report:

Only two technologies seem poised for the next wave of eCommerce implementation: 44% percent of this year’s total response pool have budget or plans to implement Self Learning Search/Facets, and another 46% are moving toward Self-learning Personalization of Site Information. However, these technologies are largely being driven by the best performers. In aggregate, there remain a great number of technologies for which many retailers have no plans, including click-to-chat, integration to manufacturers’ product information, and the eCommerce platform as a SaaS solution.

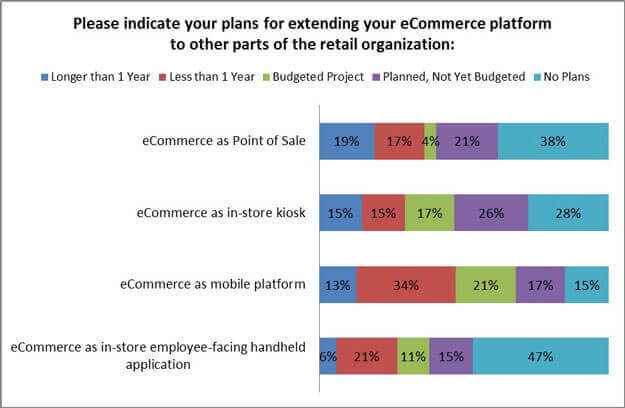

Instead, it’s worth tracking retailers’ willingness/interest in bringing the eCommerce platform across the organization in recent years, and as a result, this year marks the first time we proposed a question to determine their progress to date (Figure, below).

Figure: Soon Arriving at the Platform…

Perhaps the most interesting data points in this chart are those relating to the eCommerce platform as a mobile platform. Recent RSR benchmark reports have called upon the store as being in desperate need of more mobile technologies — both consumer and employee facing. In many ways, mobile represents the only viable hope of equalizing the consumer/retailer in-store relationship, currently off-axis in favor of the customer in every way imaginable. But with 34% of retailers in pilot and another 38% budgeting or planning to make the eCommerce platform the driving engine of not only the store customer experience, but also that of the entire digital customer experience, eCommerce platform providers are looking at a potential groundswell of new activity.

It is also worth noting that 21% of retailers plan to one day use their eCommerce platform at their point of sale (4% have budget set aside, and 36% say they have already taken steps to do so, including the 12% of survey respondents who are online-only retailers). In fact, only 38% of retailers have no plans to extend their eCommerce site to their point of sale. This does not bode well for traditional POS vendors — much of the industry has been in need of a technology refresh at the checkout counter for quite some time. The data above only confirms what we’ve long suspected: many retailers have delayed an investment in POS in anticipation of the day when their eCommerce platform can perform double duty.

So one thing we can take away from the past several years of eCommerce research is this: retailers have been asked to change the entire way they interact with the digital customer for quite some time now. And while they have been slightly slow to act, waiting for a time when online analytics tell them exactly what next move will be guaranteed to delight the new consumer, for multi-channel retailers, at least, the store seems like a likely place to play a serious game of catch-up, if not even leapfrog.

We invite you to read the new 2012 eCommerce report, which is available here.