Closing The Gap Between Online And In-Store

If you’re reading this newsletter, it’s fair to presume you’re aware that the retail industry is in the throes of a massively transformative time. We’ve moved past any discussion of “channels. ” Customers do not shop channels. They shop brands, and further, they rarely shop those brands out of loyalty, but rather because they are trying to solve a problem.

As consumers, we all have our favorite brands, but we’ve also developed something far more important: our own, individual ways of shopping. Most of these ways involve digital devices, and each time a retailer can’t anticipate or meet expectations, we develop our own personal workaround solutions, or “hacks. ” And with consumer technology enabling new and different ways to hack the retail experience, retailers are in a never-ending race not to win, but just to keep up.

Regardless of where they are, what they sell or how big or small they may be, there is not a retailer in the world that wants consumers hacking their way to a shopping experience. But how are they to get ahead of this? In a lot of ways, they can’t. The best retailers can do is narrow the gaps between the consumer and the brand. And the absolute best way to do that is to know where those gaps exist.

Our latest research report, Commerce And Convergence: Closing The Gap Between Online And In-Store, seeks to do a few things. First, to understand the state of the union: how retailers currently view the challenges, opportunities, roadblocks and technology enablers associated with how they support commerce across all of their consumer touchpoints. Along the way, we also tease out practices worth following from the best performers (which we call Retail Winners, those already several steps ahead of the pack). We also make some baseline recommendations for all retailers on how they can up their game – right now – to help support a single, converged shopping experience. To bridge the gap between consumer and brand.

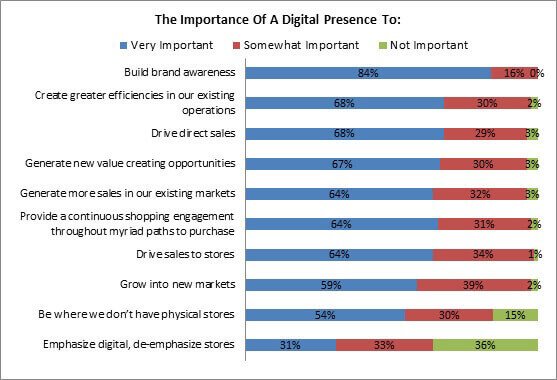

Right off the bat, retailers give us a gleaming hope for the future: near-consensus in what a digital presence is best suited to do: build brand awareness (Figure 1, below).

Keep in mind, the chart below is hardly a progress report as to what retailers’ current digital offerings accomplish, but rather serves as a window for what these offerings could (and invariably will) provide. However, retailers do believe that store sales, direct sales, operational efficiencies, new market growth and the cross-channel shopping experience all stand to gain significantly from a digital presence. This is a strong indicator of the future of digitally-enabled technologies that retailers see, on both the buying and the selling sides of the retailer/customer relationship.

Figure 1: What’s It All For?

Source: RSR Research, June 2015

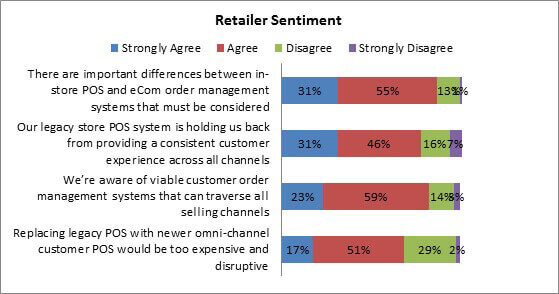

And more encouraging data comes forth when we asked our retailer respondents to rate their approval of some cross-channelconceptual statements. The good news? Retailers know their disparate systems are currently holding them back. The bad news? Not enough have a strong awarenessof viable alternatives yet, and many have a deep-rooted belief that they’ll be stuck in this situation for quite some time to come (Figure 2). Figure 2:The State Of The Union

Source: RSR Research, June 2015

It’s quite telling that retailers recognize the largest tech investment in their possession – the POS system – is alarge part of what’s holding them back from providing a seamless experience across all of their customer touch points. It’s incredibly difficult to satiatea customer’s needs when, should that customer decide to visit a store (where more than 90% of sales still conclude), virtually all of their online pre-purchasebehavior is entirely invisible to in-store staff. We also maintain that such information is needed in-store well before the customer reaches the POS.Yet early on in our data there’s a telling indicator of how this story – albeit early days in the channel-less shopping experience story – is startingto unfold. We hope you read the full report hereto find out more.