CSCMP Panel: The Role Of Visibility Data In Upstream Supply Chain Planning Processes

On October 3, 2023, I had the opportunity to moderate a panel at the CSCMP EDGE 2023 conference in Orlando, on the subject “The Role of Visibility Data in Upstream Supply Chain Planning Processes”. The panelists included Andy Kettlewell, Group Vice President of Inventory and Analytics of Walgreens, Richard Widdowson, Vice President of Global Retail & Consumer Goods at SAS Institute, and Bart De Muynck, Project44’s Strategic Advisor.

Those who have ever moderated a panel discussion know that success is defined as much by the participants as by the subject itself. I was fortunate on both scores because the subject is incredibly timely (more on that in a minute) and the panelists are experts in their field:

Andy has led Walgreens to adopt advanced AI and cloud technology to modernize the company’s demand planning and forecasting processes. This effort employed AI and machine learning to analyze the effects of weather, consumer sentiment expressed in social media, local events, and illness trends, as part of the company’s inventory and demand planning processes. As part of this effort, the company modernized processes to improve coordination between suppliers, DCs, transportation and stores.

A big part of Richard’s assignment at SAS is to help client companies along in their digital transformation journeys. Richard has rich industry experience, having worked at ASDA in the UK, Walmart (where he was Sr. Director of Supply Chain), CVS, and Academy Sports.

Bart has worked for major International companies such as EY, GE Capital, Penske Logistics, PepsiCo as well as several Tech companies. He also spent 8 years as a VP of Research at Gartner and most recently has served as the Chief Industry Officer at Project44.

As to the subject, “The Role of Visibility Data in Upstream Supply Chain Planning Processes”, recent RSR research findings point out that real-time visibility into the entire supply chain has become increasingly important to retailers, their trading partners, and logistics providers. In times past, our research showed that there was a clear differentiation between over-performing “Retail Winners” and other retailers; Winners wanted to be able to see the flow of goods from the shipper’s outbound dock, while average and under-performers didn’t pay much attention until product was flowing into the DC.

But after the disruptions that the entire ecosystem experienced during and immediately after the pandemic, those attitudes changed dramatically, even to the point of coordinating product production to consumption. In a recent RSR benchmark study, we learned that the most immediate challenge driving retailers’ interest in pursuing a digital transformation agenda is the need to expose – in real-time and with a high degree of accuracy – available-to-promise inventory to both consumers and employees anywhere within the enterprise. That also enables retailers to identify supply chain bottlenecks and disruptions, and ultimately to optimize the flow of goods as market demands dictate. Planners need to be able to identify changes in both demand and supply to make decisions in time to affect outcomes.

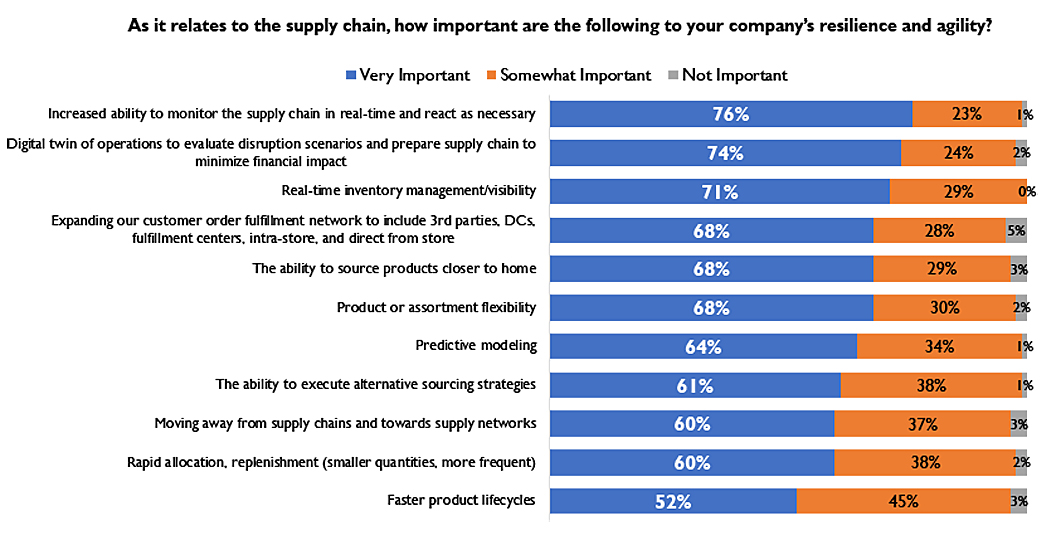

When RSR asked retailers to prioritize the capabilities needed to enable greater agility and resilience, here’s what we learned:

The question put to the CSCMP panelists was, how far have retailers and their trading partners progressed to delivering some of the value that retailers identify as “very important”?

According to Project44’s Bart De Muynck, retailers’ efforts are already well advanced: “innovative retail and CPG companies are playing in the visibility space. For them, it’s all about the question, ‘where is my stuff’? and ‘when is my stuff?’”.

Richard Widdowson backed that up: “I speak regularly with supply chain experts… I hear the latest strategies for building strong, resilient supply chains, especially in advance of the holiday season…and all of them state a desire to become more reliant on real-time data to drive smart decisioning.” Richard elaborated, “Retail and CPG companies shouldn’t have angst about modernizing their enterprise planning to include the ingestion and utilization of real-time, E2E (enterprise-to-enterprise) digital supply chain data. Although new planning processes are complex, they are NOT complicated to implement – and they yield significant precision, value, and agility in the E2E value chain.”

Ultimately, the goal for retailers is “smart decisioning”. RSR’s research show that three-quarters of Retail Winners (and even 60% of average and under-performers) assign “high value” to “improving forecasting to develop multiple demand generation scenarios”. Bart De Muynck noted that, “…we can turn our real-time data into predictive planning precision that creates a line of sight into the future. So, the customer never has to wonder where a product is, because they know where it’s going to be with a high degree of accuracy. Walgreens executive Andy Kettlewell said, “I deal every day with managing a huge number of skus, and the ability to service our customers is dependent upon the ability of our supplier partners to service the business. Predictive precision, real-time data and visibility is critical. If we are not prepared to service our customer’s needs, they have other alternatives where they can shop. Walgreens keeps its customers by keeping them happy, and that means having what they need, when they need it”.

In the final analysis, that’s really what the topic of the panel was all about: meeting customer expectations. As Walgreens’ Kittlewell said, switching costs are very low for today’s information enabled shoppers. Retailers need to be able to anticipate shifting demand and operate their supply chains at the speed of the customer. According to the CSCMP panelists, top retailers and CPGs are aggressively pursuing efforts to modernize the supply side of their businesses.